The fintech industry is growing at a rapid pace, driven by the need for faster transactions, secure digital experiences, and automated financial processes. According to Fortune Business Insights, the global fintech market was valued at 340.10 billion dollars in 2024 and is anticipated to reach 1,126.64 billion dollars by 2032, reflecting the massive shift toward digital financial services.

From mobile banking and digital wallets to lending platforms and wealth management tools, businesses across the world are investing in fintech solutions to stay competitive and meet rising customer expectations.

Building a reliable fintech product requires more than just good design. It demands strong security, strict compliance, scalable architecture, and seamless integrations with banking and payment systems. This is why companies often look for an expert fintech software development company that can turn complex financial requirements into secure, user-friendly applications.

In this guide, you will learn everything about fintech software development, including the essential features, compliance standards, development process, cost breakdown, and best practices to build a high-performing fintech solution. The goal is to help you understand what it takes to create a secure and scalable fintech platform that delivers long-term business value.

Contents

What Is Fintech Software Development?

Fintech software development refers to the process of creating digital solutions that simplify, automate, and secure financial services. These solutions help banks, financial institutions, and fintech startups deliver faster and more convenient financial experiences to users while maintaining strong security and compliance with industry regulations.

Fintech software includes a wide range of applications such as mobile banking apps, digital wallets, lending platforms, wealth management tools, payment processing systems, and insurance technology solutions. The goal is to replace manual processes with digital workflows, improve transaction security, reduce operational costs, and offer a smooth user experience across devices.

In simple terms, fintech software development is the process of building secure, compliant, and scalable digital solutions that power the next generation of financial services.

Fintech adoption market insights

Fintech adoption is accelerating across the world as consumers and businesses shift from traditional financial services to fast, secure, and fully digital alternatives. The growth is driven by rising smartphone usage, widespread internet access, and increasing trust in digital financial platforms.

- Global fintech funding reached $44.7 billion across 2,216 deals in H1 2025, reflecting a selective but active investment climate. [ KPMG]

- Digital wallets are on track to be used by more than two-thirds of the global population by 2029, implying over 5.5 billion users in the coming years. [Digital Silk]

- Digital payment transaction value is projected at $24.07 trillion in 2025 globally, with multi-year growth ahead. [Statista]

When you work with a financial software development team on custom solutions, you’re competing on capabilities, speed, and customer trust, not just transaction costs. The window to build fintech advantage is now. By the time legacy competitors catch up, the market share will already be divided.

With a clear understanding of what fintech software development involves and how rapidly the market is expanding, the next step is to explore the different types of fintech solutions businesses are investing in.

