You’ve got a mobile app idea. You know your audience is waiting, and the demand is there. You’re aware that this app could help you make money. But how do you bring it to life? How do you create an app from scratch? What’s the cost of creating an app from scratch?

As a leading app development agency, we often hear these questions from our clients countless times:

How to make an app

What is the process of creating an app?

What is needed to create an app?

How to write mobile apps

How to make a phone app

How to create an app from scratch

With over 1200 clients under our belt, we know the ropes of app development. That’s why we’re sharing a detailed, step-by-step guide on creating, designing, and launching a successful mobile application. Let’s dive into the essential steps to bring your app vision to life.

Let’s get started to know the steps to creating an application.

Table of Contents

How To Create a Mobile App in 9 Steps

Follow these nine steps to create your custom mobile application.

| Step No. | Phase Description | Phase Details |

|---|---|---|

| 1 | Define App Purpose | Define the app’s objectives and target audience. |

| 2 | Plan Functionality | Identify and prioritize app features based on importance and feasibility. |

| 3 | Research Competitors | Analyze competitors’ strengths, weaknesses, and features to differentiate your app. |

| 4 | Design Wireframes | Create sketches of the app’s user interface to plan layout and flow. |

| 5 | Choose Development Path | Decide on in-house development, outsourcing, or a hybrid approach based on resources. |

| 6 | Develop an App | Develop Android, iOS, or Cross-platform applications, integrate APIs, and implement UI/UX design according to specifications. |

| 7 | Test App | Conduct manual or automated testing to identify and fix bugs, glitches, and usability issues. |

| 8 | Launch App | Prepare for Google Play Store or Apple App Store submission, optimizing listings, and publish on platforms. |

| 9 | Promote & Market App | Develop a marketing strategy utilizing various channels to reach the target audience. |

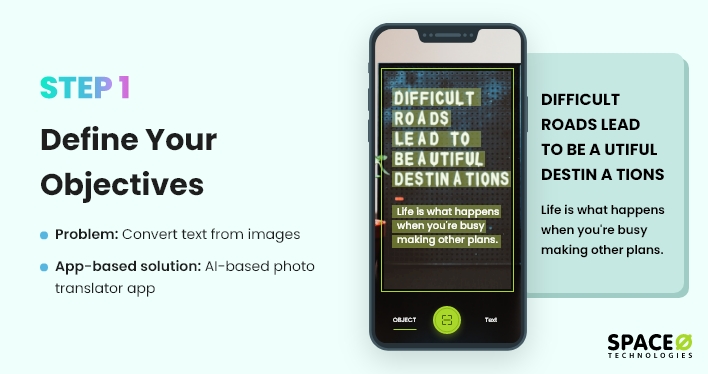

Define Why You Want to Make an Application

The process to create an app takes time. Therefore, defining the right objectives is considered one of the crucial steps in developing an app.

If your objectives are not clear, you probably won’t get the desired application as well.

The first step to building your own app is to figure out why you want to create an app.

Famous apps like WhatsApp and Facebook serve a clear purpose.The best way to answer these questions is to ask yourself:

What challenge am I trying to solve with this application?

What is the purpose of developing this application?You must identify the purpose before asking how to start a development process to make a successful app. This step will make the development process a lot easier. In fact, it also helps you reduce the average app development timeline.

There can be many reasons for building an app, but the most important thing is that your app should always satisfy these two goals:

Your ideal users’ goal and your business goals.

Make sure you invest enough time to identify your primary goal before starting a development process.

Let’s start with your potential users. Honestly, everyone is interested to know about the features of an app that are beneficial for them.

However, it doesn’t matter whether your users are interacting with the businesses online or offline, regardless of the channel – the very first thing they ask themselves is – what’s in it for me? If they don’t see a benefit in a few seconds, it becomes harder for you to get your users back on the app.

A good mobile application can help businesses in multiple ways, such as more returning customers, low expenses, increased ROI, better productivity, enriched social presence, brand identity and brand awareness as well.

If you are creating an app for your business; it’s time to ask the following questions to yourself.

