If you are planning to create a fintech application for your fintech startup or a company, you are on the right blog. From this blog, you will get an idea about the complete custom FinTech app development process, steps, cost, and timeline.

You might be surprised to learn that the total transaction value of digital payments in the United States is expected to reach $2,041 billion by 2023.

We can confidently say that the global FinTech market is scaling rapidly.

The United States has 10,755 fintech (financial technology) startups as of November 2021, making it the region with the most FinTech businesses worldwide. FinTech startups will take over the world.

But how to build a FinTech app that will help you to scale your business?

Let’s understand.

Step by Step Guide to Build Native FinTech Application in 9 Steps

Check the following steps to develop a native FinTech app. Apart from this, if you are also wondering how to create a money lending app, you will surely benefit by following this guide.

Brainstorm Your Fintech App Idea and Its Feasibility

To survive in the FinTech industry for an extended period, you need to brainstorm before starting to build the app. Take out pen and paper and start brainstorming the idea. While brainstorming, you need to ask yourself these questions.

- How to develop an app from the user’s point of view?

- How to make a fintech app scalable?

- What types of fintech apps are doing good in the current market?

- What will be the USP of your FinTech app?

Once you are clear from your end, share your mobile app idea with an expert in app development or finance-related field. Take the reference from the best FinTech apps, and consider building the app accordingly. As you are about to launch your startup, you will fintech app consulting services from our experts. Book a free consultation to get complete guidance from starting a business to scaling them.

Research About Your Target Market

FinTech is a broad market; more than a dozen subsets are being created. Along with being broad, FinTech niches are competitive as well. Age, gender, income, lifestyle, geographical location, and preferences are the key factors to determine the target audience. By applying these factors you can establish and sustain yourself in the market.

Here are the 3 methods to research effectively about your FinTech target market.

Use Social Media Analytics to know about your target audience and how you can improve your publishing and outreach strategy to target potential customers.

Checking lookalike audiences is one of the best ways to determine the target of your FinTech audience.

Even if you don’t have the existing client list, target social ads to generate leads from social media. Then refine your audience as you move forward.

- Find valuable information about your target market by checking web analytics data. Google Analytics will show you in-depth information about your target demographic. You can check customer location

- Monitor your best performing content using Google Search Console to know which website content is performing well. Even the search console shows the list of important keywords which users search, you can update them to increase clicks and impressions for your content.

The next part of target market research includes referring to competitors’ reviews. Here are some of the websites you can access to check your competitor’s ratings.

Company What They Offer Clutch - Search for different companies to check their portfolio, ratings, and profile

- Use Clutch leader’s matrix to know the top-performing companies in a particular industry

- Evaluate company based on client reviews, portfolio, and specialization

Google My Business - Search different businesses in your niche

- Check business profile, client reviews, and contact information (phone number and email address)

Capterra - Advanced search facility to check products, software categories, and resources

G2 - Search software-wise companies

- Filter out the company according to their reviews, pricing, features, category

Identify the Gap in the Market

To identify the gap, it is essential to understand what requirements your application will fulfill or the impact it will give on your market. The below table shows the 5 ways to identify the gap in the FinTech market.

Strategy Explanation Monitor trends in your area of expertise Keep yourself updated with current market trends by staying in touch with industry experts. Obtain feedback on your initial product idea from clients Always take feedback from clients and users. Make a list of the points you will apply in your upcoming product according to their feedback. Research competitors and provide unique value Check what your competitors are missing. Such as applying new trends, testing the app, and positioning themselves in the market. Thinking globally Strive to build a product that has the potential use by a global audience. Adapt to modern services and products Focus on adapting to the new technologies and enhancing your product. Want to Build Your Customized Mobile Banking App?

Consult us. Let us help you to develop a smart, scalable, and customized FinTech app according to your requirements.

Ensure Legal Compliance Before Developing a Fintech Application

While developing mobile banking apps, it is essential to apply security protocols to save your FinTech app from illicit activities. To prevent such activities from happening, it is essential to follow legal compliance. Since it is a FinTech app, users will send mobile payments to others, involving important data that must be kept secure.

