Let’s Build Your Fintech App

Fintech App Development Services We Offer

We offer a full suite of fintech app development services designed to help you build secure, compliant, and high-performing financial applications. Our team covers every stage of mobile app development from product planning and UX design to backend engineering, API integration, and deployment.

Fintech Consulting & Strategy

Not sure where to start with your fintech transformation? Our fintech consulting services provide strategic guidance on technology selection, regulatory compliance, product roadmap development, and go-to-market strategy that aligns with your business objectives and competitive positioning.

- Product roadmap and feature prioritization

- Technology stack recommendations

- Regulatory compliance strategy (PCI DSS, GDPR, SOC 2)

- Market analysis and competitive positioning

Custom Fintech App Development

Need a financial application built specifically for your business model? We develop fintech mobile applications from scratch, tailored to your unique requirements and regulatory environment. Our custom fintech solutions scale with your business growth while ensuring bank-grade security and seamless integration with your existing financial infrastructure.

- End-to-end development with modern frameworks

- Native iOS, Android, and cross-platform solutions

- Microservices architecture for scalability

- Agile sprints with regular demos and feedback

UI/UX Design for Fintech Applications

First impressions determine whether users trust your financial platform. We design intuitive, user-friendly interfaces that reduce friction in complex financial processes while maintaining the highest security standards. Our fintech UI/UX design increases conversion rates, improves user retention, and builds lasting trust with your customers.