- Which section of your business needs improvement?

- How do you create an app that solves a specific problem?

- What is the expected result of an app that you want to build?

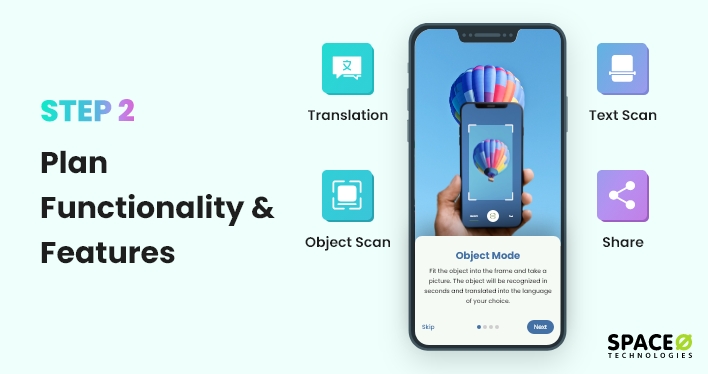

Plan Functionality and Features

Let’s move on to the second step to create an app. After defining the objectives, the second important thing that comes into play is planning your app’s core functionality and features.

Research Your Competitors

Never underestimate the value of research and finding insights before making an app. This way, you can find the scope of your app idea and also implement the required features into your app. So, ensure you do research on your competitors before building apps.

- What are the objectives of your app?

- Who are the target users of your app?

- Do app users looking for an app like yours?

- Who are your top competitors in the marketplace?

- What are the drawbacks of your competitors?

- What business model do you plan to follow for better ROI?

- How are you going to monetize your app?

Design Wireframes

You’ve defined your objectives, planned functionalities and features, and done competitors’ research to get insights on creating an app.

Now, it’s time to know how to design an app. Give it its first skeleton and combine the individual blocks together with wireframing.

What is Wireframing?

Wireframing is the visual representation of your app’s layout and the flow between the different screens. This is one of the best distraction-free methods for creating a user interface design where you don’t have to worry about other graphic elements.

The mobile app wireframe will be based on the use cases, i.e., the specific tasks your users will perform on the app. A wireframe is like a bridge between your raw thoughts and the final product before you start making an app.

Your goal should be optimizing the number and order of app screens to reach each goal. You can also create a splash screen, and multiple app screen flows for the same task to determine which will provide the best experience to the users as per an ideal user journey.

There are basically two ways of creating wireframes:

- Offline – You can simply use a pen and blank paper or printable sketch templates like the ones available on SneakPeekIt.

- Online – Several wireframing tools are available online, such as NinjaMock, Fluid UI, Adobe Suite, Mockflow, and others. Our graphic design team, at Space-O Technologies, uses Balsamiq and AdobeXD wireframe design tools for wireframing. Just select the tool or template and start sketching. Every use case should represent the full-screen flow from opening your app to achieving a goal.

Develop Your Mobile App

Building a quality mobile application considering all the requirements and following the guidelines takes time.

Being the best mobile app development company, we have highlighted some important points you should keep in mind.

- Get rid of any unnecessary elements that don’t support users’ tasks. Remember, content is your interface. A landing page is extremely important.

- Use a single input field whenever possible. Multiple fields and making users switch between different modes creates a bad user experience, and the pushes user instantly leave your app.

- Overusing push notifications is another bad practice. This annoys the user and gives them a major reason to uninstall your app.

- Consider future-proofing your app. Today, you might want just to fulfill the demands of your users. But you should also make sure that the application can bring you profit for further development. The more efficiently you market your app, the earliest you receive profit, and the faster you add more features and grow your app.

- Choosing the right and fast database also plays a vital role in the success of your mobile apps. So always consider these factors while selecting a database: required size, data structure, speed and scalability, and safety and security of the user data.

Test Your Mobile App

After the app-making process is done, it’s time to test your mobile application to ensure there are no bugs and the user experience is as intuitive as you created and tested your wireframes. While there are various kinds of testing available, we recommend you go for at least two tests: Internal Test and the External Test.