If security precaution is not taken, there is a chance for the hackers to steal users’ personal information. We have mentioned points related to legal compliance you should consider before you create a FinTech app and finalize it.

- Comprehend the legal agreements related to users’ financial data using APIs

- Generate data privacy and management policy

- Offer insurance policy to cover any accidental breach

- Create a backup in case of disaster recovery and business continuity

You need to hire a leading mobile app development company like Space-O having experienced app development team that will help you to build fully functional FinTech mobile app. Additionally, we follow all the compliances to ensure your idea remains confidential and crucial business information safe.

Taking Care of Jurisdiction While Publishing Apps in Different Countries

The confidentiality agreement protects your idea from getting exposed. Therefore, it is advisable to sign an NDA to protect your idea before sharing your FinTech application idea with any mobile app development company.

Prevent Your Product by Having Intellectual Property Rights

All work that is original and developed during the mobile app development process is referred to as intellectual property (IP). You and your team will create legal app concepts, original content, designs, logos, app names, source code, and more during the app development process. It is suggested to register trademarks, copyright, or patents to get protected against your app idea.

Protect Your Contracts With Additional Data Usage Clauses

Contract signing is an advantageous process for both parties. The contract contains the responsibilities of both parties, the discussed technologies, cost, the flow of work, and timeline as well. Always include the clause of confidentiality, code ownership, and terms of use of open-source software.

Privacy Policy Update

The privacy rights of app end-users should not be disregarded. A privacy policy is the most common technique to address the privacy rights of mobile app users.

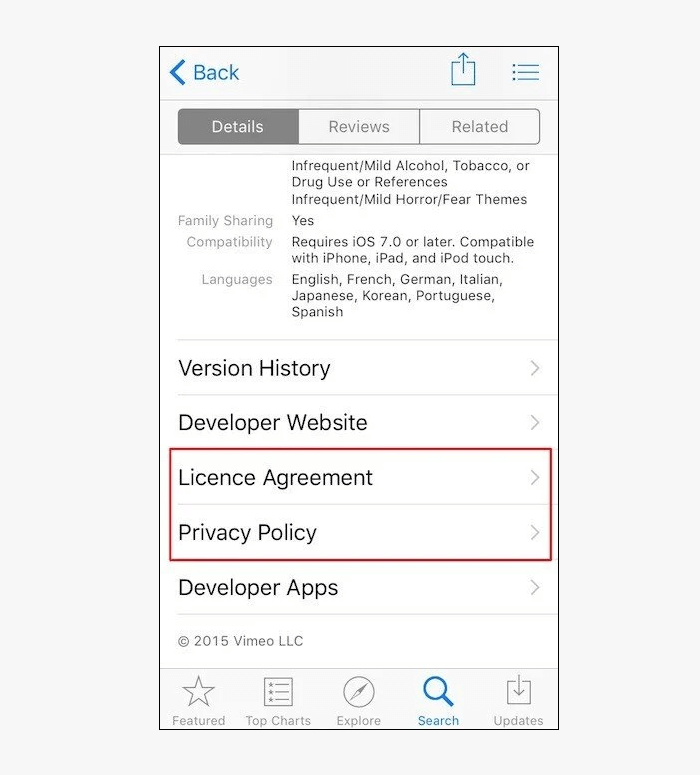

End-user License Agreement

End-user Licensing Agreements or EULA are required when the consumers download or install a mobile app. EULA is required since copyright laws protect the app. Also, EULA is an agreement between the app’s owner and the app’s users. In the below image, the license agreement and privacy policy are available for you to read.

Check these screenshots for your reference. You must have these two pages on your Fintech application.