- User research and financial persona development

- Interactive prototypes for early validation

- WCAG-compliant accessibility for all users

- Conversion-focused interface optimization

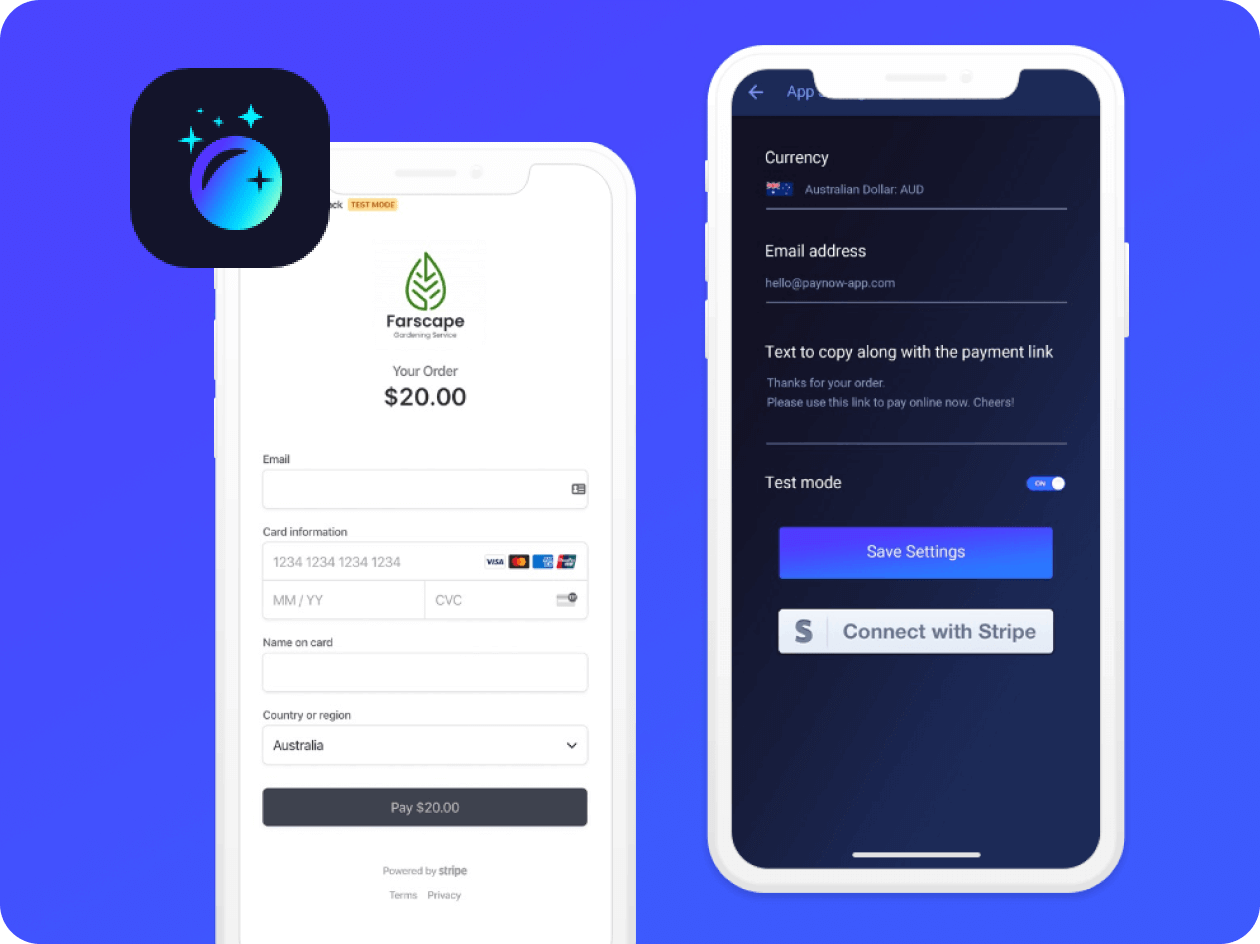

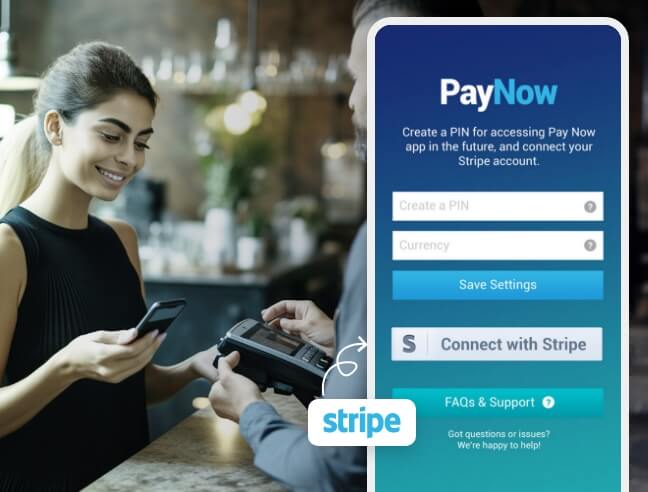

API & Third-Party Integration Services

Connect your fintech platform with the broader financial ecosystem through strong API integrations. We implement payment gateway integration, open banking API development, and core banking system connectivity that enables real-time data synchronization across all your financial touchpoints.

- Payment gateway integration (Stripe, PayPal, Square, Plaid)

- Open Banking API implementation (PSD2 compliant)

- Real-time transaction processing and settlement

- ERP and core banking system integration

Security Audits & Compliance

Financial applications demand the highest security standards. Our comprehensive security audits include penetration testing, vulnerability assessments, and compliance verification for PCI DSS, GDPR, SOC 2, and KYC/AML regulations, ensuring your fintech platform meets all regulatory requirements.

- Penetration testing and vulnerability scanning

- PCI DSS, GDPR, SOC 2 compliance audits

- Security architecture review and recommendations

- Ongoing compliance monitoring and updates

Maintenance, Support & Staff Augmentation

Need continuous support or additional fintech expertise? We provide 24/7 monitoring, proactive maintenance, security patches, and dedicated fintech developers through our staff augmentation services, ensuring your application remains secure, compliant, and performs optimally.

- 24/7 application monitoring and support

- Regular security patches and updates

- Bug fixes and performance optimization

- Dedicated fintech developers for team extension

Legacy System Modernization

Transform outdated financial systems into modern, cloud-native applications without disrupting your operations. We modernize legacy fintech platforms through cloud migration, API-first architecture transformation, and performance optimization that reduces maintenance costs while improving scalability and user experience.

- Cloud migration to AWS, Azure, or GCP

- Microservices architecture transformation

- API-first platform redesign

- Performance optimization and scalability enhancement

Fintech Blockchain Development

Leverage blockchain technology to build transparent, secure, and decentralized financial solutions. Our blockchain fintech development expertise spans smart contract development, DeFi protocols, and consensus mechanism implementation that reduces transaction costs while enhancing security and transparency.

