Have you ever had an app idea and wanted to turn it into reality?

But, is app funding the only challenge you’re facing?

We often receive this query about finding mobile app investors to get app funding. Being a leading mobile application development agency in the USA, we have experienced consultants with knowledge of app funding concepts and mobile app investors.

With their help, we have prepared a guide that answers all your queries about finding mobile app investors.

- How to find the right investors looking for mobile app ideas

- What do investors look for before funding an app idea?

- 5 crucial points to consider before pitching your idea to mobile app investors

In 10 minutes, you will learn:

Table of Contents

How to Find Mobile App Investors for Funding [Follow These 6 Steps]

We have written the six essential steps to find the mobile app investors for your mobile app. Let’s understand.

Document Your App Idea

If you have an app idea, noting it down from the initial stage helps you with planning and further development. In fact, having a document makes it easy to explain to app investors and later to the app development company.

You need to write your ideas down with enough detail so that when you come back to them you will understand the results of your experiments. Documenting your idea gives you complete traceability of your entire workflow and you can immediately figure out what to do, why to do it, and when to do it.

- Describe the idea in a sequence. Start with the navigation pattern, the initial screen of the app, the home screen, etc.

- Create a brainstorming document by including the title, data, goals, and action items.

- Draw sketches and flow charts using tools like Visme, Canva, or Lucidchart.

How to Document Your App Idea

Tip:

Whenever you write an idea, photograph it with your phone, and add the idea to Evernote or OneNote. With these apps, you can search for terms in your pics and handwriting.

Perform Market Analysis and Identify Competitors

Researching your mobile app enables you to understand the current market trends, and the likes/dislikes of your target audience, and to get the competitor’s information. Here are some of the reasons why you should perform market analysis.

- To understand what information your audience is looking for.

- What is trending currently in the industry?

- What influences the audience?

- Customer pain points and what attracts them.

- Pricing about a particular service or product.

You will have to do thorough app market research to convince for app concept funding. Once you are thorough with market analysis, get the app idea validated.

Tip:

Ensure while doing research, online samples are never so-called full-proof samples. So do online market research to get insights and direction. However, that does not mean, online surveys are not useful; they are always great for getting qualitative insights.

Validate Your Mobile App Idea

When you are done with the research, how will you ensure your idea is valid? When you validate your app idea, you study the problem and how your app provides a solution for it. Here are the points you need to take care of while validating your idea.

- Choose the relevant users and take feedback on your idea.

- Review the idea and make some necessary changes

- Consult the app development company to check the app’s feasibility.

- Check the existing app in the market.

Now that your idea is validated, take the help of a development company and create a minimum viable product to show investors a demo of your app.

Create an MVP Version of Your Mobile App

Developing a minimum viable product with basic features will give you an idea of how it works. Also, the investors will understand the operational flow of the app. They can see a physical product and use it in real-time. Providing a simplified version of the future fully-functional app increases the chances of venture capital firms investing money in your app idea.

For MVP app development, The average cost ranges between $15,000 – $50,000 as it depends on several factors including the scope of work, the type of application, the technology stack, charges of the developers, usage of third-party services, and the features and functionalities of the application.

Want to Build an MVP Within an Estimated Budget?

Contact us. We have experienced developers who can build an MVP app as per your custom requirements.

Know the Funding Required to Develop a Mobile App

At each stage of mobile app development, the amount of money you need will increase. If you cannot secure funding in time, the project may fail. There is no average money for funding. Although, the precise number will depend on the idea, the complexity of the app, and the type of app you want to build. The below image depicts the stages of funding.

Below is a quick table that provides the gist of Pre-seed, Series A, Series B, and Series C funding.

Funding Round Pre-Seed Series A Series B Series C Definition Give your idea a push and start developing Implies tested business model with a decent client base to attract third-party investors Time to focus on entering new markets as your product is now viable Business now gets considerable returns and now looking for expansion Stage Focus Prototype Revenue growth Growth Expansion on large scale Common Elements of Growth Hiring Development, Operations, and Branding Market expansion and buying business Acquiring business/ expand globally Amount of Investment $10K-$1M $10MM $15- $25MM $50MM Let’s understand each funding in detail.

Pre-seed Funding: This type of funding is often the earliest stage of funding. During this stage, investors provide startups with capital to develop products in exchange for equity. Most entrepreneurs in this situation couldn’t get a product to market and may only have a prototype. This makes it difficult to convince investors.

Series A Funding: In this round of funding, businesses must plan to develop an app for long-term profit. Investors look for companies with great ideas as well as a strong strategy for turning that idea into a successful, money-making business. The main objective of the series A funding is to continue the growth of the business and attract more investors for the future round of funding.

Series B Funding: Series B financing is the second round of funding for a company that has met certain milestones and is past the initial startup stage. At this stage the company has achieved stability, processes are set, and the app is functioning smoothly. App revenues start to build, but this may still not be enough to conquer the market.

Series C Funding: Apps that reach series C funding are successful. At this stage, the brand needs to expand, acquire other companies, and develop new products, so it looks for extra funding.

