Fintech development outsourcing has become a strategic choice for financial institutions and fintech companies looking to build secure, compliant digital products without the overhead of large in-house teams. As financial software grows more complex and regulation-heavy, outsourcing allows businesses to access specialized fintech expertise while maintaining speed and cost control.

This shift is reflected in market growth. According to Technavio, the global outsourcing market in the BFSI sector is expected to grow by USD 32.2 billion from 2025 to 2029. The increasing adoption highlights how outsourcing is no longer a short-term cost-saving tactic but a long-term delivery model for fintech innovation.

By outsourcing to a fintech software development agency, startups and enterprises can tap into experienced teams skilled in payments, lending, digital banking, trading platforms, and regulatory-compliant systems. It enables faster product launches, easier scalability, and reduced hiring risk while meeting strict security and compliance requirements.

In this guide, we explain what fintech development outsourcing is, why companies choose it, the services and engagement models available, cost considerations, risks to be aware of, and how to choose the right outsourcing partner for your fintech roadmap.

Contents

What is Fintech Development Outsourcing?

Fintech development outsourcing refers to the practice of partnering with external development teams to design, build, test, and maintain financial technology solutions. Instead of relying entirely on in-house engineering teams, fintech companies and financial institutions outsource part or all of their product development to specialized vendors with deep domain and technical expertise.

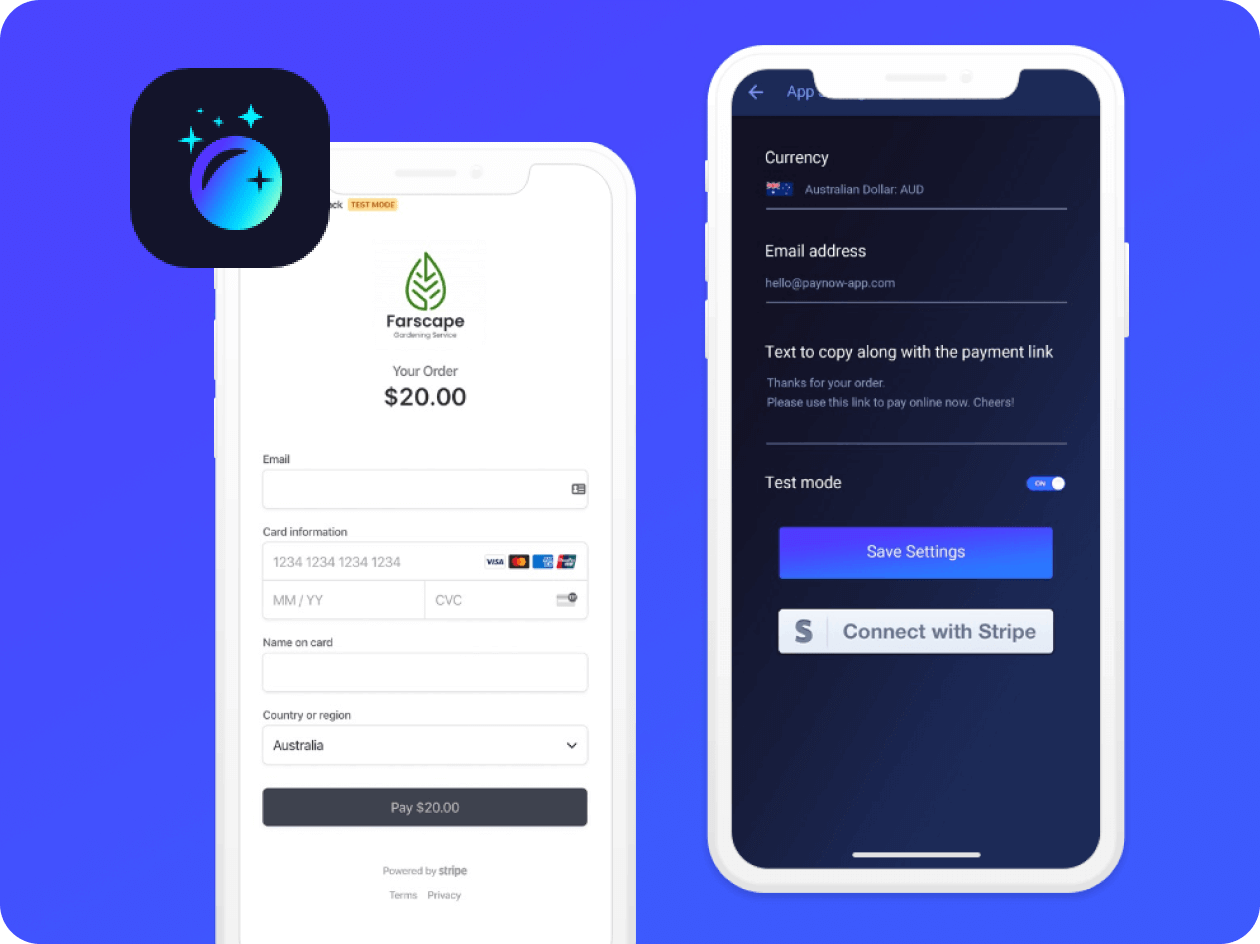

Outsourcing covers a wide range of fintech products and platforms. Companies commonly outsource the development of payment gateways, digital wallets, lending and loan management systems, trading and investment platforms, neo banking applications, and blockchain-based financial solutions.

It can include end-to-end product development or specific functions such as UI UX design, backend engineering, API integrations, quality assurance, and ongoing maintenance. Depending on business needs, fintech development outsourcing can follow different engagement models, including hiring fintech software developers on a dedicated basis, fixed scope projects, or flexible time and material arrangements.

Why Outsourcing is the Smart Choice for Fintech Development

The decision to outsource fintech software development isn’t just about cost reduction. Here’s what actually drives companies to partner with external development teams.