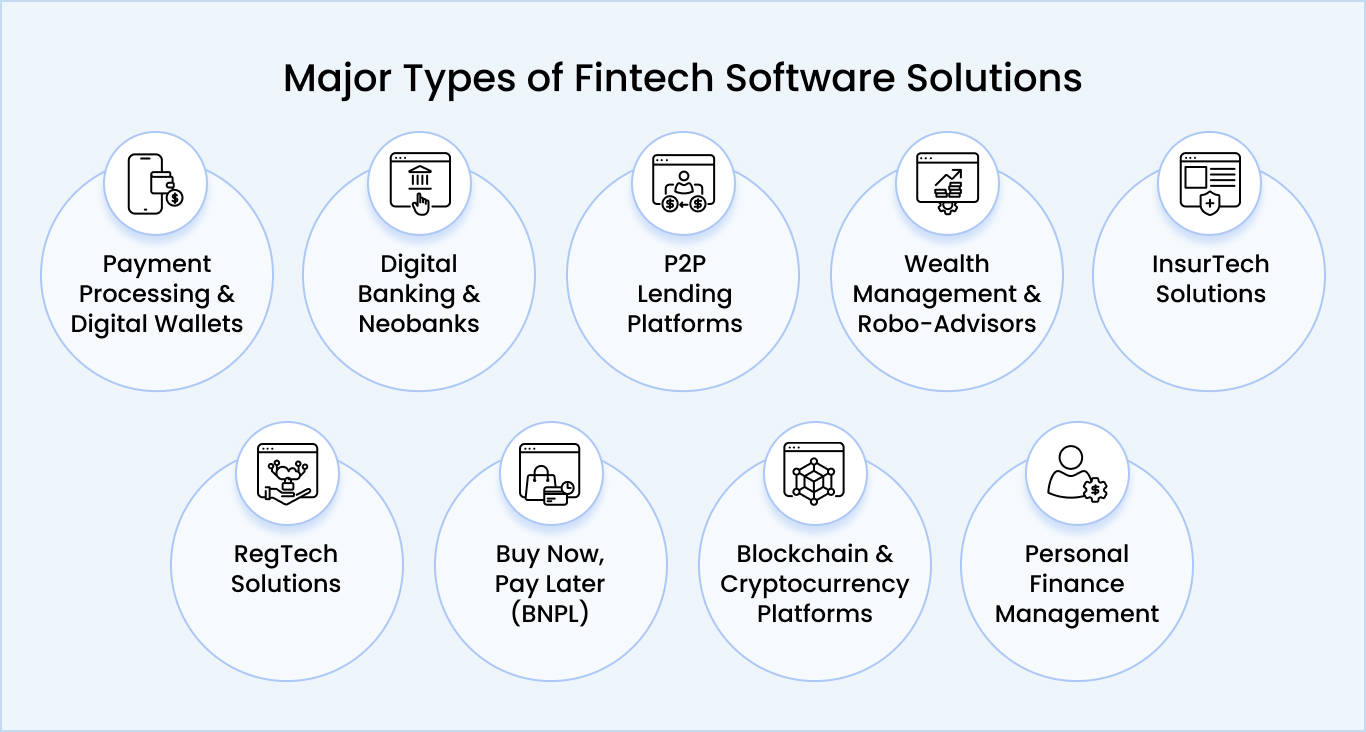

Types of Fintech Software Solutions

Custom fintech software development takes many forms, each solving distinct financial problems. Understanding what each type does and what it enables is critical to choosing the right solution for your business.

Payment processing & digital wallets

Payment processing platforms handle the critical infrastructure that moves money between parties. They enable customers to send, receive, and manage money across channels; online, mobile, or in-store, without exposing sensitive banking information. These platforms sit at the intersection of customer experience and financial security, processing transactions in seconds while protecting both parties from fraud.

Core capabilities

- Real-time payment routing across multiple channels

- Multi-currency and cross-border payment support

- Advanced fraud detection and prevention

- Instant settlement and fund availability

- Merchant integration and reporting dashboards

- Mobile wallet and recurring billing support

Why businesses build it: Payment processing and billing software development generate recurring revenue through transaction fees while becoming essential infrastructure that other financial services depend on.

Examples: Stripe, PayPal, Square

Digital banking & Neobanks

Neobanks replace the traditional bank branch with a fully digital banking experience. Customers open accounts, manage money, apply for loans, and access investments entirely through mobile or web applications.

These platforms deliver the complete set of banking services without any physical infrastructure, making banking available 24/7 from anywhere. The experience is designed from the ground up for mobile, eliminating the friction and limitations of traditional banking interfaces.

Core capabilities

- Fully digital account opening (no paperwork or branches)

- Real-time peer-to-peer and bill payments

- Loan origination with instant decisions

- Savings and investment tools

- 24/7 customer support via chat and AI

- Balance management and spending analytics

Why businesses build it: Neobanks eliminate massive overhead costs from physical infrastructure. They appeal to digital-first customers who never want to visit a branch. Revenue comes from transaction fees, subscription tiers, and lending spreads.

Examples: Chime, Revolut, N26

P2P lending platforms

Peer-to-peer lending platforms create marketplaces where borrowers can connect directly with lenders, bypassing traditional banks entirely. The platform handles all the complexity: credit assessment, loan matching, fund disbursement, and repayment processing. Borrowers access credit they might not qualify for at traditional banks, while lenders earn returns on their capital.

Core capabilities

- Automated credit decision-making using alternative data

- Intelligent borrower-lender matching algorithms

- Real-time fund disbursement to borrowers

- Portfolio management and performance tracking for lenders

- Regulatory compliance automation

- Payment processing and default management

Why businesses build it: Alternative lending captures customers that traditional banks reject. Developing a P2P app helps earn competitive returns. The platform takes a fee on each transaction, creating predictable recurring revenue.

Examples: LendingClub, Prosper, Funding Circle

Wealth management & Robo-advisors

Robo-advisor platforms replace human financial advisors with sophisticated algorithms that build, manage, and optimize investment portfolios. Customers input their financial goals and risk tolerance, and the platform automatically constructs and rebalances a diversified portfolio.

These platforms deliver professional-grade wealth management at a fraction of traditional advisory costs, making wealth management accessible to customers who couldn’t afford human advisors.

Core capabilities

- Goal-based investing and planning

- Automated portfolio rebalancing

- Tax-loss harvesting optimization

- Real-time portfolio analytics and performance tracking

- Asset allocation based on risk profile

- Low-cost advisory fees

Why businesses build it: Wealth management scales without hiring teams of financial advisors. Customers get professional-grade advice at 10% of traditional advisory costs. Revenue comes from AUM (assets under management) fees.

Examples: Betterment, Wealthfront, Robinhood

InsurTech solutions

InsurTech platforms digitize and automate the entire insurance lifecycle. From the moment a customer requests a quote to the moment claims are processed and paid, everything happens digitally and automatically. These platforms use data, AI, and real-time information to make faster underwriting decisions and deliver more personalized pricing. The result is faster turnaround times and happier customers compared to traditional insurance.

Core capabilities

- Instant online quote generation

- AI-powered underwriting and risk assessment

- Real-time dynamic pricing based on risk data

- Automated claims processing and payment

- Digital document verification and authentication

- IoT device integration for usage-based pricing

Why businesses build it: Digital insurance has lower operational costs than traditional insurance. Faster claims mean happier customers. The business model is proven across home, auto, life, and health insurance.