Internal testing means testing your app by the development team as if you were the end-user. On the other hand, external testing requires you to give the app to people who are not familiar with using your mobile application.

Testing your app aims to fix bugs and user interface issues. Tools like TestFairy, UserTesting, and Ubertesters help in external testing and to give a rich user experience.

There are two types of testing for every software. First, Whitebox testing tests the internal structures or workings of an app. Quality assurance team designs the test cases using an internal perspective of the system and programming skills.

Blackbox testing examines the functionality of the application without viewing the internal workings or structures of an app.

Launch Your Mobile App On the App Stores

As your app is now completely developed and tested, it’s time to let the world know about it.

First, submit your app to the respective app store. Whether it’s Play Store or App Store, make sure you strictly follow the guidelines of both app stores. There are also videos and tutorials available online that explain this stage in detail. You can check the videos to know everything in detail. This will improve your app store optimization score and help you make the most out of your app.

However, this is not as easy as it sounds. According to a report by CNBC, Apple’s App Store rejects over 40% of app submissions every year. At the same time, Play Store rejected at least 55% of app submissions. This rejection has various reasons like crashes, bugs, privacy policies, software compatibility, and minimum usability.

An experienced app development team understands all the guidelines and policies required to publish an app. In fact, we have published over 2800 iOS apps and 1600 Android apps on App Store and Play Store, respectively.

But launching your app is just the beginning. Once your app is live, regular mobile app maintenance is crucial to prevent issues like security vulnerabilities, performance bottlenecks, and unexpected crashes. Many apps face rejection or removal due to non-compliance with updated store policies, outdated software, or poor user experience.

By implementing ongoing app maintenance services, you can ensure that your app remains compatible with new OS updates, receives timely bug fixes, and continues delivering a seamless user experience.

Promote and Market Your Application

It is a common myth that good products don’t need marketing, but that’s not true. Marketing is the voice that tells users who you are, what you stand for, and how you’re different from others.

Companies usually have a huge budget for promotion and marketing these days. However, if you are a beginner, you can start by simply asking three questions to yourself.

- What problem does your app solve?

- Who is your target audience?

- How can you reach those users?

Some of the common ways of app marketing are: use a banner on your website, publish a dedicated blog post about the app, send emails to your existing customers, promote it on social media like Facebook by making interactive videos, publish photos or videos on YouTube and tweeting on Twitter. Then after you can track KPIs to get the optimum results.

Apart from this, you can also ask influencers to promote your mobile app on their social network via photos or videos if you want to reach more users.

Now, what next? What to do once your app is launched? Check the next section where we have addressed this concern.

Identify Top Functionalities and Features for Your App

This is one of the creative steps to make an app where you’ll have to write down all the functionalities you want to add and features needed to achieve the solutions and get the expected results, mostly known as an minimum viable product version of the app.

The best way to make an app is to make sure you carry out market research for your app to find what your competitors offer on the app stores and see what they are lacking or innovating.

How about integrating features like real-time tracking, payment gateway integration, face detection? We have developed Veebo – a virtual party app, and integrated Augmented Reality face filters like the Snapchat app.

This has made virtual parties more fun and attractive even during this pandemic. If it solves your users’ problems easily, try integrating these features when creating mobile applications.