- Smart contract development and security audits

- DeFi protocol architecture and implementation

- Private and public blockchain integration

- Tokenization and digital asset management

AI & Machine Learning Implementation

Enhance your fintech application with intelligent automation and predictive capabilities. Our AI-powered fintech solutions include fraud detection systems, credit scoring models, conversational AI chatbots, and predictive analytics that improve decision-making and reduce operational risks.

- Fraud detection and prevention systems

- Credit scoring and risk assessment models

- AI chatbots for customer support automation

- Predictive analytics and financial forecasting

Build Your Fintech App with Trusted Experts

Join 1,200+ startups and enterprises that rely on Space O Technologies for secure mobile app development. Build your finance app with confidence and full compliance.

Fintech Solutions We Develop

As a globally trusted custom fintech app development company, we deliver innovative financial solutions that streamline operations, enhance security, and improve customer engagement. Our experienced fintech app developers build scalable applications that meet the evolving needs of modern financial services while ensuring full regulatory compliance.

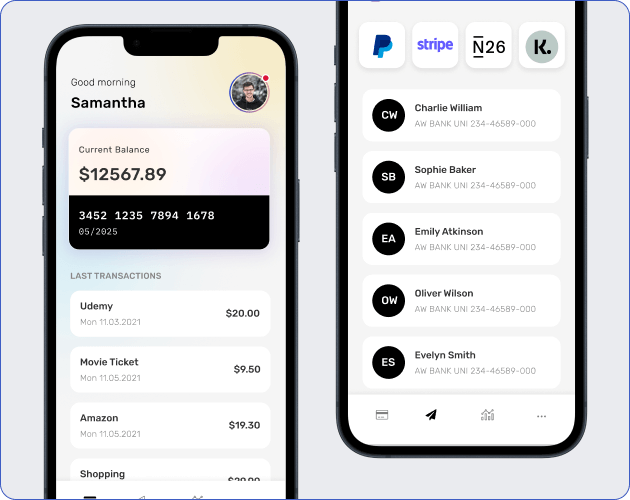

Digital Banking & Neobank Apps

Digital Banking & Neobank Apps

We develop modern digital banking solutions that provide account management, multi-currency support, card management, virtual cards, and real-time transaction processing. These apps deliver seamless banking experiences on any device while improving user engagement and operational efficiency.

Payment Processing Platforms

Payment Processing Platforms

Looking for an app that handles high-volume payments securely and reliably? Our solutions include payment gateways, cross-border processing, real-time settlements, and reconciliation tools, ensuring fast, accurate, and scalable financial transactions while reducing operational complexity for businesses of all sizes.

Digital Wallets

Digital Wallets

We design intuitive mobile wallet applications supporting cryptocurrency, multi-currency, and QR/NFC payments. These solutions simplify money management, enhance user convenience, and maintain bank-grade security, providing seamless financial transactions while improving customer satisfaction and adoption of digital payment services.

Lending & Loan Management Platforms

Lending & Loan Management Platforms

Want to streamline loan workflows from application to repayment? Our platforms include P2P marketplaces, loan origination systems, credit underwriting, and debt collection tools, automating processes, reducing manual effort, and improving operational efficiency across lending and financial services.

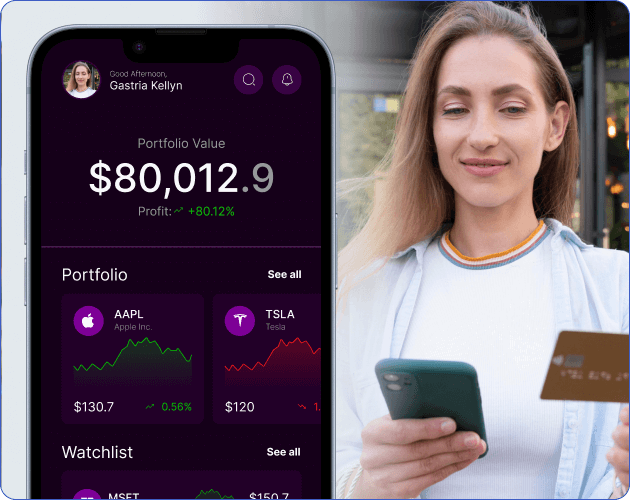

Investment & Trading Platforms

Investment & Trading Platforms

We develop sophisticated trading and investment platforms offering real-time market data, advanced analytics, and trading across stocks, forex, options, and social networks. These solutions empower investors with actionable insights, enhanced portfolio management, and seamless execution in dynamic financial markets.