Examples: Lemonade, Oscar Health, Metromile

RegTech solutions

Regulatory technology platforms automate compliance, fraud detection, and transaction monitoring for financial institutions. Rather than requiring teams of compliance officers to manually review transactions and documentation, RegTech platforms continuously monitor activity in real-time, flag suspicious patterns, and generate regulatory reports automatically. These systems reduce compliance risk while dramatically lowering the cost of staying compliant.

Core capabilities

- Automated KYC (Know Your Customer) verification

- Continuous AML (Anti-Money Laundering) monitoring

- Real-time transaction fraud detection

- Automated regulatory reporting

- Complete audit trail logging

- Compliance rule engines and policy management

Why businesses build it: Compliance is expensive and non-negotiable. Regulators impose billions in fines annually for violations. RegTech solutions pay for themselves through risk reduction alone.

Examples: ComplyAdvantage, Trulioo, Onfido

Buy Now, Pay Later (BNPL)

BNPL fintech application development enables consumers to split purchases into installments at checkout without traditional credit checks. These platforms integrate directly into e-commerce flows, allowing customers to complete transactions instantly while the BNPL platform handles underwriting and payment collection. The customer experience is frictionless, approve or decline in seconds, while merchants increase average order values.

Core capabilities

- Instant approval decisions (seconds, not days)

- Multiple installment payment schedules

- Real-time merchant integration at checkout

- Alternative credit scoring and decisioning

- Mobile-first checkout experience

- Automated payment collection and defaults management

Why businesses build it: BNPL increases average order value and customer conversion rates. Merchants pay transaction fees while the platform earns interest on installment payments. Revenue scales with e-commerce growth.

Examples: Klarna, Afterpay, PayPal Pay in 4

Blockchain & cryptocurrency platforms

Fintech app development in the crypto space enables customers to buy, sell, stake, and manage digital assets. These fintech platform development solutions provide trading interfaces, wallet management, DeFi integrations, and custody solutions. They operate on decentralized networks while providing the user-friendly interfaces that mainstream customers expect.

Core capabilities

- Cryptocurrency exchange and trading

- Digital wallet management and security

- Staking and yield farming

- DeFi (Decentralized Finance) integrations

- Smart contract execution

- Real-time market data and charting

Why businesses build it: The crypto market is valued at trillions. Early movers capture users and trading volume. Revenue comes from trading fees, withdrawal fees, and staking rewards.

Examples: Binance, Coinbase, MetaMask

Personal Finance Management (PFM)

PFM platforms help individuals track spending, create budgets, plan goals, and optimize their financial lives. These solutions aggregate data from multiple bank accounts and financial institutions, providing a single dashboard for complete financial visibility. AI-powered recommendations help users make smarter financial decisions based on their spending patterns and goals.

Core capabilities

- Multi-account aggregation and connection

- Automated expense categorization

- Budget creation and tracking

- Goal-based savings planning

- AI-powered financial recommendations

- Bill payment reminders and optimization

Why businesses build it: PFM captures engaged customers who actively manage their finances. Revenue comes from subscriptions, premium features, and partnerships with financial product providers.

Examples: Mint, YNAB (You Need A Budget), PocketGuard

When evaluating fintech solution development options, you’ll find that most opportunities fall into one of these categories. The key is identifying which aligns with your target market, competitive advantages, and revenue model.

These are the different types of fintech software, and how each category supports specific financial functions. Next, let’s understand the real value these solutions bring to businesses.

Build the Right Fintech Solution for Your Business

Work with a team that has 15+ years of experience. Space O Technologies helps you choose the right fintech product type and develops a secure, compliant, and scalable solution tailored to your goals.

The Business Benefits of Building Custom Fintech Software

Building custom fintech software development services isn’t just a technology upgrade; it’s a strategic business advantage. Organizations investing in fintech software solution development experience transformative results across multiple dimensions.

Customer experience & engagement

Fintech delivers 24/7 access from any device. Customers accomplish financial tasks in 2-3 taps instead of visiting a branch. AI-powered platforms personalize recommendations. Mobile-first design drives significantly higher daily active usage compared to traditional banking.

Operational efficiency

Automation eliminates time-consuming manual work. KYC verification becomes instant. Loan underwriting happens automatically without human intervention. All of this reduces operational costs substantially. Fintech scales infinitely without proportional cost increases, serving millions of users costs roughly the same as serving thousands.

Revenue diversification

Fintech creates monetization opportunities that don’t exist with traditional banking: transaction fees, subscription tiers, lending interest, insurance commissions, and API access fees. First-mover advantage in your market segment is worth significant competitive value.

Competitive differentiation

When your business moves faster than legacy competitors, you capture market share first. Early movers establish brand loyalty and build customer bases that competitors will spend years trying to replicate. Your business becomes the standard that customers compare others against.

Faster go-to-market

Getting to market months or years ahead of competitors means capturing revenue while the space is still wide open. Your business can refine its product based on real customer feedback while competitors are still in development. This advantage compounds over time.

Scalability without friction

Growing your customer base shouldn’t require proportionally growing your infrastructure costs or support staff. With fintech, your business grows revenue while maintaining or even improving margins. Geographic expansion becomes a software deployment issue, not a capital investment problem.