Source: Vimeo

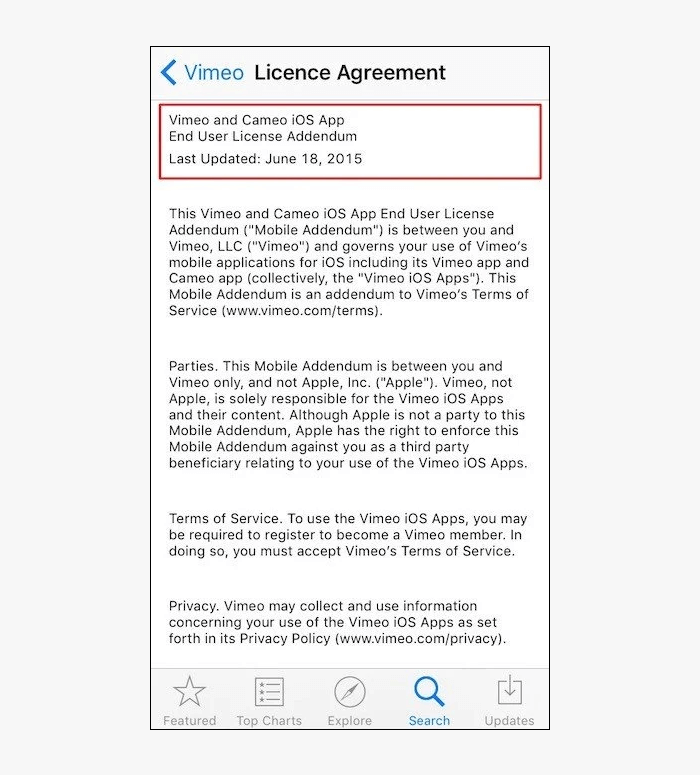

When a user will click on License Agreement, he will see the EULA embedded in the mobile app.

Source: Vimeo

Considering all the legal guidelines, we have built 2 of the best FinTech apps for our clients.

These apps have helped our clients to gain over 50,000 users and generate 35x ROI.

PayNow

PayNow for Stripe is a safe and fast NFC payment app that allows users to accept credit card payments right from their phones.

FTCash

FTCash allows you to pay vendors, merchants, restaurants, and other businesses without having to carry a wallet.

Select the Right Tech Stack During Fintech App Development

Selection of a tech stack is a crucial part of FinTech application development. Meanwhile, selecting the wrong tech stack will waste your time, money as well as resources.

Before sharing the exact tech stack to build the lending apps, here are the points you should consider while choosing the right tech stack.

Factors to Consider Explanation Scope of project Define features, project goals, functionalities, development cost, and deliverables to choose the right tech stack. App architecture While defining app architecture, all the components of an app communicate with each other. Choose MVC (Model-View-Controller) architecture which is recommended for app development. The programming languages Java and Python are popular programming languages in the financial industry, especially while building FinTech apps. Development timeline If the development timeline increases, it directly impacts the cost as well. To save time, you may opt for cross-platform app development which has become a well-known app development type in financial technology. It uses Flutter and Xamarin for app development. Thread detection technologies Budgeting apps integrate AI, biometric authentication, blockchain, tokenization, and fraud detection system. As you have learned about the key points to consider prior to choosing the tech stack. Next, we will discuss the right tech stack to follow while building financial apps.

Tech Stack to Build Android-based FinTech Mobile Application

Type Tools Android App Development Tool - Android Studio

UI/UX - Adobe XD

- Adobe Illustrator

- Figma

Frontend Tech Stack - React Native

- Angular

- Vue.js

Backend Tech Stack - Python

- JavaScript

- Java

- C/C++

- Ruby

Frameworks - React

- Node.js

- Django

- ROR

- Spring

Databases - PostgreSQL

- MySQL

- MongoDB

- Redis

Tech Stack to Build iOS-based FinTech Mobile Application

Type Tools iOS App Development Tool - Xcode

- AppCode

UI/UX - UIKit

- SwiftUI

Programming Language - Objective-C

- Swift

Tech Stack to Build Cross-platform FinTech Mobile Application

Type Tools Android App Development Tool - Android Studio

UI/UX - Adobe XD

- Adobe Illustrator

- Figma

Programming Language - React Native

- Flutter

- Xamarin

Backend Tech Stack - Python

- JavaScript

- Java

- C/C++

- Ruby

Frameworks - React

- Node.js

- Django

- ROR

- Spring

FinTech Mobile App Development

After deciding on the tech stack, the next step will be to design the front end of the FinTech app. The design plays a major role in terms of gaining users’ attention and increasing user engagement. The colors, style, and feel of the app are some of the crucial factors considered while developing the front-end of a mobile app. The next part will be to build and develop components that interact with users.

