Dream It, We Build It

Lending Software Development Services We Offer

As a trusted lending software development company, we offer a complete suite of development services that support the end- to-end build of your digital lending platform. From consulting and workflow design to custom development, system integration, API connectivity, and continuous optimization, our team ensures your lending operations run faster, smarter, and with greater accuracy.

Software Consulting & Strategy

Every lending platform needs a solid strategy before development begins. We analyze your workflows, assess regulatory requirements, and recommend the optimal technology stack. Our consultants deliver a detailed roadmap within weeks, ensuring aligned expectations and clear direction for your project.

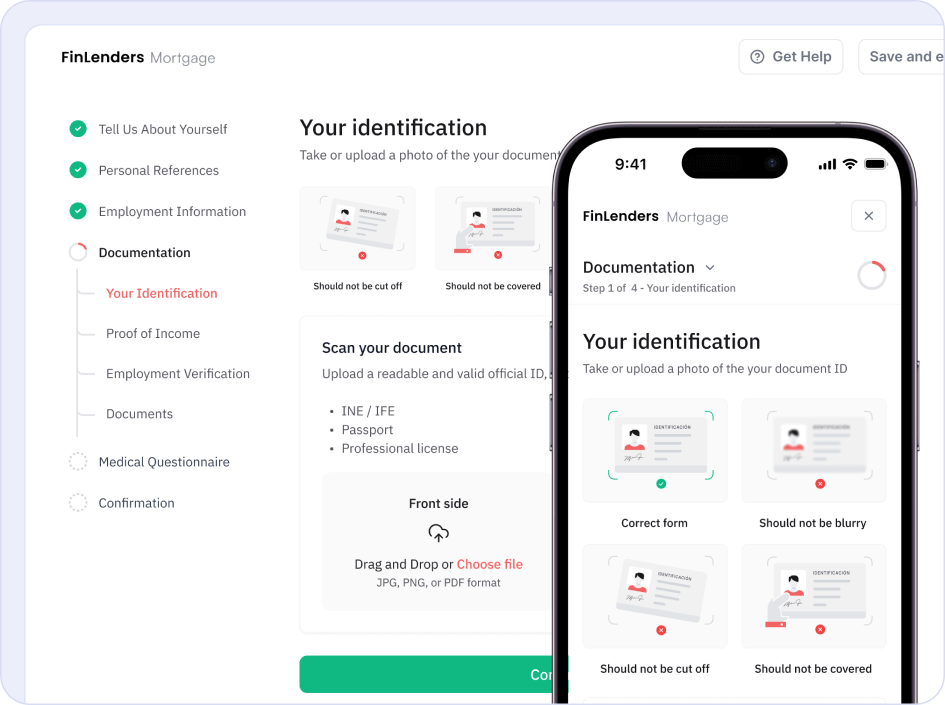

UI/UX Design for Lending Platforms

Are your lending interfaces frustrating borrowers and slowing loan approvals? We design intuitive, user-friendly interfaces for borrowers, underwriters, and loan officers. Each design simplifies complex workflows, improves adoption rates, and keeps users engaged throughout their entire lending journey with you.

Custom Lending Software Development

We build lending platforms from scratch using modern frameworks, cloud infrastructure, and enterprise-grade security. Hire fintech software developers and create complete backend systems, integrate payment gateways, and deploy to AWS or Azure. Agile development delivers working features every two weeks, keeping progress visible.

Mobile Lending App Development

Do borrowers expect mobile lending, but your app doesn’t exist yet? Hire fintech app developers who specialize in native iOS and Android lending apps with real-time notifications, secure payments, and offline data access. Your borrowers get convenient access while you reduce operational costs through smart process automation.

Lending System Integration & Migration

Most lending institutions juggle disconnected systems, causing delays and data errors. We integrate lending software with banking platforms, credit bureaus, CRM systems, and payment gateways. Unified systems eliminate manual entry, accelerate decisions, and keep all teams on the same page.