Customer loyalty

When customers integrate your platform into their daily workflow, they develop habits and dependencies that create strong switching costs. Your business benefits from higher retention rates, lower churn, and more predictable recurring revenue. Acquiring customers becomes a growth multiplier instead of a constant drain on resources.

Now that you understand the business opportunity, the question becomes: what should you build? Software development for fintech spans multiple categories, each solving different financial problems and serving different market opportunities. Many companies choose to outsource fintech development projects based on their business model, which ultimately determines which type makes the most sense to pursue.

Now, let’s proceed to understand how these solutions can be turned into a reality for your business. Check the complete step-by-step software development process.

Turn Fintech Benefits Into Real Business Growth

Leverage our proven fintech development expertise to unlock automation, security, and seamless customer experiences. Our fintech software developers can help you build high-performing fintech platforms that drive measurable results.

From Concept to Market: Fintech Software Development Process

Building successful fintech requires a systematic, proven process. Here’s exactly how fintech development translates ideas into market-ready platforms that scale.

Phase 1: Market research & validation (weeks 1-2)

Before writing a single line of code, you need to understand your competitive landscape and market opportunity. This phase involves analyzing direct competitors, sizing your total addressable market, identifying regulatory requirements for your jurisdiction, and developing a deep understanding of your target user personas.

- Conduct competitive analysis

- Research market size and growth

- Document all regulatory requirements

- Create detailed user personas

Key actions:

Why it matters: Launching without this foundation means building products customers don’t want or violating regulations you didn’t know existed. This phase prevents costly pivots later.

Phase 2: Product strategy & feature roadmap (weeks 2-4)

With market clarity established, the focus shifts to defining exactly what you’ll build. Create detailed user stories, prioritize features for your MVP versus future phases, design wireframes showing user flows, and establish a realistic roadmap. Fintech application development success depends heavily on this planning phase.

- Define core features

- Create wireframes

- Prioritize MVP scope

- Build a 12-month roadmap

- Document user stories

Key actions:

Why it matters: A Clear product strategy prevents scope creep and keeps development focused on what matters most for market launch.

Phase 3: UI/UX design & prototyping (weeks 4-8)

User experience determines whether customers adopt your platform or abandon it. Create high-fidelity mockups for every screen, build interactive prototypes that users can actually click through, conduct user testing with real customers, and refine based on feedback. This is where fintech’s complexity gets distilled into elegant simplicity.

- Design all user screens

- Build clickable prototypes

- Test with real users

- Refine based on feedback

- Finalize design specifications

Key actions:

Why it matters: Poor UX causes adoption failure regardless of how sophisticated the backend is. This phase ensures your platform delights users, not frustrates them.

Phase 4: Architecture & technology stack selection (Parallel with Phase 3)

While designing the user experience, architectural work happens in parallel. Select backend technologies, choose database solutions, plan cloud infrastructure, design API specifications, and establish security architecture. The architectural decisions made here determine whether your platform can scale to millions of users or crash under load.

- Choose the technology stack

- Design system architecture

- Plan infrastructure

- Establish a security framework

- Design API specifications

Key actions:

Why it matters: Wrong technology choices lock you into expensive migrations later. Right choices enable rapid fintech app development and effortless scaling.

Phase 5: Development & integration (months 2-5)

This is where the actual platform gets built. Development happens in 2-week sprints, with continuous code reviews, automated testing, and regular progress checks. During this phase, integrate critical third-party services: payment gateways (Stripe, PayPal), banking APIs (Plaid), KYC providers (Trulioo), and compliance tools. Financial software development at this stage requires deep expertise in security, regulatory compliance, and payment processing.

- Build core features in sprints

- Integrate payment gateways

- Connect banking APIs

- Implement automated testing

- Document APIs

Key actions:

Why it matters: Iterative development with regular feedback prevents building features nobody wants. Integration work during development (not after) catches issues early.

Phase 6: Quality assurance, security & compliance testing (months 4-5)

Before any platform touches customer money, it must pass rigorous testing. Conduct functional testing, perform penetration testing and vulnerability scanning, verify regulatory adherence, and stress-test the system under peak load conditions.

- Test all features

- Conduct security audits

- Perform penetration testing

- Verify compliance

- Stress-test infrastructure

Key actions:

Why it matters: One security breach or compliance violation destroys your business. This phase is non-negotiable.

Phase 7: Deployment & launch (week 8)

Production deployment happens carefully. Configure infrastructure for high availability, set up monitoring and alerting systems, test disaster recovery procedures, and prepare support infrastructure. Launch campaigns execute, customer communication begins, and monitoring watches for issues in real-time.

- Deploy to production

- Configure monitoring

- Train support team

- Execute launch campaign

- Verify system stability

Key actions:

Why it matters: Smooth launches establish customer confidence. Rough launches create reputation damage that takes months to recover from.

Phase 8: Post-launch support & optimization (ongoing)

Launch is the beginning, not the end. The platform requires 24/7 monitoring, critical bug fixes within 4 hours, regular security patches, feature releases based on user feedback, and continuous optimization. This is where fintech platform development proves its worth—issues get caught before customers notice them.