The front-end app development focuses on delivering perfect user requirements with a positive user experience.

For example, if you are building a FinTech app make sure to design a simple and intuitive app. Display numbers and charts in an engaging way. Don’t try to overcomplicate it for users. Make your app design responsive for users.

There are numerous technologies on which to develop a back-end. The choice between Python, Java, and even Golang is usually chosen by the scale of the project, the requirement to deal with legacy infrastructure, and plain old performance.

However, there are certain key considerations to make when selecting a back-end technology for your FinTech business.

- Is it possible to easily scale FinTech solutions later by using these technologies?

- Will these technologies help to develop a FinTech app with robust infrastructure?

- Will the selected technologies deal effectively with regulatory issues quickly?

- Is it possible for these technologies to resolve customer interface quickly?

Even API development plays an important role while building FinTech App. This means that Financial institutions provide specific APIs for third-party access to their client services. After that, multiple 3rd parties use banking services or provide them to their customers.

If you are planning to build a FinTech app, consider applying for the below-mentioned back-end technologies.

Technology Explanation Java Java has been the preferred technology of most banks and financial organizations for well over two decades, because of being platform-independent, portable, and architecturally neutral. Python Because of its basic yet strong character, it is an excellent choice for lightweight web-based finance solutions. The language is easy to learn since its dynamically typed syntax is similar to English. In other words, your team will learn and master Python far faster, significantly lowering the cost of technology acquisition. Ruby When it comes to FinTech-specific software projects, Ruby is a relatively new technology. Nonetheless, Ruby on Rails, a sophisticated framework, has made it one of the most popular and rapidly expanding languages. Big Data Big Data helps in handing larger data volume, personalized experience, and enhanced risk assessment for users. Have an App Idea?

Want to validate your app idea for free? Want to get a free consultation from an app development expert?

Build MVP Version FinTech App

Just to recap, we have discussed the gap in the market, gathered app requirements, and even identified the right tech stack to develop a FinTech app. Now, using all these components, we will build an MVP (minimum viable product) version of the FinTech app.

Especially for the FinTech startups, developing an MVP version of the app helps to gain the early traction of the users. Also, it saves your cost and time and helps you to receive constructive feedback prior to launching the final product.

After your MVP is out, you’ll need to collect data and learn about user behavior using mobile analytics. New data and early app store reviews will aid you in deciding which features to implement next.

Test Your App

While testing your application, it is essential to refine it. The application should be tested using all the essential tools. Here are the 2 points to consider while testing your application.

- It is essential to check the compatibility with several devices. Make an excel sheet, and mention outdated and latest devices. Include basic metrics like download updates and installation timeline. As this activity will help you remove the majority of the bugs in mobile app testing.

- Network connectivity is important, as the app requires an active internet connection to fetch the live data from the server.

Testing your app alone will not fetch the results. It is essential for you to constantly enhance your mobile app. Check the next section to know how you can improve your app consistently.

Consistently Improve Your App

Throughout the development, it is essential for you to keep one thing in mind, which is to consistently improve your app. Only by improving the mobile app, you can scale your business. Here 5 points to keep in mind to improve your FinTech app.

- Perform an A/B test and discuss with your team regarding enhancing the app.

- Collect users’ feedback, reviews, complaints, and requests and take immediate action or reply to them with appropriate answers.

- Improve your app on the basis of user feedback, user complaints, and user request.

- Adapt to new technologies which are being launched in the market. Technologies such as AI, ML, and Blockchain will have a huge impact on your FinTech app.

- Know about the list of essential features you need to integrate to make your FinTech app smarter.

We have discussed the detailed FinTech app, here is the list of 4 smart features to include in your FinTech mobile app.

How Much Does It Cost to Develop a FinTech Application?