Software Maintenance & Support

Is keeping your lending software updated and secure becoming a constant burden? We offer 24/7 monitoring, proactive issue resolution, and automatic security patches. Regular feature enhancements, performance optimization, and continuous improvements keep your platform competitive and reliable as years pass.

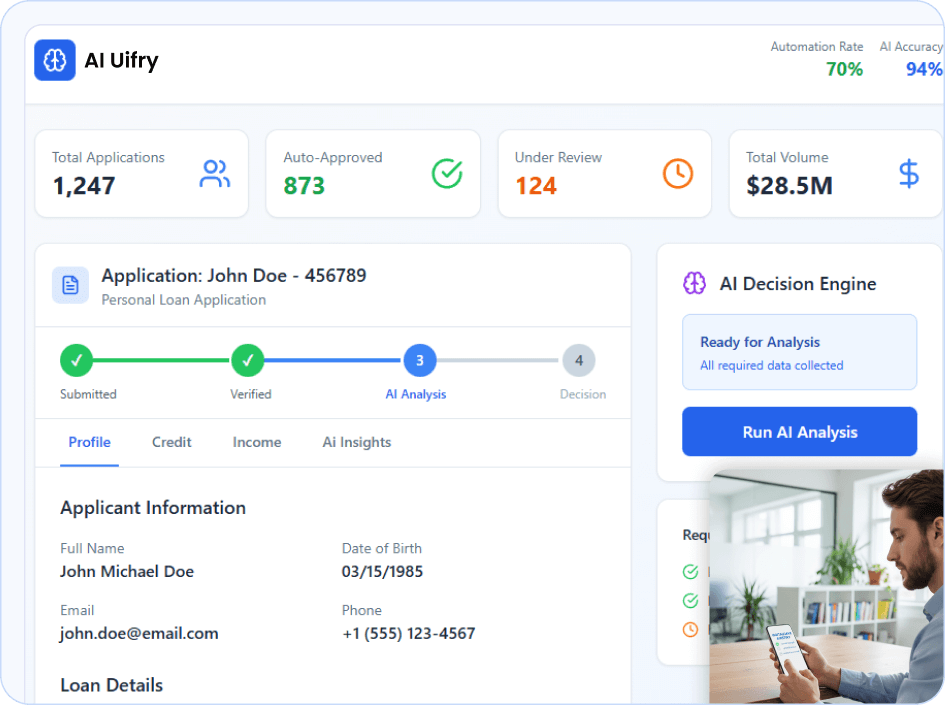

AI-Powered Lending Platform Development

Are manual credit decisions costing you profitable lending deals? Machine learning models analyze thousands of data points to predict defaults more accurately than traditional industry methods. AI-powered decisioning approves qualified borrowers faster while reducing fraud and significantly improving portfolio quality.

Quality Assurance & Testing for Financial Software

Lending software must work flawlessly without compliance failures or security breaches. Our QA specialists test regulatory requirements, conduct penetration testing, validate payment processing, and stress-test under peak loads. Every release includes comprehensive test reports ensuring reliable, production-ready quality.

Lending Platform Security & Compliance

Lending platforms face serious security threats every day from sophisticated cybercriminals. We implement PCI-DSS, SOC 2, and ISO 27001 compliance standards as core requirements. End-to-end encryption, role-based access controls, continuous monitoring, and regular security audits protect everything.

Build a High-Performing Lending Platform With Our Experts

Work with a team that understands lending workflows, compliance needs, and modern fintech architecture. Get custom lending software designed around your business model.