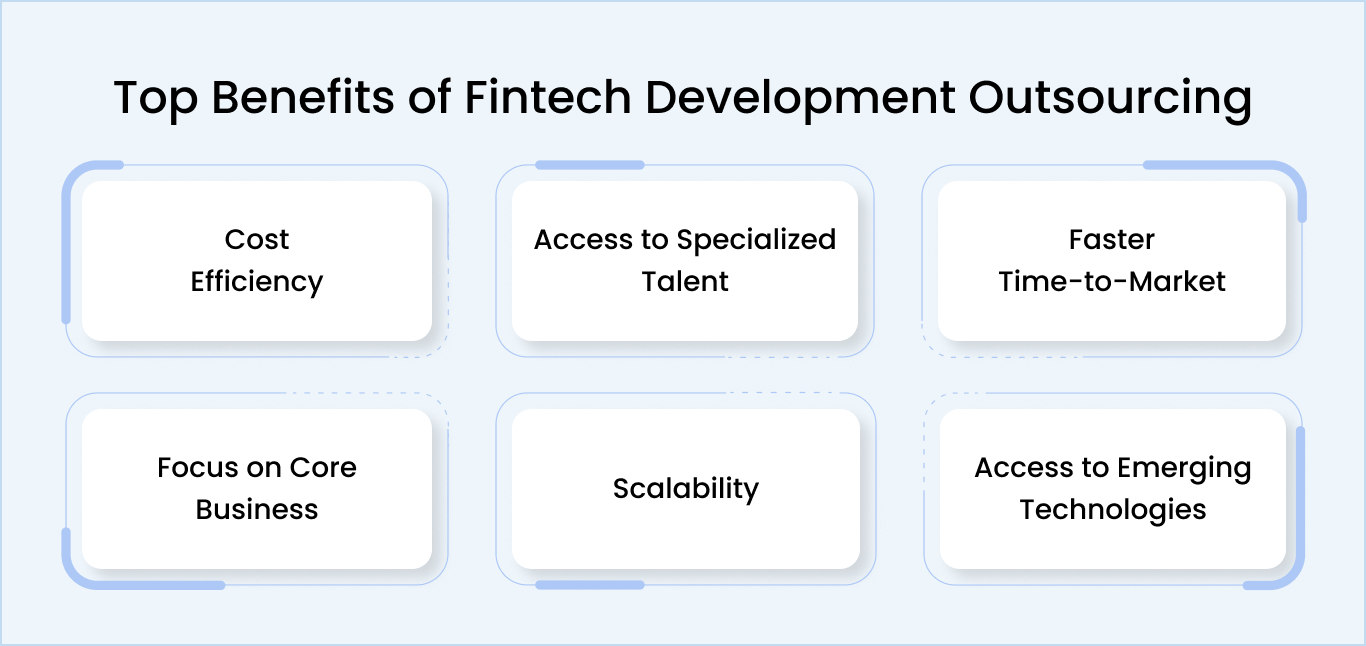

Cost efficiency

Building an in-house fintech team is expensive. A 5-person development team costs $650,000 to $950,000 annually in salaries, benefits, recruitment, and infrastructure before delivering a single feature. Outsourcing provides the same capability for a fraction of the cost. It also converts fixed staffing costs into predictable operating expenses, improving cash flow and financial planning.

Access to specialized talent

Fintech requires expertise in blockchain, payment systems, machine learning, and regulatory compliance. Few companies can hire all these specialists in-house. Outsourced partners maintain this expertise year-round across multiple projects. This cross-domain exposure helps avoid costly architectural mistakes and ensures best practices from day one.

Faster time-to-market

Building in-house takes 6 to 9 months for an MVP. Outsourced teams deliver in 3 to 4 months using proven processes and compliance templates. That 3 to 6 month advantage means reaching customers and validating product-market fit first. Early market entry often translates into faster feedback, quicker iterations, and a stronger competitive position.

Focus on core business

Your internal team should focus on product strategy, customer acquisition, and business development, not infrastructure, code reviews, and compliance documentation. Outsourcing frees your team to do what matters most. Leadership time shifts from delivery management to growth, partnerships, and revenue-generating initiatives.

Scalability

Fintech growth is unpredictable. You might need 3 developers for MVP launch, then 8 when entering a new market, then 2 for maintenance. Outsourced partners scale on demand without severance obligations or unused headcount. This flexibility reduces operational risk while supporting rapid expansion or controlled downsizing.

Access to emerging technologies

Specialized fintech development companies stay current with AI, blockchain, cloud-native architecture, and real-time payment systems. You gain access to this expertise without hiring specialists in each area.

Understanding why companies outsource is just the first step. The next question is: what can you actually build through outsourcing?

Looking for a Reliable Fintech Development Outsourcing Partner

Space-O Technologies has supported 1200+ clients worldwide with compliant, scalable fintech solutions backed by 15+ years of product development experience.

