Recently, the Near Field Communication (NFC) payment apps have caught the attention of many people worldwide.

NFC is a simple method of contactless communication of data between two devices placed in less than 20 cm proximity. and this technology has already been adopted in Europe, Asia, and gaining increasing popularity in North America.

In fact, NFC mobile payments are available in the U.K. since 2011. And even if you’ve never owned an NFC equipped smartphone like Nokia Lumia or Galaxy S5, you probably have used NFC.

What is NFC (Near Field Communication)?

NFC is a technology that lets two local devices share small bits of data, and it is embedded things such as smart cards, print advertisements, and commuter cards.

But today, this technology has been placed in Android, iOS, and Windows phones, and due to this, the NFC app for Android has become more relevant than ever, especially when it’s the matter of mobile payments.

How Does NFC App Work?

- After launching the payment app or best pay app on your phone, the phone is tapped on the credit card terminal and a connection is made using NFC.

- At this step, you need to scan your finger or enter a passcode to approve the transaction.

- After that, the transaction will be validated with a separate chip called the secure element (SE), which relays that authorization back to the NFC modem.

- At this step, the payment will be finished processing the same way that it would in a traditional credit card swipe transaction.

Nowadays, Google Pay might be the first app that comes to mind when you think about the best NFC Android apps, but there’s more to it than just mobile payments. An experienced user knows how to use NFC tags to automate a whole host of phone functions, like passing contacts, launching apps, or even configuring the wireless settings.

Check out the following best NFC payment apps for Android and iOS that are secure to use.

Top NFC Payment Apps for Tap and Pay

| Apps | Downloads | Reviews (Play Store) | Download |

|---|---|---|---|

Google Pay Google Pay | 500 Million+ | 4.1 82.8L Reviews | |

Apple Pay Apple Pay | 100 Million+ | 3.1 2.6K Reviews | |

PayPal PayPal | 100 Million+ | 4.4 26.5L Reviews | |

LifeLock Wallet LifeLock Wallet | 1 Million+ | 4.5 30.2K Reviews | |

Square Wallet Square Wallet | 100 Million+ | 4.3 145K Reviews |

Google Pay (previously Android Pay)

For Android-powered smartphones, Google Pay is an NFC payment app for Android that can be used to tap and pay in stores. You can use it to make in-app payments. Google Wallet, retooled as a person-to-person payment app, has been replaced by Google Pay and you can use to send money to your family and friends.

The application allows you to use most of your credit and debit cards from major card brands, including American Express, Discover Cards, and more. You can also use cards issued by many large banks including Bank of America, Citi, and Wells Fargo. A full list of participating banks is available on the Google Pay website.

You can easily use this app to pay for things within apps on your phone and in a wide variety of real-life stores and even some vending machines. Most of the major mobile phone carriers like T-Mobile, Verizon, and AT&T also accept payments through this service.

Apple Pay

Apple Pay is a mobile wallet app for iPhones and the Apple Watch that allows you to load it with your credit & debit cards. A Google Pay alternative app allows to tap & pay at stores and restaurants, which have contactless point-of-sales systems.

Obtainable on iPhone 6 and new phones as well as the Apple Watch, you can use this application to make in-app purchases using the iPhone or the iPad. Your iPhone requires you to lock your screen using a passcode and Touch ID to allow Apple Pay, and you can also use Touch ID or your passcode to authorize payments.

If you want some additional security, you can choose a 6-digit code rather than the traditional 4-digit PIN. To protect your payment card data, Apple Pay makes use of tokenization and like other popular electronic wallets, it doesn’t store your payment card details on your device.

The only risk is losing your phone or having it stolen; therefore, it is important to turn on Find My iPhone that allows you to turn on Lost Mode to suspend Apple Pay or to erase your device remotely. To disable Apple Pay, you can use iCloud as well.