Lending Software Solutions We Build

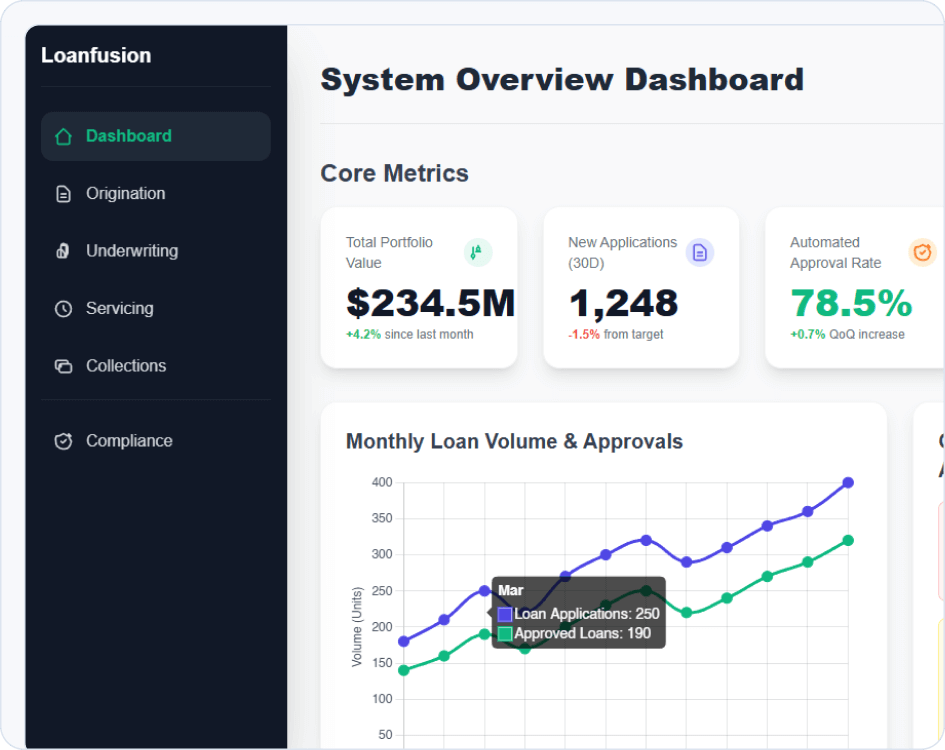

At Space-O Technologies, we develop custom lending software solutions that support the entire loan lifecycle from borrower onboarding to final repayment. Each solution is designed to help lenders automate workflows, improve credit decisioning, enhance compliance, and deliver a smooth experience to both customers and internal teams.

Loan Management System

Loan Management System

We build complete digital platforms automating the entire loan lifecycle from origination through collections. Our solutions streamline applications, underwriting, servicing, and collections with real-time tracking and compliance. Banking systems, payment gateways, and credit bureaus all connect seamlessly for unified lending operations.

Mortgage Software Platform

Mortgage Software Platform

We develop specialized mortgage solutions with property valuation integration, escrow management, and automated TILA and RESPA compliance. Build platforms that offer document automation, underwriting workflows, and borrower portals, accelerating closings significantly for lenders and borrowers alike across the entire process.

P2P Lending Marketplace

P2P Lending Marketplace

Our platform connects lenders and borrowers transparently through secure peer-to-peer lending marketplaces. Intelligent matching algorithms, secure fund management, and automated disbursement drive transactions seamlessly. Investor dashboards and scalable infrastructure support thousands of users managing complex lending portfolios effectively.

Commercial Lending Platform

Commercial Lending Platform

We engineer enterprise solutions supporting multi-entity business loans and complex syndication workflows. Advanced credit analysis tools track deals, manage portfolios, and provide comprehensive visibility. Oversight into syndicated lending structures helps enterprise banks close complex commercial deals successfully.

Consumer Lending Software

Consumer Lending Software

We enable AI-powered decisioning engines that accelerate consumer lending software approvals. Flexible repayment options, self-service portals, and mobile-first design enhance borrower experience significantly. Rapid processing provides a competitive advantage while seamless credit bureau integration streamlines verification.

Collateral Management System

Collateral Management System

Our system tracks collateral in real-time with automatic LTV monitoring and liquidation workflows continuously. Real-time risk alerts and automated enforcement protect lending institutions effectively and proactively. Comprehensive collateral history supports audit requirements for auto finance and equipment finance.