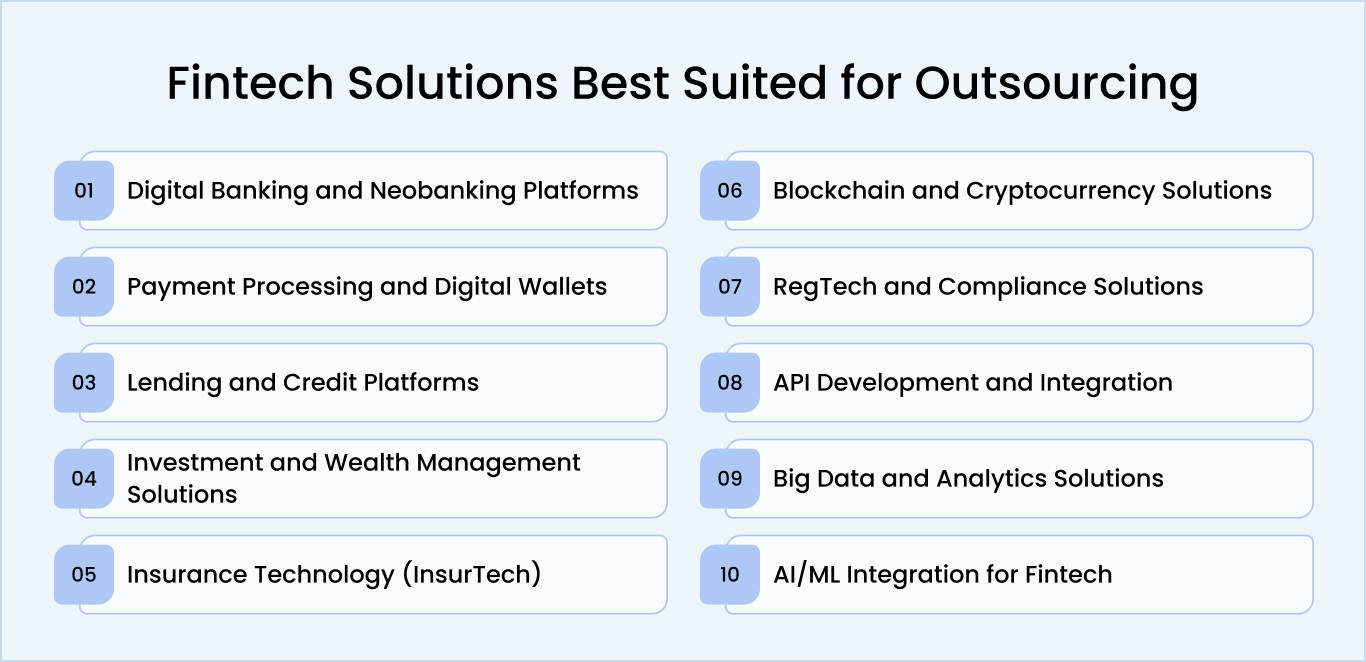

Types of Fintech Solutions You Can Outsource

The breadth of fintech solutions available for outsourcing is enormous. Here’s what’s commonly built through outsourced fintech software development. Whether you’re building a consumer app, an enterprise platform, or a specialized compliance tool, most fintech products have been successfully outsourced by companies looking to accelerate development without sacrificing quality or security.

Digital banking and neobanking platforms

What it includes: White-label or custom core banking systems, mobile banking applications, web portals for account management, real-time balance updates, transaction history, and bill payment functionality.

Why outsource: Core banking systems are complex, heavily regulated, and require deep expertise in payment rails and account management. Building in-house takes 18 to 24 months. Software development outsourcing reduces this to 8 to 12 months. Using white-label frameworks like Fintech Core can accelerate to 4 to 6 months.

Timeline: 4 to 6 months (white-label MVP) or 8 to 12 months (custom full-featured platform)

Cost range: $50,000 to $250,000

Payment processing and digital wallets

What it includes: Payment gateways, peer-to-peer payment systems, digital wallet functionality, integration with card networks (Visa, Mastercard), cryptocurrency payment support, and settlement systems.

Why outsource: Payment systems demand PCI-DSS compliance, fraud prevention, and integration with multiple payment networks. This is specialized work. Regulatory compliance typically adds 15 to 20 percent to development costs and 2 to 4 weeks to the timeline.

Timeline: 2 to 3 months (basic payment gateway) or 4 to 6 months (full-featured wallet with multiple payment methods)

Cost range: $30,000 to $200,000

Lending and credit platforms

What it includes: Loan origination systems, automated underwriting, credit scoring, KYC verification, document management, repayment tracking, and portfolio management.

Why outsource: Building credit algorithms requires machine learning expertise. Compliance with lending regulations (Truth in Lending Act, Fair Lending laws) is non-negotiable. Outsourced fintech development companies have templates and expertise. ML-based credit scoring and automated underwriting significantly increase development complexity.

Timeline: 4 to 6 months (basic P2P lending MVP) or 8 to 12 months (full platform with automated underwriting and ML-based credit scoring)

Cost range: $75,000 to $250,000

Investment and wealth management solutions

What it includes: Robo-advisor platforms, trading interfaces, portfolio tracking, rebalancing algorithms, tax-loss harvesting automation, and performance reporting.

Why outsource: Investment platforms require integration with market data feeds, portfolio analytics, and regulatory compliance (SEC, FINRA). Specialized fintech developers have existing integrations. Real-time market data feeds and sophisticated analytics add significant development cost.

Timeline: 5 to 7 months (basic robo-advisor MVP) or 10 to 14 months (advanced platform with real-time market data and predictive analytics)

Cost range: $70,000 to $350,000

Insurance technology (InsurTech)

What it includes: Policy management systems, claims processing automation, underwriting platforms, premium calculation engines, and customer portals.

Why outsource: InsurTech requires domain knowledge of insurance products, regulatory compliance, and integration with legacy insurance systems. Outsourcing accelerates development while reducing compliance risk.

Timeline: 4 to 6 months (basic policy management) or 9 to 12 months (comprehensive platform with claims automation and underwriting)

Cost range: $50,000 to $200,000

Blockchain and cryptocurrency solutions

What it includes: DeFi platforms, smart contracts, tokenization systems, NFT marketplaces, cryptocurrency exchanges, and wallet integration.

Why outsource: Blockchain is new, rapidly evolving, and requires deep technical expertise. Few in-house teams have this capability. Outsourced partners often specialize in blockchain-specific fintech software development. Security audits for smart contracts are mandatory (not optional) and typically cost $30,000 to $100,000 with a 2 to 4 week timeline.

Timeline: 6 to 8 months (DeFi MVP with smart contracts) or 12 to 18 months (full cryptocurrency exchange platform). Add 2 to 4 weeks for mandatory security audits.

Cost range: $120,000 to $500,000 (includes mandatory security audits)

Regtech and compliance solutions

What it includes: KYC/AML automation, fraud detection systems, transaction monitoring, regulatory reporting, and compliance documentation.

Why outsource: Compliance is table stakes in fintech. Building KYC/AML systems requires understanding global regulations (FinCEN, OFAC, GDPR). Specialized fintech software development companies maintain compliance templates and expertise. Regulatory compliance validation typically adds 15 to 20 percent to development costs.

Timeline: 5 to 6 months (basic KYC/AML MVP) or 8 to 12 months (comprehensive compliance suite with transaction monitoring and automated reporting)

Cost range: $80,000 to $250,000

API development and integration

What it includes: Open banking APIs, third-party integrations, Banking-as-a-Service (BaaS) integrations, and connectivity with payment networks, credit bureaus, and financial data providers.

Why outsource: API development for financial data is specialized work. Outsourced fintech developers have experience with OAuth, tokenization, secure data exchange, and regulatory-compliant API design. Scope varies dramatically from single payment gateway integration to full BaaS platform ecosystems.