InsurTech Solutions

InsurTech Solutions

We deliver intelligent insurance technology applications, including policy management, automated claims processing, comparison platforms, and embedded insurance. These solutions improve operational efficiency, reduce processing errors, and enhance customer experience by modernizing traditional insurance workflows.

Wealth Management & Robo-Advisory

Wealth Management & Robo-Advisory

We develop robo-advisory and wealth management apps offering automated investment strategies, portfolio optimization, retirement planning, and goal-based investing. These applications make professional wealth management accessible, delivering personalized advice, smarter decisions, and scalable investment management for a wide audience.

RegTech & Compliance Platforms

RegTech & Compliance Platforms

Want to reduce compliance risks while saving operational costs? Our RegTech apps include KYC/AML automation, transaction monitoring, fraud detection, and regulatory reporting dashboards, helping businesses automate regulatory workflows and ensure accurate adherence to evolving financial standards.

mPOS & Merchant Solutions

mPOS & Merchant Solutions

We develop mobile point-of-sale and merchant solutions, including payment gateways, invoicing, and inventory integrations. These applications streamline business operations, enhance cash flow management, and provide flexible, reliable payment acceptance for merchants of all sizes and sectors.

DeFi Protocols & Decentralized Exchanges

DeFi Protocols & Decentralized Exchanges

Curious how decentralized finance can broaden your financial services? We build DeFi solutions, including liquidity pools, automated market makers, yield farming, decentralized exchanges, and NFT marketplaces, enabling secure, transparent, and permissionless financial operations globally.

Personal Finance Management Apps

Personal Finance Management Apps

Looking to help users gain control of their finances? We design apps with budgeting, expense tracking, bill reminders, goal planning, and tax management tools, enabling informed financial decisions and promoting wellness through simple, intuitive interfaces.

Alternative Finance Platforms

Alternative Finance Platforms

Looking to expand access to capital innovatively? We build platforms for crowdfunding, Buy Now Pay Later, invoice factoring, and peer-to-peer lending, connecting borrowers and investors while enabling inclusive financial models that drive growth and opportunity worldwide.

Hear From Our Fintech Clients

Project Summary

iOS & Android Dev for Fintech Company

SA fintech company hired Space-O Technologies to develop a mobile application that helps users manage their savings more efficiently. The team also built an iOS and Android version of the app.

Project Summary

Mobile App Dev for Tech Company

Space-O Technologies developed a mobile app for a tech company. They built an iOS- and Android-friendly platform that enabled communication among users and provided them access to nearby television listings.

Our Fintech Mobile App Development Success Stories

We’ve developed transformative fintech mobile app solutions that enhance security, improve user experiences, and drive measurable business growth. Our portfolio demonstrates proven results across digital banking, payment processing, and innovative financial platforms.

Let Us Build Your Next Fintech Success Story

Turn your idea into a secure and scalable fintech app backed by our successful portfolio across payments, lending, wealth, and neobanking.

Our Solutions Recognized & Featured In

Technologies We Use for Fintech Mobile App Development

We use standard technologies to build secure, scalable, and high-performance fintech applications that meet modern demands, ensure regulatory compliance, and deliver exceptional user experiences across all platforms.

Benefits of Fintech Mobile App Development

Developing a fintech mobile app delivers measurable improvements across customer engagement, operational efficiency, and business growth, giving you competitive advantages that off-the-shelf solutions simply cannot match.

Enhanced Customer Experience & Engagement

Give your customers complete control over their finances instantly. With intuitive mobile interfaces, personalized recommendations, and smooth transactions, fintech apps reduce friction, boost engagement, improve retention, and create stronger brand loyalty while delivering experiences users enjoy and trust.

Improved Operational Efficiency & Automation

Automate time-consuming processes like payment handling, loan approvals, KYC checks, and compliance reporting. Custom fintech apps cut operational costs significantly, enabling higher transaction volumes without adding staff or infrastructure, helping your business run faster and smarter.