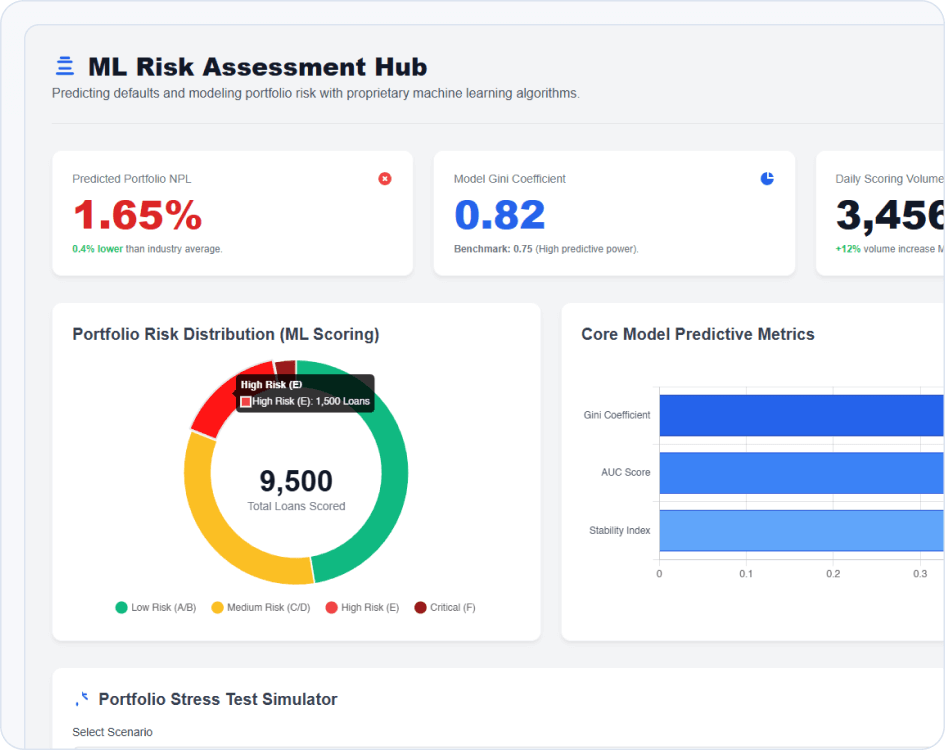

Credit Scoring & Risk Assessment Platform

Credit Scoring & Risk Assessment Platform

We create proprietary credit scoring platforms that predict defaults more accurately than industry standards consistently. Machine learning analyzes thousands of data points to create custom scoring algorithms automatically. Portfolio risk modeling, stress testing, and scenario analysis enable competitive advantage.

Fraud Detection & Compliance Platform

Fraud Detection & Compliance Platform

Our team builds software that delivers fraud detection and AML/KYC compliance with real-time transaction monitoring, identifying patterns. Automated AML/KYC verification, sanctions screening, and identity verification ensure full regulatory compliance. Comprehensive audit trails and compliance dashboards support inspections for financial institutions.

Collections Management & Debt Recovery Software

Collections Management & Debt Recovery Software

Automate collections management with workflows that route delinquent accounts efficiently to appropriate teams. Payment plan options, automated reminders, and recovery analytics accelerate cash collection significantly. Early intervention reduces delinquency rates while maintaining borrower relationships and maximizing recovery.