- Monitor performance 24/7

- Fix critical bugs immediately

- Release security patches

- Gather user feedback

- Optimize based on usage patterns

Key actions:

Why it matters: Fintech platforms never stop. Continuous improvement keeps you ahead of competitors and maintains customer trust.

The complexity reality: Why expertise matters

Building fintech software is fundamentally complex. Regulations vary by jurisdiction. Security breaches destroy trust instantly. One compliance mistake costs millions in fines. This is why many businesses hire fintech developers from experienced fintech development companies specializing in this space.

Professional fintech software development services provide institutional knowledge from hundreds of projects. Teams understand regulatory requirements, security architecture, and payment complexity deeply. Partnering with fintech experts helps you avoid costly mistakes and reach the market faster than building these solutions in-house.

Once the process is clear, the next important question is how much it actually costs to build a fintech product. The following section breaks down the major factors that influence fintech software development cost to help you plan your budget more accurately.

Get Expert Assistance From Our Fintech Software Developers

Our team follows a structured approach that ensures strong security, regulatory alignment, and smooth delivery. Partner with Space O Technologies to turn your fintech idea into a reliable digital product.

How Much Does Custom Fintech Software Development Cost?

Custom fintech development costs vary widely because every product has different needs, security levels, compliance requirements, feature sets, and integration depth. Below is a practical breakdown so you can quickly estimate which range your project fits into.

| Complexity Level | Estimated Cost Range | What This Usually Includes |

|---|---|---|

| Basic Fintech App | $30,000–$80,000 | Simple features like user onboarding, basic transactions, dashboards, and limited APIs. |

| Mid-Complexity Solution | $80,000–$200,000 | Advanced workflows, automated processes, analytics, role management, and moderate integrations. |

| High-Complexity / Enterprise-Grade Platform | $200,000–$500,000+ | AI/ML, fraud detection, personalization engines, multi-layer security, heavy integrations, and custom UI/UX. |

Think of complexity the same way you’d think about building a house, adding extra rooms, advanced security systems, or premium materials, naturally raises costs. Fintech software works the same way: the more intelligence, automation, and compliance it needs, the higher the investment.

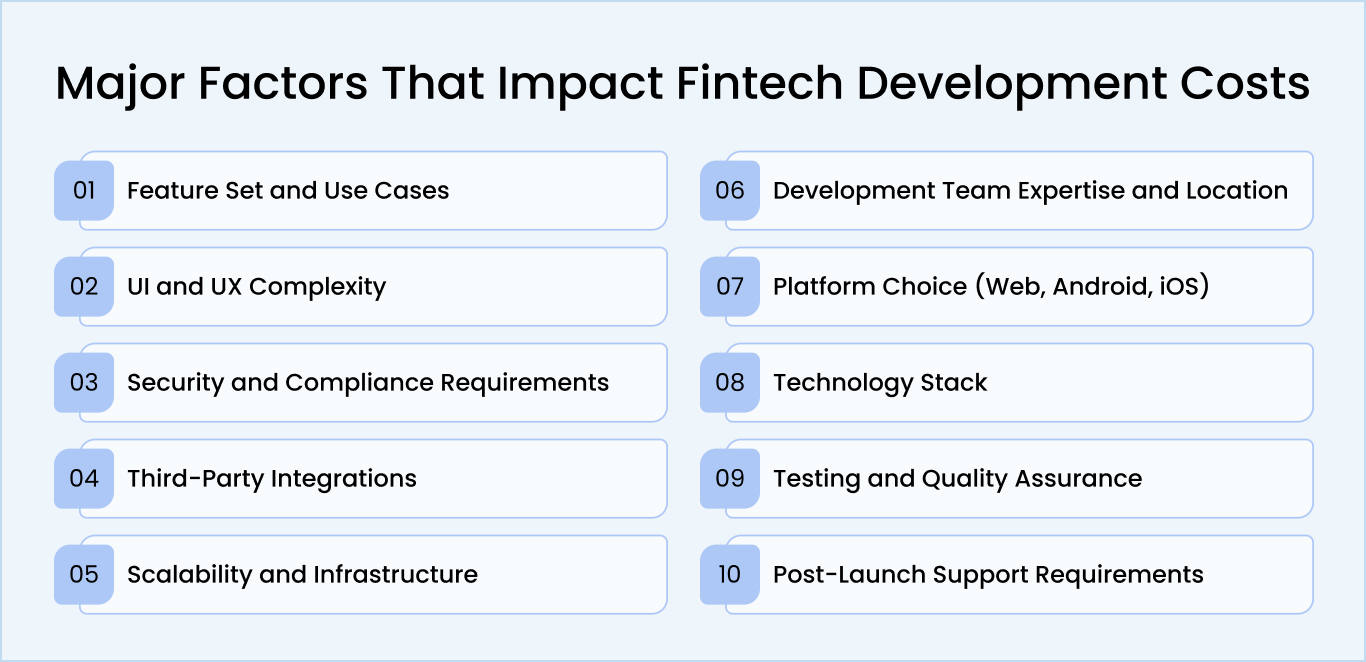

Key Factors Influencing Fintech Development Cost

Understanding fintech development cost isn’t just about the app’s complexity; several behind-the-scenes factors also shape the final price. Here’s what matters most:

Feature set and use cases

Your feature list determines how much engineering work is required. The more modules, workflows, and automation you add, the more development hours and testing the product will need.