Timeline: 2 to 4 weeks (single API integration) or 8 to 12 weeks (multi-API ecosystem or full BaaS platform)

Cost range: $30,000 to $200,000

Big data and analytics solutions

What it includes: Customer behavior analysis, predictive analytics, risk assessment tools, fraud pattern detection, and business intelligence dashboards.

Why outsource: Analytics platforms require data engineering expertise, cloud architecture, and fintech-specific KPIs. Outsourcing brings both the talent and the infrastructure. Machine learning models for predictive analytics add significant development complexity and cost.

Timeline: 4 to 5 months (basic analytics dashboard) or 10 to 16 months (enterprise BI platform with advanced predictive analytics)

Cost range: $80,000 to $300,000

AI/ML integration for fintech

What it includes: Chatbots and virtual assistants, fraud detection, personalized recommendations, credit risk modeling, and automated decision-making systems.

Why outsource: AI/ML expertise is scarce and expensive. Fintech-specific machine learning (credit scoring, fraud detection) requires domain knowledge. Outsourced partners specialize in this combination. AI/ML features typically add high cost depending on the sophistication level.

Timeline: 6 to 8 months (basic ML feature like fraud detection) or 10 to 14 months (sophisticated multi-model system with credit scoring, fraud detection, and personalization)

Cost range: $70,000 to $300,000 (including base development), or add $30,000 to $150,000 to the existing project for AI/ML features

Note: All timelines assume standard development processes. Using pre-built frameworks and white-label solutions can reduce timelines by 30 to 50 percent. Regulatory compliance (GDPR, PSD2, PCI-DSS, KYC/AML) typically adds 15 to 20 percent to costs and 2 to 4 weeks to timelines. Mandatory security audits for blockchain solutions add $30,000 to $100,000 and 2 to 4 weeks.

Now that you know what solutions you can outsource, it’s time to understand how to structure the engagement. Choosing the right pricing model and engagement type directly impacts your project’s success and budget.

Common Fintech Development Outsourcing Models

Choosing the right engagement model is critical. The wrong choice creates misaligned incentives, scope creep, and budget overruns. The model you choose for outsourcing software development should match your project’s clarity, timeline, and resource constraints. When you outsource fintech services, you typically choose one of five engagement approaches.

Each model represents a different way to structure your relationship with the vendor and how you’ll pay for their work. Here’s how each model works:

Fixed price model

How it works: You define requirements, the vendor quotes a fixed price, and delivers the agreed-upon scope.

Best for: Well-defined projects, MVPs, specific features with clear acceptance criteria.

- Budget certainty (no surprises)

- Clear scope boundaries

- Faster decision-making

Pros:

- Inflexible for changing requirements

- Vendors build in risk buffers (higher prices)

- May sacrifice quality if scope changes

Cons:

Example: “Build a payment gateway integration with Stripe and our banking system. Fixed price: $75,000.”

Time and materials model

How it works: You pay for actual hours worked at an agreed hourly rate. Flexibility for evolving requirements.

Best for: Products with evolving requirements, research and development, projects where the scope is uncertain.

- Flexible for requirement changes

- Pay only for work completed

- Transparent billing

Pros:

- Less budget certainty

- Requires active project oversight

- Can lead to scope creep if not managed

Cons:

Example: “Hire fintech developers at $65 per hour. Monthly billing based on hours tracked.”

Dedicated team model

How it works: You hire a dedicated team (3 to 10 developers) who work exclusively on your projects. Monthly billing covers all team members, infrastructure, and management.

Best for: Long-term partnerships, products requiring continuous development, and companies that want a true extension of their team.

- Team continuity and context

- Exclusive focus on your product

- Scalable (add or reduce team members)

- All-inclusive pricing (no hidden costs)

Pros:

- Higher monthly commitment

- Requires a clear project roadmap

- Best ROI comes after 6 or more months

Cons:

Example: “Hire a dedicated team of 4 fintech developers plus 1 QA engineer. $25,000 per month, including all infrastructure and management.”

Staff augmentation

How it works: You hire individual developers or specialists (blockchain engineer, security architect, compliance expert) who integrate into your existing team.

Best for: Filling skill gaps, supplementing existing development capacity, and specialized short-term roles.

- Hire for specific skills needed

- Integrates with the existing team

- Pay only for what you need

Pros:

- Management responsibility falls on you

- Less continuity if a person leaves

- May struggle with cultural fit

Cons:

Example: “Hire 1 blockchain developer ($80 per hour) and 1 compliance specialist ($70 per hour) for 6 months.”

When evaluating your outsourcing options, consider these fintech software development services as core capabilities any vendor should provide: user authentication, payment processing, compliance automation, real-time monitoring, and ongoing support.

The model you choose directly impacts your budget predictability, team dynamics, and project flexibility. Select based on your project’s characteristics, not just cost considerations.

With engagement models defined, the next step is to understand how to outsource fintech development. The coming section answers this question.