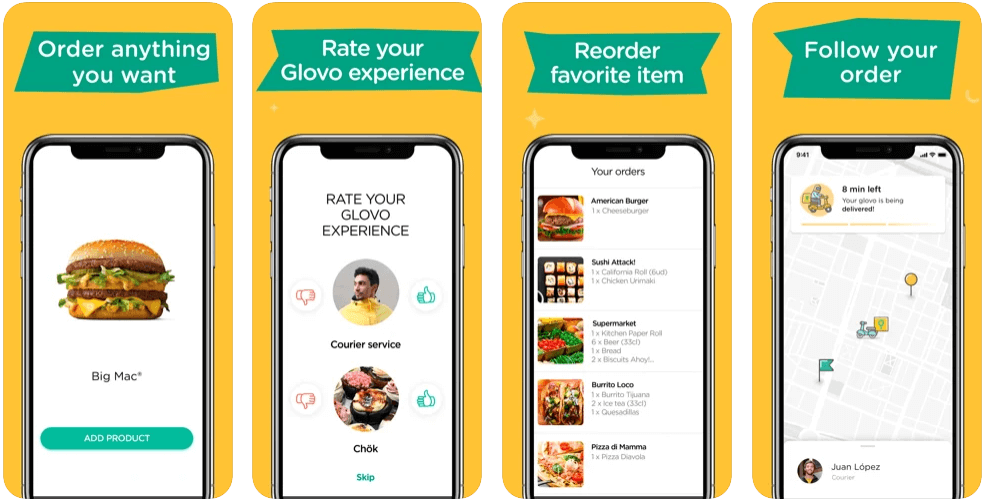

In fact, we have designed and developed Glovo, an on-demand delivery app. Glovo has received total funding of $1.2 billion from 32 investors and managed to gain over 50 million downloads.

Image Source: Glovo

For Glovo, we have integrated features like real-time order tracking, push notifications, search orders, places, and items, and POS. So, ensure you are integrating all the essential features in your app to make it successful in the long run.

Remove Irrelevant Features From Your List

Just remember, adding irrelevant features won’t do any good. Ultimately, it affects the app’s performance. At the initial stage, we recommend you make sure you only list down the features that will add value to your app. Once you release the first version, then work on the remaining features.

At first, you can create a minimal viable product (MVP) and then integrate the features into the app. This way, you can check the customer reviews and their feedback and implement features accordingly. Not only can you save costs, but also give a rich user experience.

This will help you and your team focus entirely on the things that really matter. Then, you can use this list as a guide and get started with the app development process.

Talking about the hotel booking app from the previous example, you can add different room details, videos of customer reviews, and filters for getting results based on timing and prices.

You can also add the room service details, user feedback, one-click chat, and push notifications for discounts and offers.

It’s important that you should know the answers to these questions before jumping into the creation of an app.

You’ll get an idea of the demand for the app you’re making and help you fill the gaps your competitors had left. You always have to grab the opportunity when it comes to creating a mobile application.

Sometimes, you may even have to leave your desk and walk in the shoes of your customers to know them better. But, ultimately, if you conduct market research, it will save you from making many mistakes at an early stage of your app creation.

Want to Make Your Own App?

Get in touch – Our team has designed and developed 4400+ mobile apps for startups and enterprises using cutting-edge technologies.

Focusing on wireframing at an earlier stage could save you hundreds of development hours later on.

Test Wireframes

Once you are done with designing the use cases of the app, it’s time to test them. This is also a very important step of your app-building where you can test the flow of your app to make improvements in the user experience.

In order to test your wireframes, you can use InVision. As you know, wireframes just show the expected design of the app, but InVision can help make them interactive. Using this awesome tool, you can connect your screens and link actions to simulate a real encounter with the app.

Choose a Custom App Development Path

Once you finish the wireframing for creating an app, one of the essential steps comes to build your app. In this part, you must choose the app development platform and coding language. We know it’s not easy for all people to discuss application-building platforms and programming languages. But if you are clear with your app project requirements, budget, and users, this isn’t that difficult too.

Let’s look at a different app-building platform based on devices and what are the things you have to keep in mind while developing your app on them

Select Platform As Per Your Requirements And Budget

One of the crucial steps to building an app is to choose one of the powerful app development platforms which suits your requirements and budget. Also, if you have a question such as what are the requirements for developing an app, don’t worry, we have covered that in the following section as well.