UI and UX complexity

Fintech users expect smooth and trustworthy experiences. Complex design systems, detailed screen flows, and multi-device optimization increase both design and frontend development time.

Security and compliance requirements

Standards such as PCI-DSS, SOC-2, and GDPR require strict implementation. Multiple layers of encryption, audit trails, and verification processes add significant technical work.

Third-party integrations

Fintech apps often integrate with payment gateways, banks, KYC and AML services, and financial data providers. Each integration demands API work, testing, validation, and security checks.

Scalability and infrastructure

If your platform must support high-frequency transactions or real-time processing, a stronger cloud infrastructure is required. Building scalable and resilient systems increases engineering hours.

Development team expertise and location

Fintech specialists command higher rates because they understand compliance and financial workflows. Team location also plays a major role in overall hourly costs.

Platform choice (Web, Android, iOS)

Developing for multiple platforms increases design, development, and testing efforts. The cost of developing a fintech app for multiple platforms is more than the cost of building a single-platform MVP.

Technology stack

Using technologies like blockchain, real-time data streaming, or AI for fraud detection increases complexity. These tools require niche knowledge and more advanced engineering.

Testing and quality assurance

Fintech apps require extensive testing, including security checks, load testing, transaction validation, and compliance testing. More complex workflows require more QA time.

Post-launch support requirements

If your solution needs continuous optimization or new bank integrations, ongoing support becomes a recurring investment. Most fintech platforms continue evolving long after initial launch.

Now that you understand the investment required, the question becomes: what happens with that budget? Understanding how a professional fintech developer actually builds these systems, from planning through launch, helps you make informed decisions about timelines, resources, and what to expect at each stage.

Get a Clear, Accurate Estimate for Your Fintech Product

Space O Technologies can help you plan efficiently with expert guidance and transparent costing. Connect with our team to get a tailored estimate for your fintech software.

Compliance and Security Essentials in Fintech Software Development

Compliance and security aren’t add-ons in fintech; they’re the foundation. Experienced financial software development companies bake compliance and security into architecture from day one, not as an afterthought.

The challenge is that regulations vary by geography and product type, but certain standards apply globally. Successful fintech platforms bake compliance and security into architecture from day one, not as an afterthought.

Global Compliance Frameworks You Must Know

Regulations vary significantly by geography and the type of fintech you’re building. However, these five frameworks apply globally or in major markets. Understanding which ones apply to your business is critical; violations range from millions in fines to criminal liability for executives.

| Framework | What It Does | Key Requirements |

|---|---|---|

| GDPR (Europe) | Governs data privacy for anyone in the EU; considered the strictest global privacy regulation. | Explicit user consent for data collection; right to erasure; breach notification within 72 hours; maintain detailed processing records. |

| AML/KYC (Global) | Prevents money laundering and terrorist financing via identity verification and activity monitoring. | Verify customer identity before accounts; continuous transaction monitoring; SAR/STR reporting; maintain detailed verification records. |

| PSD2 (Europe) | Requires banks/fintechs to open APIs for third‑party access to customer data (with permission). | Build secure third‑party APIs; implement Strong Customer Authentication; transparent data‑sharing agreements. |

| HIPAA (US) | Protects health information privacy for fintechs handling PHI. | Encrypt all health data; role‑based access control; immediate breach reporting; Business Associate Agreements with partners. |

| SOC 2 & ISO 27001 (Global) | Security compliance frameworks demonstrating strong data protection practices. | Access controls, encryption, incident response procedures, and regular audits. |

Essential Security Architecture

Security is built in layers. Each layer protects against different threats. A breach in any single layer can compromise the entire system. Here are the five critical security layers that protect fintech platforms from fraud, hacking, and data theft.

| Security Layer | What It Protects | Implementation |

|---|---|---|

| Encryption | All sensitive data | AES‑256 for data at rest; TLS 1.2+ for data in transit; field‑level encryption for SSNs and payment data; Hardware Security Modules (HSMs) for key management. |

| Authentication & Access | User identity and data access | Multi‑factor authentication (MFA), role‑based access control (RBAC), biometric options (Face ID, fingerprint), and automatic logout after inactivity. |

| Fraud Detection | Real‑time transaction threats | AI/ML pattern analysis; velocity checks on transaction limits; geolocation verification; device fingerprinting. |

| Monitoring & Response | Ongoing threat detection | 24/7 automated monitoring; instant alerts for suspicious activity; defined incident response procedures; monthly security audits; quarterly penetration testing. |

| Data Protection | Information lifecycle management | Separate development and production data; daily backups with 30‑day retention; enforced data retention policies; GDPR right‑to‑be‑forgotten implementation. |

Compliance without security means you follow the rules but still get hacked. Security without compliance means your data is protected, but you’re still breaking laws. Both are essential. Both require ongoing investment and attention.

Understanding compliance and security requirements is one thing. Actually building systems that meet all these standards while staying on timeline and budget is another challenge entirely. Here are the five most common obstacles fintech teams face, and how to overcome them.