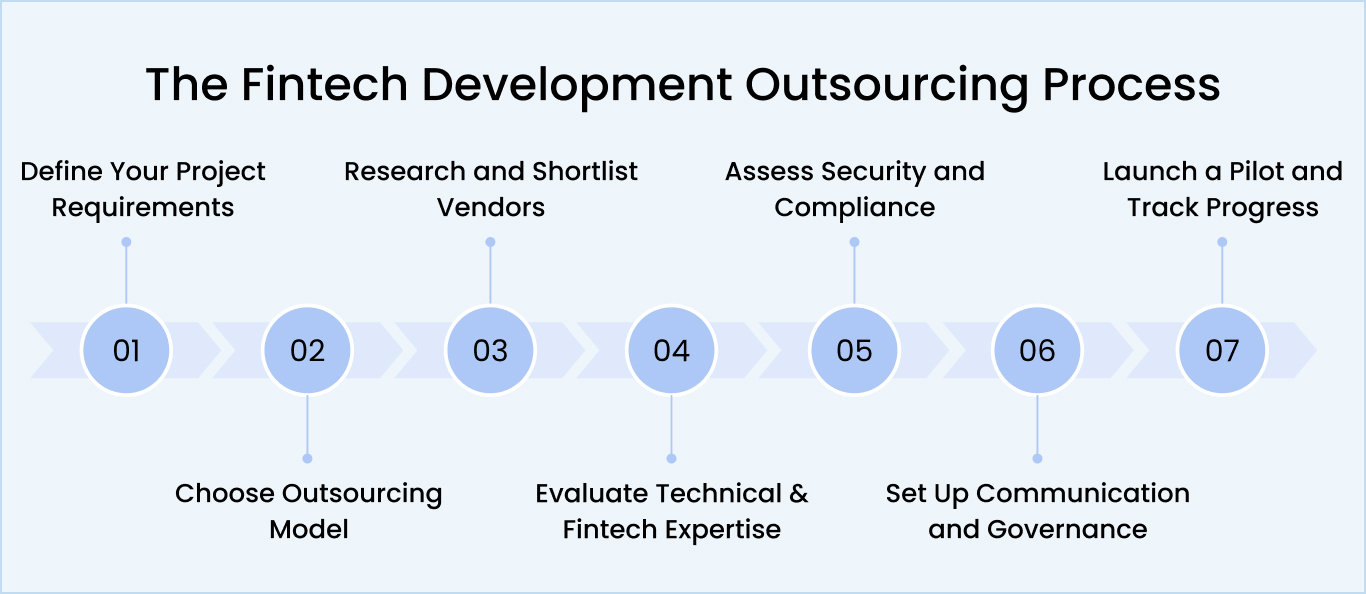

7-Step Process to Successfully Outsource Fintech Development

Here’s the systematic approach to selecting and managing your fintech development outsourcing partner: Following these seven steps reduces risk, ensures vendor alignment, and accelerates your path to launching a secure, compliant financial application that meets both user and regulatory requirements.

Step 1: Define your project requirements and goals

Before talking to vendors, be crystal clear about what you’re building. Clear requirements prevent misunderstandings, reduce scope creep, and help vendors provide accurate estimates. Document everything from business objectives to technical specifications, ensuring both your team and potential vendors understand the project scope, timeline, and success metrics from day one.

- Write business objectives: What problem does this solve? Why does it matter?

- Define target users: Who uses this product? What are their specific needs?

- List core features: What’s essential for MVP? What’s phase 2?

- Specify technical requirements: APIs needed? Integrations? Technology preferences?

Action items

Step 2: Choose the right outsourcing model

Different projects require different engagement structures, and selecting the wrong model creates misaligned incentives, budget waste, and relationship friction. The right model depends on how well you understand your requirements, your timeline, your team capacity, and your comfort with uncertainty. Matching your project reality to the optimal engagement model prevents costly pivots mid-project and ensures vendor and client incentives stay aligned throughout the development cycle.

- Evaluate project definition: Clear scope goes fixed-price, evolving goes dedicated team or T&M

- Consider timeline needs: 3-6 months favors fixed-price, 12+ months favors dedicated team

- Assess existing team capacity: Do you have development staff already? Staff augmentation or full outsourcing?

- Determine risk tolerance: Conservative approach favors fixed-price, flexible approach favors dedicated team

Action items

Step 3: Research and shortlist potential vendors

Finding quality fintech vendors requires systematic research across multiple sources. Industry marketplaces, direct searches, founder referrals, and specialized directories all yield different vendor pools. Initial vetting should focus on proven experience, business stability, geographic location, and client satisfaction ratings to create a manageable shortlist of 5–7 qualified candidates for deeper evaluation.

- Search marketplaces: Clutch, GoodFirms, Toptal, with fintech filters

- Ask for referrals: Network with other fintech founders about vendors they’ve used

- Check minimum criteria: 50+ fintech projects, 10+ years in business, 4.5+ stars rating

- Verify location stability: Based in a country with a strong tech industry and a regulatory framework

Action items

Step 4: Evaluate technical expertise and fintech experience

Fintech requires specialized knowledge beyond general software development. Vendors should demonstrate deep fintech expertise, familiarity with your specific domain, and proven ability to build scalable systems that handle payment processing, compliance automation, or blockchain integration.

Schedule discovery calls with top candidates to validate technical capability and identify red flags early in the evaluation process before committing significant time to deeper assessments.

- Request case studies: Get 3–5 fintech projects with technologies used, timeline, team size, and results

- Assess tech stack: Do they have experience with technologies you need (React Native, AWS, blockchain)?

- Evaluate team: How many developers? Average experience level? Do they have blockchain or ML specialists?

- Ask about process: How do they approach fintech development? Is their process documented?

Action items

Step 5: Assess security and compliance capabilities

Security and compliance are non-negotiable in fintech. Your vendor’s security posture directly impacts your product launch ability and regulatory approval timeline. Evaluate their data protection standards, audit procedures, and incident response capabilities thoroughly.

Verify they have dedicated security expertise separate from development teams. Request recent security audit reports and references from similar fintech clients to validate their security infrastructure and compliance track record.

- Request certifications: Ask for ISO 27001:2022, SOC 2 Type II reports, and PCI-DSS compliance documentation

- Evaluate compliance team: Do they have dedicated compliance staff? What regulations have they implemented?

- Ask about audits: When was their last penetration test? Do they conduct regular security assessments?

- Verify incident response: Do they have written procedures for security incidents? Have they been tested?

Action items

Step 6: Establish communication and governance framework

Clear communication protocols prevent costly misunderstandings and ensure project transparency throughout engagement. Define meeting schedules, communication channels, project management tools, code review processes, and escalation paths before development starts.

Regular synchronization, real-time visibility, and clear responsibilities ensure alignment throughout the engagement and reduce delivery surprises. Create shared glossaries and acceptance criteria templates so everyone works from the same definitions and standards.

- Define meeting schedule: Daily 30-minute standups plus weekly planning and monthly strategy reviews

- Choose communication tools: Slack/Teams for chat, Jira/Asana for tracking, email for formal communication

- Document processes: Create glossary of terms, definition of done, acceptance criteria template, risk register

- Set escalation path: Identify who to contact if problems arise and how quickly issues get addressed

Action items

Step 7: Start with a pilot project and monitor progress

Rather than committing to a full year-long engagement, reduce risk by starting small. This approach lets you assess delivery quality, code standards, communication effectiveness, and cultural fit with manageable financial exposure.

Establish clear success metrics upfront so you can objectively evaluate performance rather than relying on subjective impressions. Monitor progress continuously throughout the pilot and make adjustment decisions based on concrete data rather than assumptions about how the vendor will perform on larger commitments.