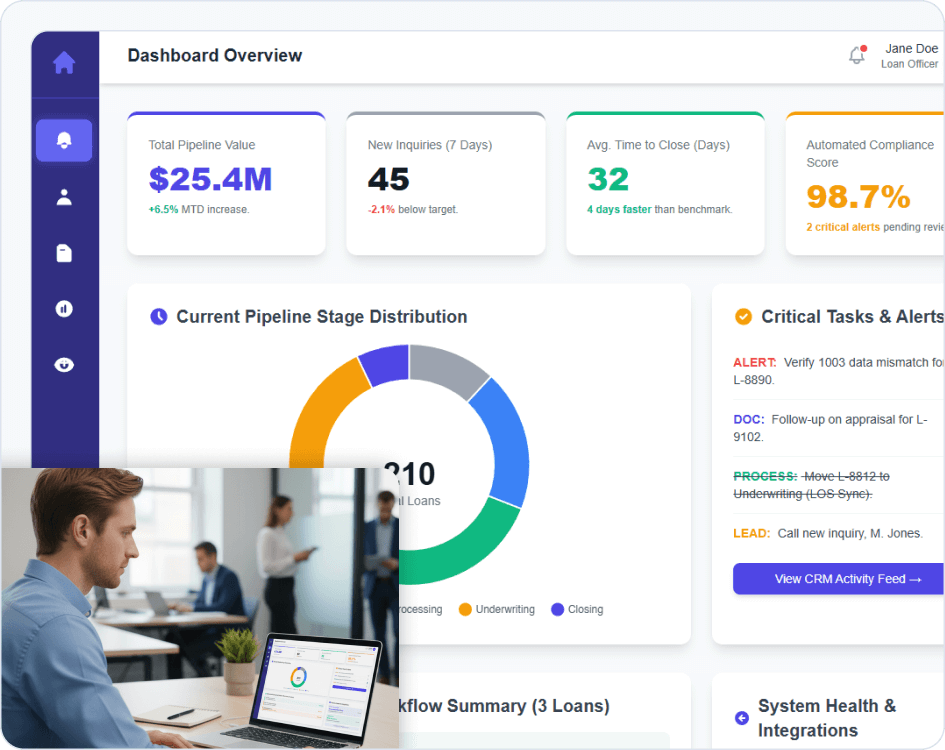

Mortgage CRM & Loan Officer Tools

Mortgage CRM & Loan Officer Tools

We provide comprehensive mortgage CRM systems capturing inquiries, managing pipelines, and automating document workflows. Compliance tools ensure adherence to lending regulations throughout operational processes automatically. Productivity features and integration with loan origination systems streamline operations for lending teams.

Alternative Lending Solutions

Alternative Lending Solutions

Our platform serves emerging lending markets with instant approvals and merchant integrations effectively. We support software for loan management, including buy-now-pay-later, merchant cash advances, and invoice financing. Rapid decisioning, merchant dashboards, and commission tracking enable competitive advantage.

Loan Decisioning & Underwriting Engine

Loan Decisioning & Underwriting Engine

We power loan decisioning and underwriting engines, applying complex lending criteria consistently. Our systems validate documents instantly with integration to credit bureaus, income verification, and collateral. Accelerate underwriting while ensuring consistency and full compliance with lending standards.

Recognized Excellence in Software Development

Our Lending Software Development Success Stories

We’ve delivered innovative lending software solutions that transform lending operations and enhance borrower experience. Our portfolio demonstrates measurable results across diverse lending platforms and business models.

Transform Your Lending Operations With Custom Software

From LOS and LMS to BNPL and underwriting engines, we build secure and scalable lending platforms that accelerate your digital lending process.

Clients Love Space-O Technologies

Project Summary

iOS & Android Dev for Fintech Company

A fintech company hired Space-O Technologies to develop a mobile application that helps users manage their savings more efficiently. The team also built an iOS and Android version of the app.

Project Summary

Mobile App Dev for Tech Company

Space-O Technologies developed a mobile app for a tech company. They built an iOS- and Android-friendly platform that enabled communication among users and provided them access to nearby television listings.

Partner with the Top Lending Software Development Company

We are a globally trusted lending software development agency that builds intelligent lending platforms that accelerate loan approvals while maintaining iron-clad security and compliance. From fintech startups to established institutions, we empower lenders with technology that drives revenue growth and reduces operational friction.

-

Solutions We Build Feature:

- Fast Loan Approvals: AI-driven decisioning engines that evaluate applicants in minutes, not days, while maintaining superior credit quality

- Bank-Grade Security: Enterprise-level encryption, SOC 2 compliance, and continuous monitoring embedded at every layer of your platform

- Future-Ready Architecture: Cloud-native infrastructure that scales seamlessly as your lending volume grows without costly system rebuilds

We transform lending from a slow, manual process into a competitive advantage. Our platforms power thousands of daily transactions for institutions that trust us with their most critical operations.