Tip:

Gain enough traction and market share on your own before going to an investor. This will make sure that instead of running around, trying to find investors you will be able to dedicate more time to improving your product.

From the above explanation of pre-seed and Series A, B, and C funding, you may come to know the amount required for your mobile app funding.

In fact, we have even developed an on-demand delivery app – Glovo which has also reached the Series F round of funding (funded by Lugard Road Capital, Luxor Capital Group). This startup had received a total funding of $1.2B from more than 33 investors. Today, the doorstep delivery app has secured its place among the top Spanish Lifestyle Apps since 2018.

Select the Source of Investors

Now that you know the fund required for your mobile app, you need to source the right type of investors. In the upcoming section, we have listed the various types of investors available on the market. Once you understand the investors listing, it will help you choose the right source and type of capital to acquire.

Let’s get an understanding of the types of app investors to fund your mobile app.

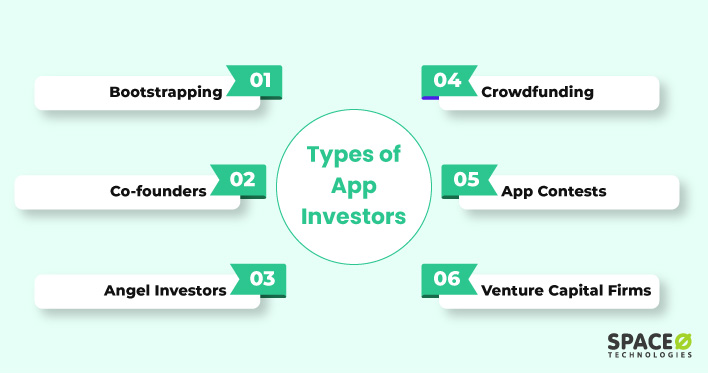

6 Types of App Investors to Fund Mobile App Development

There are not one but 6 types of investors who can raise funds for you. Below are the listed types of potential investors.

Bootstrapping

Self-funding is another name for bootstrapping. This refers to the process of investing with only personal savings, borrowed from the personal network of friends and family, or from existing personal investments.

- The entrepreneur gets to experience while risking personal savings. So if the business fails, the entrepreneur will not have to pay off loans or other borrowed funds.

- With bootstrapping, entrepreneurs can focus on the growth of the company, optimize the process, and not on fundraising.

Why is bootstrapping one of the best types of funding?

Co-founders

Another way to find an investor is to get your family member to become a co-founder. If they are convinced with your app idea, they are likely to invest in your app project.

- Co-founder acts as a sounding board for all your thoughts, but also actively aids in making the final decisions.

- You are saved from debt or bank loan and a family relationship is easy to reach whenever you need it.

Why are co-founders one of the best types of funding?

Angel Investors

Seed funding is another name for angel funding. Angel funding is more flexible and less complicated compared to other sources of investors. Ensure to complete your groundwork before you put your app idea in front of an angel investor.

- Angel investors don’t have to repay the funds because you’re giving ownership shares in exchange for money.

- Angel investors have experience and thus can understand the consequences of bringing success to your starting a business.

Why are angel investors one of the best types of funding?

Crowdfunding

Go through a funding campaign based on three types which are donation-based, reward-based, and investment funding. There are sites like Kickstarter and Indiegogo, that are used by entrepreneurs, and investors to raise funds, for development efforts.

- Investors can track your progress which may help you to promote your brand through their networks.

- It’s an alternative finance option if you have struggled to get bank loans or traditional funding.

Why is crowd-funding one of the best types of funding?

App Contests

There are plenty of funding contests that take place worldwide. One of the well-known funding contests is the TV series Shark Tank. Well, you should get into Shark Tank to get your app funded if possible. But that is not the point here. There are tons of similar contests sponsored by universities, and tech companies give opportunities to entrepreneurs to present their idea and convince investors for funding.

- With multiple investors in the app contests, show an interactive demo experience to attract them.

- Participate in app contests to collaborate with other founders to grow the business and understand the industry better.

Why is an app contest one of the best types of funding?

Venture-capital Firms

Venture capitalists provide a large amount of cash. Although this takes time it is not always the case. These investors look for a fast-running app with greater returns.

- There is no obligation to repay the venture capitalists. Also, venture capital firms offer funds at zero interest.

- Venture capitalists are helpful in offering an extensive network for the company and demand no security.

Why is a venture-capital firm one of the best types of funding?

Tip:

Before you select the type of investor, you need to ensure the capital you need for your app. A successful startup would never pitch to investors without knowing how much money you need as funds for your mobile app development.

Branding Your Business

Once you have identified investors; brand your business. Investors are always keen to know if your company has created an identity and that the product is a part of logical branding. This helps the investors to visualize the app idea in a better way. Here are the reasons why startups need branding:

- Get a unique identity apart from your competitors.

- Maintains consistency and becomes the most reliable brand in the industry.

- Improves visibility among customers and investors.

- Conveys your core business and creates trust.

- Tell people who you are and why you’re here.

- Identify problems, and market size, define competitors, and focus on the goals.