- Start with MVP or pilot phase: Begin with a 1–3 month engagement rather than a full year commitment

- Define success metrics: On-time delivery (90%+), test coverage (80%+), security issues (0 critical), satisfaction surveys

- Conduct sprint reviews: Every 2 weeks, review completed work and discuss quality or concerns

- Plan escalation management: Address issues immediately; don’t let problems fester until retrospectives

Action items

Now that you understand the complete 7-step process for selecting and managing your outsourcing partner successfully, the next critical question is how much it costs to outsource fintech development to an external vendor.

Start Your Fintech Development Project with Our Experts

From defining requirements to building compliant fintech products, Space-O Technologies supports end-to-end fintech development outsourcing.

How Much Does Outsourcing Fintech Development Cost

With your engagement model selected, pricing becomes the next critical decision. Geographic location is one of the largest cost variables in fintech development. The same payment platform that costs $100,000 in North America might cost $40,000 in Eastern Europe, yet both teams can deliver comparable quality.

Understanding regional pricing helps you allocate resources strategically while accessing the best talent for your budget.

Developer hourly rates by region

When you hire fintech developers, location directly impacts your hourly costs. However, cheaper rates don’t guarantee faster delivery or better outcomes. A senior developer in Eastern Europe charging $50 per hour often delivers higher quality work than a junior developer in North America charging $120 per hour, resulting in fewer revision cycles and faster time-to-market.

| Region | Hourly Rate | Monthly Team Cost (5 developers) | Best For |

|---|---|---|---|

| North America | $100–$150/hr | $50,000–$75,000 | Regulatory complexity, US compliance focus, premium expertise |

| Western Europe | $70–$120/hr | $35,000–$60,000 | GDPR and PSD2 compliance, EU clients, legal proximity |

| Eastern Europe | $30–$65/hr | $15,000–$32,500 | Architecture-focused projects, high skill depth, cost efficiency |

| Latin America | $30–$55/hr | $15,000–$27,500 | Strong timezone overlap with the US, cultural alignment, and growing talent |

| Asia-Pacific | $20–$45/hr | $10,000–$22,500 | Maximum cost savings, largest talent pool, timezone challenges |

Key Insight: The true cost of software development for fintech includes not just hourly rates but also communication overhead, rework cycles, and compliance complexity. A developer working in your timezone costs more hourly, but reduces coordination overhead that could add weeks to your timeline.

Total project costs: Regional comparison

When evaluating fintech software development services, consider the complete picture of costs, not just developer rates. This comparison shows the first-year investment across regions for the same project scope.

MVP payment platform (3–4 months)

Scope: User authentication, payment processing integration, transaction history, and basic compliance

| Region | Development Cost | Hidden Costs | Year 1 Total |

|---|---|---|---|

| North America | $120K–$180K | $15K–$20K | $135K–$200K |

| Eastern Europe | $45K–$75K | $8K–$12K | $53K–$87K |

| Latin America | $40K–$65K | $7K–$10K | $47K–$75K |

| Asia | $35K–$60K | $10K–$15K | $45K–$75K |

Cost-to-Quality Tradeoff: All regions present a fundamental tradeoff between hourly rate and other factors like communication efficiency, rework cycles, and timezone overlap. Lower hourly rates don’t automatically mean lower total investment when you factor in coordination overhead and revision cycles. Your choice depends on how much budget buffer you have for unforeseen challenges and how critical your timeline is to your business goals.

Full-featured banking app (6–9 months)

Scope: Multi-account management, real-time processing, compliance automation (KYC/AML), secure APIs, iOS + Android apps

| Region | Development Cost | Support Year 1 | Total Investment |

|---|---|---|---|

| North America | $300K–$450K | $30K–$40K | $330K–$490K |

| Eastern Europe | $110K–$180K | $12K–$18K | $122K–$198K |

| Latin America | $100K–$160K | $11K–$16K | $111K–$176K |

| Asia | $90K–$140K | $10K–$14K | $100K–$154K |

The cost variations across regions reflect different combinations of hourly rates, timezone overlap, communication infrastructure, and team experience. Higher costs can correlate with synchronous timezone alignment and immediate decision-maker access, while lower costs may come with longer feedback cycles that require stronger async documentation and project management.

Choose based on your project’s communication requirements, regulatory complexity, and timeline flexibility rather than hourly rate alone.

Hidden costs in fintech development outsourcing

Beyond hourly rates and development estimates, fintech outsourcing introduces legitimate costs that many founders underestimate. These typically represent 15–25% of your total first-year investment.

Security and compliance review: $5K–$20K

Regulators and customers require proof that your fintech app is secure and meets compliance standards. You’ll need third-party security audits, penetration testing, and compliance certifications before launch. These aren’t optional; they’re mandatory for regulatory approval and user trust. Budget includes initial security audit ($8K–$15K) and annual reassessments ($5K–$10K).

Communication and coordination overhead: $500–$2K/Month

Working with an outsourced team requires project management tools (Jira, Asana), communication platforms (Slack, Teams), and time spent coordinating across different time zones. Additional documentation is needed to keep a distributed team aligned. A $100K project with significant timezone differences might add $6K–$12K in coordination costs across the entire project lifetime.

Quality assurance and rework cycles: $3K–$10K

When specifications are unclear or teams work across different standards, revision cycles are common. Your outsourced team might misinterpret requirements, testing gaps emerge, or integration challenges with existing systems require rework. Plan for a 10–15% time buffer for potential revisions and build clear acceptance criteria upfront to minimize this cost.

Infrastructure and DevOps: $1K–$3K/Month

Fintech applications can’t run on cheap shared hosting. You need enterprise-grade cloud infrastructure with redundancy, backup systems, and compliance-grade security. This includes cloud services (AWS, Azure, GCP at $500–$2K/month), database backups, monitoring systems, encryption, and disaster recovery procedures. These protect your customers’ data and keep your system running 24/7.

Post-launch maintenance: 15–20% of development cost annually

Launching is just the beginning. Your fintech product requires continuous investment for security patches (critical as new vulnerabilities emerge), bug fixes, feature enhancements, and regulatory compliance updates as standards change. A $150K development project budgets $22.5K–$30K for Year 1 support to keep the app secure and operational.