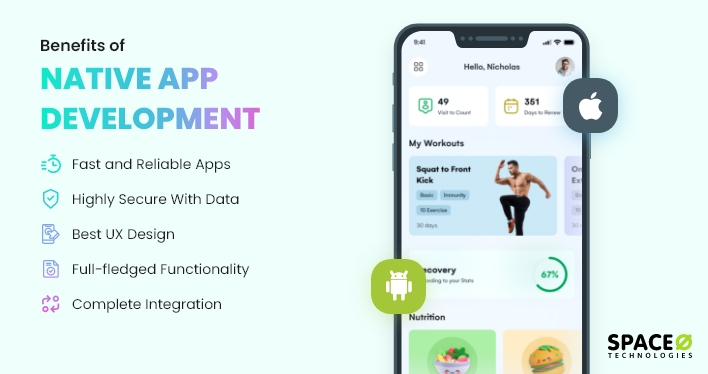

1. Native App Development

This app development simply means developing an app for a particular operating system. Android devices or iPhone devices. Suppose you want to build an app to gain maximum downloads and generate revenue through ads. In this case, you can easily leverage the user base of Android.

On the other hand, if you want to build ios apps on the iOS platform, you can develop an iOS app for Apple users.

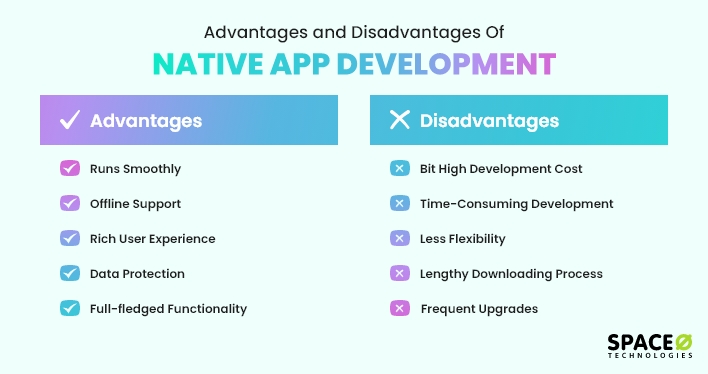

Something you should remember while you create native apps from scratch is – you’ll need to create two separate apps for the Play Store and App Store. But before going ahead, check the advantages of building a native app.

There’s no doubt that such an app provides robust and reliable performance. Though many Android developers are available out there, developing a ‘quality app’ needs a significant budget.

Also, you may need to have two separate development teams to create your own app for iPhone and Android, one for each operating systems. As you manage two codebases, it becomes difficult to find a way to streamline any update.

However, if you are looking for performance, rich user experience, security features, then going ahead with the native app development process is the right choice. Also, you must check the advantages and disadvantages of building a native app to ensure you make the right decision.

2. Mobile App Frameworks

The second path allows you to create hybrid apps that can run on both Android and iOS platforms. Several frameworks are available, such as React Native, Framework 7, PhoneGap, which lets you create a single app and deploy it on both Google Play Store and Apple App Store. As a result, there’s no need to spend a hefty amount on two development teams and maintain two code bases.

If you are an individual developer or a start-up with a limited budget, just go for hybrid apps. Though their performance may lag compared to a native Android or iPhone app, the situation is improving over time. Talking about the current time, something truly applicable at the gaming level.

Lastly, you’ll also have to consider something like extra features that you may want to add in the future. These additional requirements sometimes cause too much trouble later. It couldn’t only delay your launch but also strain your budget somehow.

3. Drag and Drop Mobile App Builder

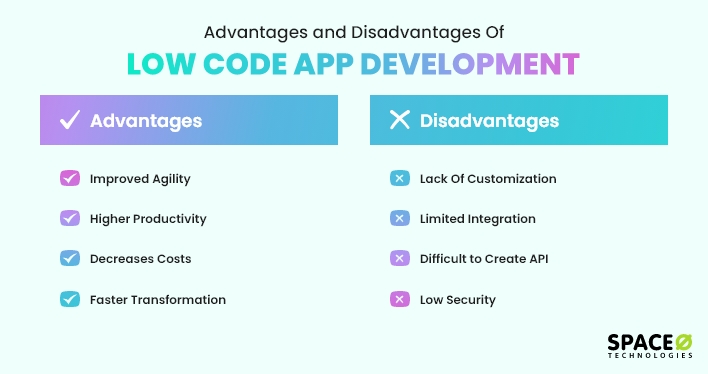

If your budget is extremely limited or you are just not comfortable with the above two ways, let’s check out one more way to develop mobile apps. This app development method is called low-code app development.