- Provide a clear concise solution with features that investors can understand easily.

- Show off your brand/MVP and the service that you’re selling.

- Make them understand that you have the financial knowledge to reach your goals.

- Finally tell investors what you need from them with reasons.

Industry and Domain Knowledge

As a company if you are looking for the right source of funding, even investors would look for the right company to invest in. Look at their past investments in the market and identify if it is right to pitch them. For example, most venture capital investors go through a thorough checklist to screen your company and match its criteria.

Also, they would not like to invest in a company where the founders lack industry experience and knowledge. You will need to prepare a compelling pitch for your and your team to ensure that you are aware of the industry’s market.

Look for the Unique App Idea

As the owner of the app idea, you may think that the idea is one in a million. But if there isn’t any uniqueness about the app, there are chances that the investors might have heard the same idea or seen a similar app somewhere. Answer these questions before you present the idea to investors:

- Is there any potential for your app idea?

- Does it solve the issues of the target audience?

- Will the app bring any new innovation or invention?

You need to show why your app would be different from what your competitors offer. This is a competitive edge that is your USP to become successful over other companies.

Understanding About Market Data

If you really want to convince your investor, you need to show that there is enough market for your product. The requested capital should make sense. If you are asking for a million dollars of investment, the investors should be sure that the market size is sufficient. To do this, lay out the data to prove a large market and customer base.

Check for the Effective Business Model

Present the business model that you are currently using. Prove that the business plan will help you gain profits. Different investors seek different plans and attributes. If you are looking for prospective investors, you need to customize the plan and pitch according to each investor. For example, angel investors and venture capital investors emphasize finance and market issues. So, focus on those areas while pitching a business idea.

If you still have queries on how to get funds quickly, here are some things to consider that help you get the funds quickly.

- Get your numbers right and strong enough to support your app startup.

- Consider your location of raising funds, whether you are raising offshore or sourcing domestic investors.

- Are you targeting angels with more flexibility or venture capitalists with a structured process?

- Check the time of the year before you think to raise money. Just before Christmas would take a longer time.

- Run through your own pitch multiple times before you pitch in front of the investors. Invest more time to prepare the best pitch.

- Look for a reliable co-founder to become your partner for a startup

- Start a crowdfunding campaign

- Raise your own money as funds

- Focus on early-stage venture capitalists

- Find your niche, and target audience

- Start branding activities at the initial stage

- Build a pitch deck to impress investors

- MVP is the key to a successful pitch

Prepare a Pitch for Investors

Do not expect the investors to hear your innovative business ideas and offer initial investment to your mobile app startup. Your aim is to initially grab the interest of the investors to continue the communication to a higher level. To achieve that goal, you need to understand how to pitch an app idea.

Planet of the Apps is one of the best examples to understand how the pitch meeting takes place. The contestants just have 60 seconds to pitch an app idea. When you pitch an app idea, make your investors understand the problem you want to solve with the features that you have used. Use PowerPoint or Slideshow presentation to prepare your pitch; but, when you showcase the idea don’t read the exact script in the meeting.

What to Include in Your Pitch Deck?

Here are the things that you can include in your pitch deck.

Tip:

Focus on how the investor will make money. Show them how you will return their money in a few years. Make them understand how you can do it and everything will fall into place.

Now that you know the steps to find the right investors, you should also be aware of what investors expect from a company that needs funds.

What do Investors Look for Before Funding an App Idea?

Here is the list of important things an investor would seek before investing his money.

Looking for Experienced App Developers for Your App Idea?

We, at Space-O, have dedicated mobile app developers who have built around 4400+ mobile apps on iOS and Android platforms. So, build customized apps as per your requirements.

Things to Consider for Early Access Funds From Mobile App Investors

Here’s the complete checklist to consider for the fundraising process.

Since you know the things to consider for mobile app investors, but if you still have doubts let’s understand FAQs for mobile app investors.

Frequently Asked Questions About Mobile App Investors

How long does the fund granting process take?

The process of venture capital funding may take 3- 9 months. Raising funds for your mobile app startup can be time-consuming and the timeline depends on the stage and sector of the business. You should be ready with how much funding you get during the early stage.

How do you get seed funding for app development?

The seed stage covers critical business needs. There are 5 proven ways to get seed funding for your app funding.

How to gain the attention of investors

Investors only invest in startups if they find the app idea to be unique. Startups entrepreneurs must have innovative ideas about their apps before they pitch to investors. You need to portray the product’s USP. Follow the below process before you pitch an app idea to the investors.

Find Potential Investors for your Startup for Business Growth

Most mobile app startups fail due to lack of funding or poor planning. However with the right approaches and in-time executed strategies you can find the right investors for your mobile application.

All you need to do is prove your app concept and sell your app idea as investors only fund the strongest ideas that sustain in the market. Remember that app development is a one-time process but you can update with new features to attract new users.

Do you need help developing a bug-free MVP? Look no further. Space-O is a leading app development company that has vast experience in developing scalable applications globally. To ensure your app achieves digital transformation goals, contact us.