Understanding the costs and models is essential, but outsourcing fintech development comes with real challenges that you need to anticipate and manage proactively. Let’s examine what can go wrong and how to prevent it.

Want an Accurate Cost Estimate for Your Fintech Product?

Get a tailored fintech development cost estimate from Space-O Technologies based on your product scope, compliance needs, and timelines.

Key Challenges and Risks in Fintech Development Outsourcing

Outsourcing fintech development is powerful, but it’s not risk-free. Here’s what can go wrong and how to prevent it: Understanding and preparing for these challenges upfront gives you the tools to mitigate risks and protect your investment.

Data security and privacy concerns

You’re entrusting a third party with sensitive financial data, including customer information, transaction records, and payment credentials, in any financial app development project. A single breach destroys customer trust instantly, triggers severe regulatory fines, and causes permanent brand damage that’s difficult to recover from.

- ISO 27001:2022 certification and SOC 2 Type II compliance (verified by requesting their latest reports)

- Encryption standards: AES-256 for data at rest, TLS 1.2 and above for data in transit

- Multi-factor authentication, role-based access controls, and audit trails for all systems

- Annual penetration testing and incident response plan with written security procedures

Solution

Regulatory compliance challenges

Fintech is heavily regulated across multiple jurisdictions with different rules: GDPR (Europe’s strict data privacy and residency), PSD2 (open banking regulations), PCI-DSS (payment card handling), KYC/AML (Know Your Customer verification globally), CCPA (California privacy), and state money transmitter licenses (US requirements).

When pursuing fintech development outsourcing, your vendor may be excellent at development but ignorant of these regulations, leaving you liable for compliance failures that can block product launch or trigger regulatory fines.

- Dedicated compliance team on staff with certifications and experience in your target jurisdictions

- A proactive regulatory roadmap showing how they stay current with regulatory changes

- Written compliance checklist specific to your jurisdictions (GDPR, PSD2, KYC/AML, etc.)

- Indemnification clause: Vendor shares liability if their code fails compliance requirements

Solution

Communication and cultural barriers

Your vendor operates in a different country, timezone, and language with different cultural attitudes toward hierarchy, deadlines, and process. In fintech software outsourcing, miscommunication compounds quickly: requirements get lost in translation, timezone mismatches create 24-hour feedback delays, and accountability expectations misalign between cultures, causing projects to slip weeks or months.

- A dedicated project manager at the vendor who speaks your language fluently and understands your business

- Daily 30-minute stand-ups or 3 times per week check-ins with real-time Jira/Asana visibility

- Everything documented in writing (requirements, decisions, changes) with no verbal-only agreements

- Clear escalation path with specific contact information for resolving issues immediately

Solution

Quality control and code standards

You can’t see code being written daily, creating a risk of poor workmanship, unmaintainable architecture, or security vulnerabilities that only surface after launch. Without proper quality gates, poor code decisions made early compound into technical debt that costs 10 times more to fix later.

- Minimum 80 percent automated test coverage and documented code review process before merging

- Full code repository access from day one, and request code samples from recent fintech projects to review

- Clear coding standards, architecture decisions, and design patterns are documented and shared with your team

- Third-party security code reviews at key milestones (not just internal reviews by the vendor)

Solution

Intellectual property protection

Who owns the code you paid for? Can your vendor reuse it for competitors? Unclear IP ownership creates legal disputes where vendors claim retained rights to architecture, you can’t modify code without permission, or code remains in legal limbo if the vendor fails.

- Full IP ownership clause: “All source code, documentation, and intellectual property developed under this agreement shall be owned exclusively by [Your Company]”

- Work-for-hire clause stating everything produced is yours, not licensed to you, with no reuse for other clients

- Third-party IP indemnification: Vendor guarantees no third-party code is used without proper licensing

- Source code held in escrow with automatic release if the vendor fails or the relationship ends, reviewed by a lawyer

Solution

Vendor dependency and knowledge transfer

Your vendor becomes your single point of failure. Code locked on private servers, documented only in one developer’s head, or built with proprietary tools, becomes unmaintainable if the vendor relationship ends, leaving you unable to add features, fix bugs, or hire another team to continue development.

- Comprehensive technical documentation, architecture diagrams, and deployment procedures are provided regularly

- Regular knowledge transfer sessions where the vendor teaches your team their code and architectural decisions

- Full code repository access from day one, with automatic release if the vendor goes out of business

- Code built using open standards (Node.js, Python, React,) not proprietary vendor frameworks or tools

Solution

Hidden costs and budget overruns

Scope creep, requirement changes, and unexpected complexity lead to budget overruns that consume contingency and additional funding. Projects starting at $150k easily balloon to $200k-$250k without proper controls due to unclear initial requirements, mid-project changes, compliance surprises late in development, or integration challenges discovered during implementation.

- Crystal clear written requirements documented before development starts, with a formal change management process for any scope changes

- Milestone-based payments (25 percent upfront, 25 percent per milestone, not all upfront) tied to deliverables

- Budget 20 percent contingency above estimates, specifically for unexpected compliance or security requirements

- Fixed-price contracts for well-defined scope, time, and materials for evolving projects with weekly budget tracking

Solution

Now that you’re aware of potential pitfalls, here’s the systematic approach to selecting and managing your outsourcing partnership successfully from start to finish.

How to Choose the Right Fintech Outsourcing Partner: 7 Essential Criteria

The vendor you choose determines your product’s success. These seven criteria separate good partners from exceptional ones and should guide your final vendor selection decision.

Proven fintech and security expertise

General software development doesn’t prepare vendors for fintech complexity. When evaluating fintech software development companies, prioritise vendors with a minimum of 10 fintech projects, case studies from regulated markets, ISO 27001:2022 certification, and SOC 2 Type II reports. Vendors treating fintech as generic software cause compliance failures and security breaches.

Technical proficiency and modern technology stack

Outdated technologies create technical debt and security vulnerabilities. Your outsourced services provider should demonstrate expertise in React Native/Flutter, Node.js/Python/Java, AWS/Azure, PostgreSQL/MongoDB, and REST/GraphQL. Verify they’ve built scalable products as users grow with cloud-native architecture and blockchain experience. Legacy choices limit future engineering hiring.