Many different app-building platforms like Appy Pie, AppSheet, and BuildFire allow you to develop mobile apps with zero coding knowledge. You just have to choose a template or drag and drop elements, and your Android or iPhone app will be ready in no time.

On these, you have the freedom to design your app in the same way you want. Whether you want a landing page or not, it is up to you. There’s no need to wait for several months or spend thousands of dollars on apps development. However, you must not forget some limitations associated with these platforms.

We have discussed the advantages and disadvantages of low code app development. Please check the following image.

We do not suggest you go for free Android or iPhone app builders because they have a lot of limitations. First and foremost, the security of confidential information is not up to the mark as you involve a third party in the process.

You can’t access the new and latest technologies, tools, and techniques that hinder the performance of your app. You can’t customize your app properly and get advanced app features.

Just to know them better, we tried and tested one of the popular free application building platforms a few days ago. We wanted to create a simple WebView app. So, we just added our website’s URL and exported the APK, and the size of the APK is 67.31MB. Unfortunately, the app was not only lagging but also showing watermarks at various places.

We are not against app builders, but we’d suggest you choose them wisely. Select a plan that provides most of the freedom so that you can customize and optimize your app in any manner you want. Using these best app builders, you can save up to 75% of your mobile app’s development budget.

Select the Right Programming Language

When you have decided on the development path, it won’t take time to select the right programming language.

Starting with the Android app, the first thing you’ll need is Android Studio. After that, you can design the interface of your app using XML and write all the logic using any language like Kotlin, Java, and C++. According to Google, more than 50% of developers are now using Kotlin to develop their apps, so if you’re just starting out, go with Kotlin.

For the iOS app, you’ll need XCode IDE and knowledge of Swift language (Swift 5 is the latest version). Though you can still use Objective-C, Apple itself seems to be moving away from C-based languages. Swift is supposedly much easier to use and work with.

Other than native app development, the advantage is that you don’t really have to think about the programming languages in other development paths. If you have planned to build a hybrid app, just follow the framework’s documentation, and you’ll be good to go.

Want to Build Your Own Mobile App?

Want free consultation from our tech professionals? Get your free consultation now.

What are the Requirements for Developing an App by Scratch?

Here are the 7 best practices you need to know before building an app.

- You need to have a clear idea of what your app will do and who your target audience is. You should also determine the unique selling points that sets your app apart from similar apps on the market.

- Choose a development team or a company that has experience with the platform you’ve chosen and the features you want to include. Make sure that they have a good track record of delivering quality work on time and within budget.

- Determine how you will monetize your app, whether it’s through in-app purchases, subscriptions, or advertising.

- Make sure that your app is easy to use, visually appealing, and intuitive. Hire a professional designer to help you create a great user experience.

- Depending on the type of app you’re developing, you may need to comply with certain regulations and guidelines. For example, if your app deals with healthcare information, you may need to comply with HIPAA regulations.

- Your app should be fast and responsive, even under heavy usage. Make sure that your app is optimized for performance and that it works well on different mobile devices and networks.

- Your app will likely need a backend infrastructure to support it, including servers, databases, APIs, and other resources. Ensure that you have a plan for building and maintaining this infrastructure.

Let’s now see answers to some of the most commonly asked questions regarding app development projects.

FAQ About How To Create An App

How long does it take to build an app?

The time required to develop an app can vary in a range of anything from 2-3 weeks to 9+ months. Simple apps are made in a short duration, while complex apps or mobile app building software systems require a longer time. Multiple factors need to be considered while estimating the app development timeline, like the number and complexity of features, uniqueness of the app design or interface, development complications, use of third-party libraries, and so on.

How do free apps make money?