The cost of app development and maintenance depends upon app functionalities and requirements. It would be hard to share the standard pricing of the FinTech app. Here is the approximate budget to build a banking app.

| Types of FinTech App | Approximate Budget |

|---|---|

| Basic | $20,000 to $50,000 |

| Average | $40,000 to $70,000 |

| Complex | Above $1,00,000 |

How Long Does It Take to Build a FinTech App?

It takes 3 to 5 months to build a basic FinTech App.

However, the timeline matters on several factors such as app complexity, requirements, and the type of app development you select.

After discussing with our experienced app developers, here is the approximate timeline to consider while building a FinTech app.

| App Type | Timeline |

|---|---|

| Basic | 2 – 4 months |

| Average | 4 – 6 months |

| Complex | 6 – 9+ months |

Smart FinTech App Features

Blockchain-based Security

A large number of FinTech applications have used blockchain, a decentralized database technology. Data manipulation of any kind is totally prevented by a blockchain, which is a chain of data blocks storing data with unique time stamps. A write-only protocol enforced by blockchain databases makes it impossible to delete or tamper with any data. It provides the most advanced security solution for FinTech apps to protect transactions and data.

AI Integration

Artificial intelligence (AI) technology is used to provide cutting-edge advancements to banking apps. The capabilities of FinTech apps can be greatly boosted by incorporating artificial intelligence (AI) into them. A FinTech app with AI assures a large number of benefits, including operational efficiency, pinpoint precision, improved customer service, effective fraud detection, and wealth management.

Personalization Functionality

User experience plays a vital role in FinTech mobile app development. Making a change in UX design, designing custom menu options, and offering mobile app features according to user preferences are the key points that will help your app to stand out from the competition. Technologies such as AI and Big data analytics will also help to gather the user behavior and allow you to deliver polished UI for your mobile app.

Alert and Notification

Alerts and notifications play a huge role when it comes to integrating features in the FinTech app. Users should not be bombarded with hundreds of alerts and notifications. Only notify users with valuable information. Such as important financial transactions, payment reminders, bank account balance updates, and auto-debit notifications.

Which are the Best FinTech Apps Available in the Market Currently?

| Apps | Total Valuation (2021) | Country of Origin | Download |

|---|---|---|---|

Coinbase | $82.7 Billion | USA | |

Robinhood | $32 Billion | USA | |

Nubank | $30 Billion | Brazil | |

Chime | $25 Billion | USA |

Above we have discussed the top FinTech apps, in the next section we have mentioned the frequently asked questions related to fintech application development.

FAQs of FinTech App Development

What is the difference between Neobanks and FinTech apps?

Neobanks are digital banks that do not have any physical branches. It’s possible to describe it as a true branchless digital bank. Chime, Current, Aspiration, Varo are some of the biggest Neobanks in the USA.

On the other hand, money transfers, bill payments, invoicing, and cost trackers will be done through mobile banking apps, bypassing the banks’ bureaucracy.

How do FinTech apps make money?

Most of the money FinTech apps make is from advertising, third parties, and subscriptions. However, we have also written a guide on how FinTech apps make money that you must check.

What are the different types of FinTech companies?

The below table contains the 4 categories into which FinTech companies are divided.

| Categories | Explanation |

|---|---|

| Lending | Simplified the way money is borrowed. Now, the companies use advanced software to assess borrowers’ credit. |

| Payment | The payment you transfer will be processed without passing through the banks. |

| International money transfers | Provide international money transfers that are faster and less expensive |

| Personal finance | Manage your budget, save money and get investment and retirement advice |

Ready to Develop a Top-notch FinTech App?

You have learned about the step-by-step procedure, cost, timeline, and well-known FinTech mobile applications. Along with the rapid growth and innovations, FinTech has a tremendous future. If you are looking to build a FinTech mobile app for your business, then reach out to us.

Space-O Technologies is an experienced fintech application development company and can help you with validate your idea, and develop a custom financial software solution as per your specific needs.

We offer free 30-minute consultations when you connect with us for a mobile app development service, during which ask any questions you have about your app. Please contact us using the ‘Contact Us’ form if you require assistance with any of the services. One of our sales representatives will contact you as soon as possible.