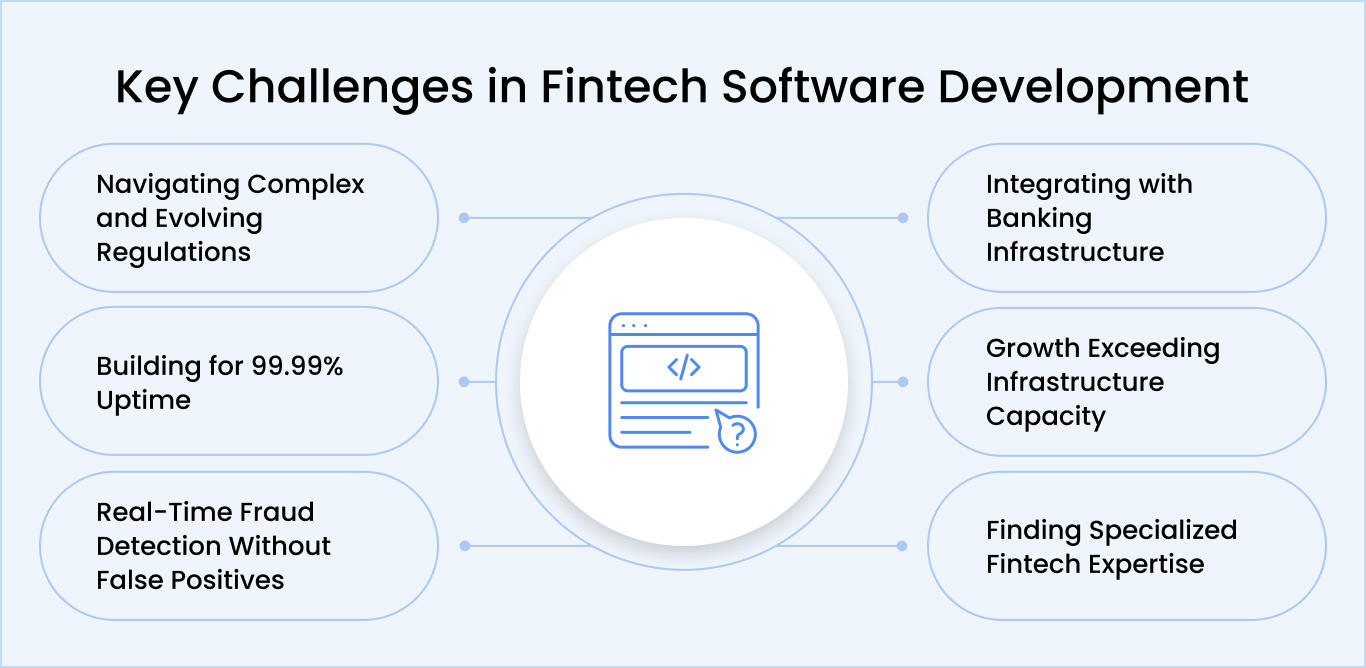

Common Challenges in Fintech Software Development

Building fintech is hard. You’ll face technical obstacles, regulatory complexity, and infrastructure challenges that don’t exist in other software domains. The most successful fintech builders anticipate these challenges early and plan for them rather than discovering them mid-project. Here are the six biggest obstacles you’ll encounter and proven strategies to overcome them.

Navigating complex and evolving regulations

Regulations change constantly and vary by jurisdiction. Your custom fintech software development might be legal in one country but violate rules in another. Teams often underestimate the compliance effort required, leading to rushed work that creates security gaps or regulatory violations.

Solutions

- Hire compliance experts from day one, not after development

- Build compliance into architecture rather than adding it later

- Use RegTech automation tools to monitor regulatory changes

- Maintain legal counsel familiar with your jurisdictions

- Budget 15–25% extra time beyond feature development for compliance

Building for 99.99% uptime

Fintech services operate 24/7, but infrastructure fails. Server crashes, database corruption, and network outages destroy customer trust instantly. Building systems reliable enough for millions of transactions without downtime is technically complex and expensive. Most fintech platform development teams dramatically underestimate the infrastructure cost and redundancy required.

Solutions

- Use managed cloud services with automatic failover capabilities

- Implement multi-region deployment from the start

- Build comprehensive monitoring and test disaster recovery monthly

- Budget for infrastructure costs exceeding application development costs

- Maintain on-call teams with proper compensation and response protocols

Real-time fraud detection without false positives

Detecting fraud in real-time is critical, but systems flagging too many legitimate transactions frustrate customers while missing real fraud costs money. When building financial software development solutions, balancing fraud prevention against user experience requires continuous refinement based on real transaction data.

Solutions

- Start with conservative rules and gradually expand based on actual patterns

- Use machine learning trained on your transaction data

- Implement multi-layered detection combining velocity checks, geolocation, and behavior analysis

- Build user workflows to quickly appeal false fraud blocks

- Update detection rules quarterly and partner with fraud specialists

Integrating with banking infrastructure

Connecting to banks, payment networks, and financial institutions is technically complex, heavily regulated, and slow. Partner institutions move slowly, require extensive compliance documentation, and have strict technical standards. Fintech application development projects fail when teams underestimate integration complexity and timelines.