You can develop an app for free and monetize it. There are various strategies for monetizing your app that you can use to earn money from it. Here are a few of them:

- Advertisements

- Subscription model

- Subscriptions

- Paid-features

- In-app purchases

- Collecting and selling data

- Freemium model

How to find app developers

You can find and hire app developers on various websites like Clutch or Upwork. In fact, Space-O also offers a flexible hiring model. You can take interviews before hiring our developers and designers for your dedicated project. Being a leading app maker company, we have 96% job success on Upwork and maintain an average rating of 4.8 on Clutch.

You can check the developer’s work profile as well as see what their previous clients are saying about them. This helps you in making informed decisions based on it. Further, you should also check out the portfolio of developers to see the kind of work they’ve done before. If an app developer or company has developed a similar app like yours for anyone, this will benefit your project.

How much does it cost to publish an app?

In this section, we have described how much does it cost to deploy an app on AppStore and Play Store.

Apple App Store: A developer needs to pay $99 per year to get an approved developer’s account on App Store. The App Store also charges a 15% transaction fee for every purchase. In simple words, if downloading your app, subscribing to it, or making an in-app purchase costs $10 for your app, you need to $1.5.

Google Play Store: The developer needs to pay a one-time lifetime registration fee of $25 to become a registered developer on it. For the first year after the app is published, It charges 30% for every purchase, which decreases to 15% for subscription apps after a year.

Amazon Appstore: There is no charge to register and publish your app as a developer. They charge a fee of 30% for every purchase.

Who will own the source code of the mobile app?

You own the rights to your app. Once we’re done with the app development and deployment, we hand over the code to you. Although we develop your new mobile app, your code belongs to you. We own no rights to the code of your app.

Is it possible to create a mobile app using ChatGPT?

No, you cannot create a mobile app using ChatGPT. ChatGPT is an AI language model that’s not capable of directly creating a mobile app.

To create a mobile app, developers need to use programming languages like Swift, Kotlin, Java, React Native, and Flutter. However, ChatGPT provides information and guidance on how to create a mobile app using various programming languages, tools, and frameworks.

Is it easy to make an app?

As an experienced app development company, we can confidently say that making an app is not easy. Developing an app requires a lot of effort, time, and expertise. It involves multiple stages such as planning, designing, development, testing, and deployment. Each stage requires a different set of skills and tools

Creating an app that meets the needs of your target audience, is visually appealing, user-friendly, and functional requires an in-depth understanding of the mobile ecosystem, programming languages, and user experience design. Therefore, it is recommended to get in touch with a reliable app development company like us.

What do you need to make an app?

To make an app, you need an idea, research, design, development, and testing. You must design the user interface and user experience, write code, and build the backend infrastructure. Thorough testing is essential to ensure that the app is functional, free of bugs, and meets the needs of your target audience.

How to find someone to build an app

Here are some steps to find someone to build an app:

- Define your requirements including the features you want, the budget you have, and the timeline you expect.

- Look for app development companies or freelance developers who have experience building apps similar to yours.

- Post your job requirements on freelancing platforms, job boards, or social media. This can help you reach a wider audience and get responses from multiple developers.

- Once you have shortlisted a few candidates, interview them to assess their skills, expertise, and communication skills.

- Before you start working with the developer, sign a contract that outlines the project scope, timelines, milestones, payment terms, and any other relevant details.

By following these steps, you can find someone who can build your app and help you turn your idea into reality.

Let’s Build an App For Your Business

We hope you found the article helpful and got an answer to your question – about the app building process. As your brand-new app has just started gaining traction, it’s time to figure out where your skills stand in this app development process steps and do your best to improve it.

However, suppose you need any guidance from a professional mobile app development agency or want to get the answer to a question such as how to create apps or how much does it cost to create an app for your business. In that case, you can get in touch with a leading app maker company like us as we have already developed over 4400 mobile apps for iOS and Android platforms. In fact, we do have over 200 mobile app developers who are constantly praised and appreciated by our clients. Proof? Here it is:

In any case, if you have any query like how much does it cost to develop an app, what is the procedure to create an app and make money, why to develop an MVP before we create an app, and app developer cost to hire, feel free to discuss all your queries with our sales representative. Just fill out the contact us form, and we will assign our best resource who can help you out.