Robust Security & Regulatory Compliance

Security is built in from day one. Bank-grade encryption, multi-factor authentication, biometric verification, and regular audits ensure your fintech platform meets PCI DSS, GDPR, and SOC 2 standards, keeping sensitive financial data safe and regulatory requirements fully satisfied.

Scalability for Rapid Business Growth

Scale confidently as your business expands. Cloud-native fintech apps, microservices architecture, containerized deployments, and elastic infrastructure deliver consistent performance, accommodate new markets or product lines, and support rapid user growth without costly downtime or infrastructure overhauls.

Competitive Market Advantage

Stand out in a crowded market with unique features, superior experiences, and innovative capabilities. Custom fintech apps enable fast feature deployment, quicker market response, and continuous improvement, giving your business a measurable edge over competitors while delighting users.

Multi-Currency & Global Reach

Expand financial services globally with multi-currency support, local payment methods, and region-specific compliance. Fintech apps handle internationalization, cross-border transactions, and local regulatory adherence, making it easier for your business to grow and succeed worldwide.

Why Choose Space-O Technologies as Your Fintech App Development Company

With expertise across banking, payments, and blockchain, we deliver fintech solutions that meet regulatory standards while driving business growth.

Proven Track Record in Fintech

We have successfully delivered 4,400+ app projects with deep fintech expertise across digital banking, payment processing, lending, and blockchain solutions. These applications serve millions of users daily. They improve operations, enhance customer satisfaction, and deliver measurable business outcomes.

Expert Development Team

Our team of skilled fintech app developers specializes in financial technology and stays current with evolving regulations, including PCI DSS, GDPR, SOC 2, and KYC/AML standards. We maintain ISO 27001:2022 certified development processes, ensuring delivery of secure, compliant fintech solutions.

Proven Experience with Financial Institutions

We’ve partnered with traditional banks, payment processors, fintech startups, and financial service providers to deliver mission-critical applications. Our experience with financial workflows, regulatory environments, and integration requirements makes us the ideal partner for your fintech transformation.

Flexible Engagement Models

Choose the collaboration model that best fits your needs. We offer Fixed Price for well-defined projects, Time & Material for evolving requirements, and Dedicated Team/Staff Augmentation for continuous development and scaling, ensuring optimal resource allocation and cost efficiency.

Security-First Development Approach

Security is paramount in everything we build. We’ve maintained a zero security breach record across all fintech projects through rigorous security audits, penetration testing, secure coding practices, and continuous monitoring. Every line of code is written with bank-grade security standards in mind.

High Client Satisfaction Rate

We’ve successfully delivered 1000+ software projects with a 98% client satisfaction rate on Upwork. Our proven development practices, transparent communication, and genuine long-term partnerships ensure projects exceed expectations and deliver measurable business results.

Work with a Trusted Fintech App Development Company

Join startups and financial businesses that rely on our 15+ years of expertise, strong delivery standards, and secure engineering practices.

Our 6-Step Fintech App Development Process

Our fintech app development experts follow a proven methodology to ensure fintech mobile applications are delivered on time, within budget, and exceed quality expectations. Every milestone prioritizes security, regulatory compliance, and seamless user experience, helping your financial solution succeed from day one.

01

Discovery & Requirements Analysis

Every successful fintech project starts with understanding your business. We conduct stakeholder workshops, analyze competitors, identify regulatory requirements, and document functional and technical specifications. Within 1–2 weeks, you will receive a detailed roadmap with clear milestones, budget, and timeline.

02

UI/UX Design & Prototyping

Financial apps must be intuitive for diverse users. Our designers create user flows, wireframes, and interactive prototypes that simplify complex processes. You experience the full user journey before development begins, ensuring alignment with your vision and expectations.

03

Development & Integration

Our team builds your fintech platform using modern frameworks and security best practices in 2-week agile sprints. Each sprint delivers functional features incrementally, including development, code reviews, unit testing, and security validation to maintain high quality throughout the process.

04

Security Testing & Compliance Audit

Before launch, your fintech app undergoes thorough security testing. QA engineers conduct penetration testing, vulnerability assessments, compliance verification (PCI DSS, GDPR, SOC 2), and performance testing under load to ensure bank-grade security and regulatory adherence.