Regulatory and compliance knowledge

Regulatory violations result in fines, blocked features, or shutdown. For banking outsourcing services, vendors must demonstrate a deep understanding of GDPR, PSD2, KYC/AML, PCI-DSS, CCPA, FINRA/SEC, and state licenses. Ask them to walk through compliance processes for your jurisdiction and explain how regulations influence design decisions. Failed regulatory review causes costly re-engineering.

Transparent communication and agile methodology

Clear visibility prevents costly surprises. Require a dedicated project manager speaking your language fluently, daily standups, weekly planning, and monthly reviews. Demand real-time Jira/Asana access, sprint velocity tracking, burndown charts, and weekly risk updates. Ghost projects with hidden problems create relationship friction and delivery disappointment.

Data security and IP protection measures

Your code and customer data are most valuable. Require AES-256 encryption, TLS 1.2+, multi-factor authentication, and audit logs. Verify full IP ownership clauses (not licensing), work-for-hire agreements, no-reuse clauses, third-party IP indemnification, and source code escrow. Annual penetration testing and third-party audits are standard. Security investments cost far less than breaches.

Client references and proven track record

Talk to actual users of the vendor’s services. Require minimum 10 verifiable testimonials, callable client references, 2+ year relationships, high renewal rates, and industry recognition. Ask references about delivery timeliness, budget adherence, communication quality, and likelihood of rehiring. Reference checking prevents choosing vendors based purely on marketing hype.

Scalability and Long-term partnership potential

Your product evolves; partners must scale with you. Require the ability to add developers in 2-4 weeks, reduce teams without penalty, and maintain quality during growth. Verify post-launch support, flexible engagement models, month-to-month commitments, and knowledge transfer processes. Vendors disappearing after launch or charging exorbitant rates create long-term frustration.

Even with clear vendor selection criteria in place, many fintech companies still make critical mistakes that derail their outsourcing projects. Learning from these common errors can save you significant time, money, and frustration throughout your engagement.

Looking for a Proven Fintech Development Partner?

Choose Space-O Technologies, a fintech development agency with 15+ years of experience, 1200+ clients served, and 300+ software solutions delivered.

Partner with Space-O Technologies for Secure and Scalable Fintech Development

Outsourcing fintech software development accelerates growth, reduces operational burden, and focuses your team on customers and strategy. Companies outsourcing fintech development ship products faster, reduce complexity, and maintain focus on customer acquisition and market advantage through proven partner relationships and shared expertise.

At Space-O Technologies, we bring 15+ years of experience as a leading software design and development agency with proven fintech software development expertise. Our 140+ developers, 98% success rate, and 97% client retention demonstrate partnership quality.

We’ve delivered 300+ software projects, including neobanking, payment systems, lending platforms, compliance automation, and blockchain integration with deep security and compliance excellence.

We maintain ISO 27001:2022 certification and SOC 2 Type II compliance with annual security audits. Our engagement models adapt to your needs: fixed-price, time and materials, dedicated teams, or staff augmentation. Check our portfolio to see successful fintech projects and case studies from companies like yours.

If you are evaluating fintech development outsourcing and want a partner that combines technical excellence with fintech domain expertise, Space-O Technologies can help you move forward with confidence. Talk to our experts today to discuss your product requirements and explore how we can support your fintech development roadmap.

Frequently Asked Questions About Fintech Development Outsourcing

How long does it take to develop a fintech app?

Timeline depends entirely on scope. MVPs with basic features take 3–4 months, while full-featured banking apps require 6–9 months. Enterprise platforms can take 12–18+ months. Fintech app development services move faster with clear requirements (saving 20%), pre-built APIs (saving 4–6 weeks), and MVP-first approaches.

Compliance surprises mid-project add 4–8 weeks. Unclear requirements cause 30%+ delays. When you hire fintech developers experienced with your project type, timelines become predictable and achievable.

Is outsourcing fintech development secure?

Yes, when you partner with the right vendor. Security requires ISO 27001, SOC 2 Type II, and PCI-DSS certifications. Demand AES-256 encryption at rest, TLS 1.2+ in transit, multi-factor authentication, and annual penetration testing.

Red flags include vendors unwilling to share certifications, lacking multi-factor authentication, keeping code on private servers, or having no incident response plan. Fintech software outsourcing with transparent security practices protects your customers’ data and your company’s reputation.

What compliance standards should my outsourcing partner follow?

Minimum requirements include GDPR (Europe), PSD2 (payments), PCI-DSS (cards), KYC/AML (everywhere), CCPA (California), ISO 27001, and SOC 2 Type II. Your vendor must clearly explain the implementation of each relevant regulation for your jurisdiction.

When you engage banking outsourcing services or fintech outsourcing, compliance should be built into development from day one, not added afterward. Non-compliance leads to blocked features, fines, or complete product shutdown; it’s non-negotiable.

How do I ensure quality when outsourcing fintech development?

Quality assurance requires clear acceptance criteria, code reviews, 80%+ automated test coverage, security testing, user acceptance testing, and performance testing. Use Jira for tracking, GitHub for code review, automated testing frameworks like Selenium, and security tools like OWASP.

When you hire fintech developers, establish these QA standards upfront. Software development for fintech demands rigorous testing; poor quality leads to security vulnerabilities, compliance failures, and user trust loss. Don’t compromise here.

Can I scale my fintech development team up or down easily?

Yes, with the right vendor. Dedicated team model scales with a 2–4 week notice. Staff augmentation adds/removes individual developers as needed. The hybrid model maintains a core team while augmenting with specialists. Avoid long-term fixed contracts with no flexibility. Best practice: Month-to-month agreements after initial 3–6 month commitment. Ensure contracts allow scaling so you control costs as project phases change and your needs evolve.

What happens if the outsourcing relationship doesn’t work out?

Your contract should include termination for convenience (30-day notice), transition plan with vendor support, full source code handoff, and knowledge transfer. Transition typically takes 2 weeks to identify alternatives, 2–4 weeks for work transition and knowledge transfer, and 1–2 weeks for final testing.

Outsourcing relationships occasionally fail due to communication, quality, or scope issues. Clear exit clauses and code escrow protect you from being trapped in a bad partnership.