Solutions

- Start integration work early, not after core development completes

- Use established payment platforms rather than building connections from scratch

- Work with integration specialists experienced in financial systems

- Build API documentation and testing before integration work begins

- Maintain a 2–8 week buffer per integration for unexpected delays

Scaling operations faster than the infrastructure can support

Your platform works perfectly with 1,000 users, but breaks at 100,000. Databases become bottlenecks, and payment processing hits rate limits. Custom fintech software development requires an architecture designed for scale from day one, but scaling infrastructure costs significantly more upfront than typical applications.

Solutions

- Design for microservices where each component scales independently

- Use database sharding for horizontal scaling and implement aggressive caching

- Load test at 10x expected peak traffic before launch

- Use cloud auto-scaling so infrastructure grows automatically with demand

- Monitor database performance continuously and optimize queries proactively

Finding specialized fintech expertise

Building fintech requires payment processing expertise, security specialization, regulatory compliance knowledge, and scalability experience. Most developers are generalists, and hiring specialists is expensive. When you hire fintech developers or build internal teams, you compete with well-funded startups for talent. Many fintech software development services fail because teams lack expertise in critical domains.

Solutions

- Partner with experienced fintech development companies instead of building everything internally

- Hire security specialists and compliance experts before general engineers

- Offer competitive compensation or equity to attract specialized talent

- Join fintech communities to access networks of experienced professionals

- Consider fractional roles (CTO, compliance officer) for specialized guidance

Transform Your Fintech Vision Into a Production-Ready Reality With Space-O Technologies

Building fintech internally means competing for specialists you can’t afford, navigating regulations you don’t understand, and launching platforms that fail under real transaction volume. Most teams underestimate security complexity, compliance timelines, and infrastructure costs. The smarter approach? Partner with fintech experts who’ve solved these problems hundreds of times.

At Space-O Technologies, we have spent 15+ years solving fintech’s hardest problems for clients globally. Our 140+ specialists bring deep payment processing expertise, regulatory knowledge spanning jurisdictions, and proven ability to build systems handling billions in transactions. We move fast because we’ve built this before.

We’ve shipped payment platforms, lending marketplaces, neobanking systems, and compliance automation, all with zero security breaches and a 97% client retention rate. Our team handles PCI-DSS architecture, fraud detection engines, and banking integrations. See proven implementations across our fintech portfolio that demonstrate exactly what’s possible.

Your fintech concept deserves partners who deliver. Schedule your free consultation today. We’ll map your regulatory landscape, architect your platform strategy, and show you exactly how to launch faster than competitors while staying bulletproof on compliance and security. Let’s build something that scales.

Frequently Asked Questions About Fintech Software Development

Should we build custom fintech software or use off-the-shelf platforms?

Custom solutions win when your business model requires unique workflows. Off-the-shelf platforms cost $5,000–$50,000 monthly in licensing and lack flexibility. Hiring a fintech development company for custom work costs more upfront but saves money within 18–24 months while giving complete control.

A quality fintech software development agency builds for your specific customers, not generic users. The decision isn’t about cost; it’s about competitive advantage versus vendor lock-in.

How long does fintech software development actually take?

Basic MVPs take 3–4 months. Mid-complexity solutions need 5–7 months. Enterprise platforms with fraud detection and integrations require 8–12 months. Third-party integrations (payment gateways, banking APIs) add 2–4 weeks each. Compliance work gets underestimated by 50%.

Work with an experienced fintech software developer who knows where delays occur and builds realistic timelines. Don’t rush; underestimating timelines kills more projects than overestimating budgets.

What happens if our business model changes mid-development?

Smart fintech development companies build modular architecture supporting pivots. Core payment processing, authentication, and data storage should be flexible so you can swap features without rebuilding foundations.

This is why architecture decisions matter early. Work with a financial services software development partner treating flexibility as a feature, not an afterthought. Plan for evolution and choose developers experienced in handling model changes gracefully.

Can we integrate with banking systems and payment networks?

Absolutely, but integrate earlier than planned. Most teams wait until core development finishes, then discover banking APIs require 2–8 weeks for approvals. Start integration work in parallel. Use established payment platforms rather than building connections from scratch.

Partner with a fintech software development agency experienced in your specific integrations—they know the quirks and timing challenges that surprise unprepared teams.

What’s the difference between fintech developers and regular software developers?

Fintech specialists understand payment processing, regulatory compliance, fraud detection, and security architecture. They’ve worked with banking APIs, handled PCI-DSS requirements, and debugged real transaction failures.

Regular developers build web apps. A fintech software development agency charges a 20–50% premium because expertise prevents disasters costing exponentially more. Verify that any partner has shipped financial platforms, not just standard applications.

Can we start with an MVP and add features later?

Yes. Start with core features: registration, transactions, and basic security. Launch, gather feedback, and build advanced features next. This reduces risk and gets revenue faster. Most successful fintech development companies follow this approach.

Ensure your MVP architecture supports future growth without complete rebuilds. Work with developers who prioritize sustainable foundations over feature maximization early on.