Talk to Our Experts Now

Why Financial Institutions Choose Space-O for Lending Software Development?

As one of the leading lending software development companies, we combine 15+ years of technical expertise with deep financial services industry knowledge to deliver lending software development services that transform lending operations.

Proven Track Record

We’ve successfully delivered 300+ software projects across various industries with significant lending expertise. Our solutions serve thousands of users daily, helping financial institutions automate operations and drive measurable business growth consistently.

Expert Fintech Team

Our 140+ highly skilled software engineers specialize in lending software development and continuously stay current with evolving regulations. We maintain ISO 27001:2022 certification and SOC 2 compliance, ensuring secure lending solutions built on proven processes.

Global Client Base

We’ve served 1200+ satisfied clients across banking, fintech, lending, and 50+ other industries worldwide, spanning every continent. Our deep lending expertise spans diverse market segments from innovative fintech startups to established financial institutions.

High Client Satisfaction

We’ve successfully delivered 1000+ software projects with a 98% client satisfaction rate maintained consistently throughout our history. Our genuine long-term partnerships mean clients return for additional projects and confidently recommend us to peers.

Complete Transparency

We ensure complete transparency through dedicated project managers, real-time progress tracking, and regular demos. You receive updates throughout development, approve changes before implementation, and maintain direct developer access.

Security & Compliance

We deliver lending platforms with zero data breaches across all financial projects historically. Built-in PCI-DSS compliance, SOC 2 certification, and ISO 27001 standards protect sensitive borrower data completely and continuously through regular audits.

Talk to Our Lending Software Development Specialists

Discuss your lending workflows, integration needs, and platform goals. Our team will help you design a solution that improves speed, accuracy, and automation.

Technologies We Use for Lending Software Development

As a trusted lending software development company, we build secure lending platforms using cutting-edge technologies that handle complex financial operations, real-time transactions, and strict regulatory requirements. Our fintech software developers are skilled across the entire technology stack required to power modern lending solutions.

Our Proven Process for Lending Software Development

How do you build a lending platform that’s secure, compliant, and scalable while moving fast? As a trusted lending software development company, Space-O Technologies answers that challenge through a proven methodology balancing speed with regulatory rigor, ensuring nothing is compromised in the process.

01

Discovery and Analysis

Every successful lending platform starts by understanding your business model and target borrowers. We conduct workshops to document strategy, identify requirements, assess compliance needs, define metrics, and create a detailed project roadmap with clear timelines.

02

UI/UX Design and Prototyping

Lending platforms need intuitive interfaces for borrowers and loan officers. Our design team creates user flows, wireframes, and prototypes showing workflows, decision flows, document uploads, and dashboards. We validate designs with potential users before development.

03

Development and Integration

Our team builds your lending platform using frameworks in two-week sprints. We integrate payment processors, credit bureaus, verification APIs, document management, and accounting platforms. Sprints include development, code reviews, and unit testing.

04

Quality Assurance and Testing

Before launch, your lending platform undergoes testing across functionality, security, and compliance. QA engineers test flows, decisioning, payment processing, security controls, and performance. We conduct penetration testing and compliance audits.

05

Deployment and Launch

We handle technical complexity, deploying your lending platform to production on cloud or on-premise infrastructure. Our deployment includes configuration, database migration, security hardening, and monitoring setup. We execute phased launches with gradual scaling as needed.

06

Ongoing Support

After launch, we monitor metrics, respond to issues with guaranteed response times, and implement security updates. We manage compliance changes and develop new features. We optimize approval times, reduce fraud losses, and increase completion rates.

We Build Lending Solutions For

Space-O Technologies builds specialized lending platforms for a wide range of businesses, tailored to their business model and regulatory requirements.

Frequently Asked Questions on Lending Software Development

How long does lending software development take?

Development timelines depend on complexity and features. A basic loan lending app development takes 4-5 months. Mid-level platforms with integrations require 6-8 months. Complex enterprise systems with AI and advanced analytics need 10-14 months. We use agile sprints to deliver working features incrementally throughout your project.