05

Deployment & Training

We manage the technical complexities of production deployment. Whether cloud-based or on-premise, we configure servers, implement monitoring tools, set up backups, and provide user training, ensuring a smooth launch with minimal disruption to your ongoing operations.

06

Ongoing Support & Enhancement

Post-launch, we monitor performance 24/7, resolve issues proactively, and implement updates as needed. Regular maintenance windows include security patches and optimizations, while we collaborate with you to prioritize new features based on user feedback.

Engagement Models We Offer

Choose the working model that fits your fintech project needs, whether you need a dedicated team, extra developers, or a fixed-cost solution for a well-defined scope. When you hire fintech software developers from Space-O Technologies, you get flexibility aligned with your goals.

Dedicated Team

Access full-time fintech specialists committed solely to your financial software project, with management flexibility under your direction or ours. Perfect for continuous development cycles or expanding platform capabilities without permanent recruitment costs.

Time & Material Model

Adapt seamlessly to evolving project requirements with this flexible approach. Investment scales with actual development hours and resources consumed, enabling you to refine features and adjust priorities as your fintech solution matures.

Fixed Cost Model

Establish project boundaries, delivery schedules, and budget amounts upfront. This approach suits fintech MVPs and initiatives with clear specifications, stable requirements, and a defined scope that minimizes mid-project changes.

Staff Augmentation

Integrate skilled fintech professionals into your existing development team without recruitment overhead. We manage candidate selection, integration processes, and assistance, enabling rapid capacity expansion while maintaining operational focus.

We Build Fintech Mobile App Solutions For

Our fintech app development services extend across multiple financial sectors, helping businesses innovate, streamline operations, and deliver superior customer experiences through secure, scalable digital solutions.

Banking & Financial Services

Transform traditional banking with mobile-first solutions. We develop digital banking platforms, core banking integrations, and customer-facing applications that modernize operations while ensuring regulatory compliance and data security.

Insurance (InsurTech)

Revolutionize insurance operations with intelligent automation. Our insurtech solutions include policy management systems, claims processing automation, underwriting platforms, and customer portals that reduce processing times and improve customer satisfaction.

Payments & Remittances

Build a secure payment infrastructure that handles high-volume transactions. We create payment gateways, digital wallets, cross-border remittance solutions, and mobile payment applications that ensure secure, instant financial transactions.

Investment & Wealth Management

Empower investors with sophisticated trading and investment tools. We develop stock trading platforms, portfolio management systems, robo-advisory applications, and wealth management solutions that democratize access to investment opportunities.

Lending & Credit

Streamline lending operations from application to repayment. Our lending platforms include P2P lending marketplaces, loan origination systems, credit scoring engines, and automated underwriting solutions that accelerate loan processing while managing risk.

Cryptocurrency & Blockchain

Lead the decentralized finance revolution. We build cryptocurrency exchanges, blockchain protocols, DeFi applications, NFT marketplaces, and crypto wallets that leverage blockchain technology for transparent, secure financial services.

RegTech & Compliance

Navigate complex regulatory landscapes with intelligent automation. We develop KYC/AML verification systems, transaction monitoring platforms, regulatory reporting tools, and compliance management solutions that reduce costs while ensuring regulatory adherence.

Real Estate (PropTech)

Modernize real estate financing and transactions. We develop property investment platforms, real estate crowdfunding solutions, mortgage automation systems, and property management applications that simplify real estate financial operations.

Accounting & Tax Management

Simplify financial management for businesses and individuals. Our solutions include accounting software, expense management platforms, invoicing systems, and tax filing applications that automate financial record-keeping and compliance.

Frequently Asked Questions on Fintech Mobile App Development Services

How much does fintech mobile app development cost?

Fintech app development costs vary based on complexity, features, integrations, and compliance requirements. Basic fintech apps with essential features start around $30,000–$50,000, while mid-level applications with payment integration and advanced security range from $60,000–$120,000.

Comprehensive enterprise solutions with blockchain, AI, and multi-platform support typically cost $150,000–$300,000 or more. Consult with our experts for a precise estimate based on your specific requirements.