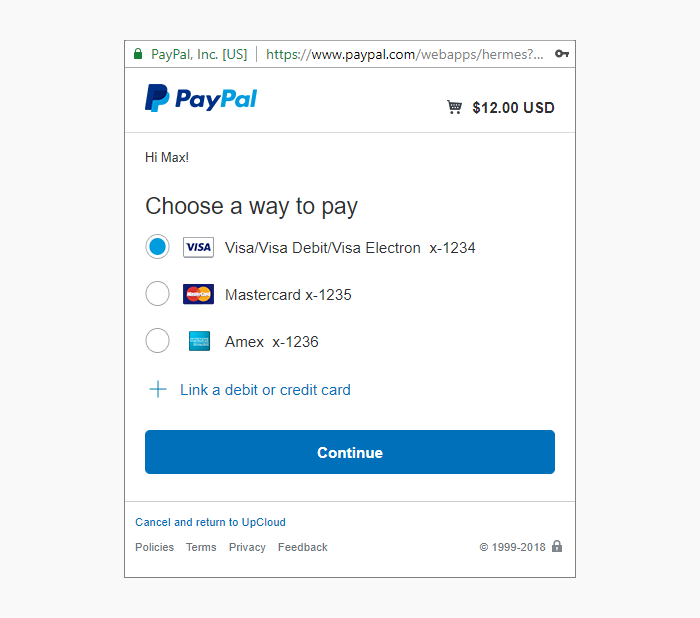

PayPal

Sending money or paying online to almost anywhere in the world is possible in just a few seconds with PayPal. Download this wonderful application on your device and manage all the ways you send, receive, and spend money at a glance.

Users of this app can instantly transfer money to PayPal account holders in more than 100 countries using the mobile phone. Once they get money in their account, they can spend the money online or withdraw it with just a single tap. Being completely free, this app allows you to send money to friends in the US from your bank account or PayPal balance.

The best thing about this application is whenever you send, receive, and spend money with PayPal, it sends an instant notification to help you track it all. No matter whether you are making use of PayPal Credit, your balance, your bank or your debit and credit card to pay with PayPal, you can easily find anything you need to simply manage it all in this secure payment app.

LifeLock Wallet

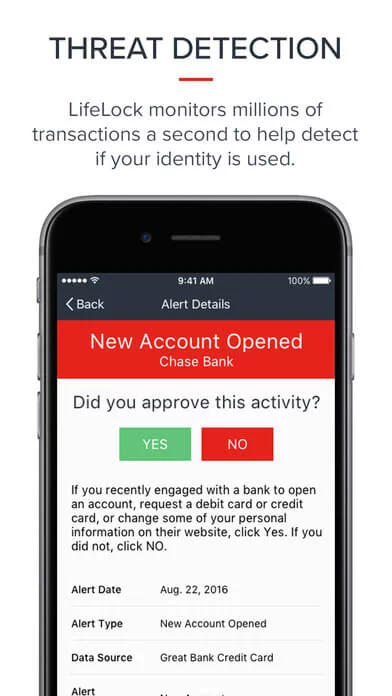

LifeLock is an identity theft protection service, which acquired Lemon Wallet in December 2013 and launched its own digital wallet platform called “LifeLock Wallet”.

LifeLock Wallet is one of the best NFC payment apps that allows you to store debit, credit, ID, insurance number, and loyalty cards, in addition to providing identity theft protection service within its app only.

It scans millions of transactions every second to detect and alert you to threats to your identity. And if you, unfortunately, become a victim of identity theft, an Identity Restoration Specialist is dedicated to your case to fix the issue from start to finish.

Square Wallet

Obtainable on iOS and Android platform, Square Wallet works like Lemon Wallet, but with some additional features. You can link your credit card to the app, but rather than paying directly with the credit card, it requires the use of merchant cards.

Therefore, the Square Wallet app works amazingly. As this app is location-based, the store knows that you are ordering something and will charge it to the card linked to your Square account.

Offering a hands-free checkout option, the app allows you to favorite the merchant. All you need to do is to say your name at checkout. As you visit these stores, you can earn any reward or discount that you can use on your next visit.

On a Concluding Note

So, these are the top NFC mobile payment service apps or best NFC apps on Android that are used by people worldwide for their day-to-day payments. With the growing demand for NFC payment apps, there are various merchants, who are realizing the benefits of having NFC payment apps for their customers.

If you are a merchant and looking for NFC tap an app, you can get in touch with us as we are a custom mobile app development for startups, having experience in developing a custom NFC-based mobile app solution.

In case, if you still have any query or confusion regarding windows phone NFC payments, mobile app development cost, how long does it take to make an app, or steps to making an app for windows phone NFC payments, how to develop best payment apps, then you can get in touch with us through our contact us form. One of our sales representatives will revert to you as soon as possible. The consultation is absolutely free of cost.