Let’s Build Your Project

Trading Platform Development Services We Offerr

As an expert trading platform development company, we offer end-to-end trading platform development services designed to support real-time trading, seamless integrations, and long-term platform scalability.

Software Consulting & Strategy

Strategic guidance on project feasibility, regulatory requirements (SEC, FINRA, MiFID II, GDPR), and technology stack selection. Hire dedicated developers and get help defining the approach before engineering begins, saving months of rework and architectural mistakes.

- Business and technical requirements analysis

- Regulatory compliance assessment

- Technology stack recommendations

- Detailed project roadmap

App UI/UX Design

Complex financial data requires an intuitive, professional design that traders enjoy using daily. We create dark-mode dashboards, real-time charting layouts, customizable watchlists, and streamlined workflows that reduce cognitive load and drive user retention.

- User research and trader persona development

- Interactive prototypes for early validation

- Professional-grade charting interfaces

- Responsive designs for all devices

Web & Desktop Platform Development

We engineer high-performance web terminals using React, Angular, and Vue.js with C++ and Electron for desktop environments. Our architecture delivers microsecond execution and 99.99% uptime during critical market hours without compromise.

- High-performance web frontend engineering

- Desktop terminals with microsecond execution

- Real-time data streaming via WebSocket

- Institutional-grade reliability and speed

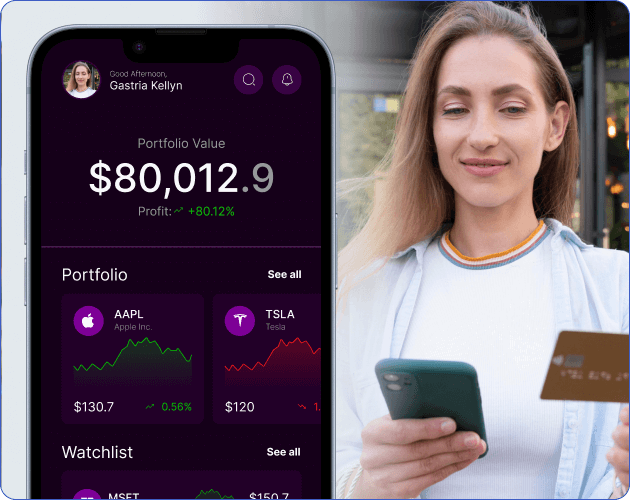

Mobile App Development

We develop native iOS apps and Android apps for traders globally. Our mobile trading app developers engineer platforms featuring biometric security and real-time push alerts, keeping traders connected and empowered to trade 24/7.

- Native iOS app development

- Native Android app development

- Cross-platform app development

- Biometric authentication and push notifications

Trading API Development & Integration

We connect your platform to liquidity providers, market data feeds (Bloomberg, Reuters, eSignal), and institutional networks via the FIX protocol. Our integration expertise ensures reliable multi-source connectivity powering your trading ecosystem.

- Multi-exchange connectivity

- Market data aggregation and streaming

- FIX protocol implementation

- Custom APIs for legacy integration

Legacy Trading System Modernization

We migrate outdated on-premise legacy trading systems to secure, modern cloud architectures on AWS or Azure with guaranteed zero data loss. Our approach improves performance and unlocks modern feature development without disrupting your active traders.

- Cloud migration with zero data loss

- User interface modernization

- Performance optimization and API development

- Seamless transition planning and execution

QA, Security & Compliance Testing

We conduct rigorous specialized testing, including latency benchmarking, penetration testing, and stress testing under real market load. Our automated compliance validation ensures your platform meets every regulatory standard before launch.

- Functional testing with market simulations

- Security and penetration testing

- Performance testing under load

- Regulatory compliance validation

DevOps & Cloud Infrastructure

We architect and deploy low-latency server environments with auto-scaling, automatic failover, and 24/7 monitoring. Our infrastructure ensures 99.99% uptime during critical hours with zero performance degradation under any conditions.

- AWS and Azure infrastructure architecture

- Auto-scaling and load balancing configuration

- 24/7 monitoring and incident response

- Disaster recovery and failover systems

Post-Launch Support & Maintenance

We provide round-the-clock monitoring, SLA-based support, and continuous performance optimization. Our team delivers security patches, strategic feature enhancements, and improvements, keeping your platform operational and competitive.

- 24/7 monitoring with 4-hour response times

- Regular security patches and updates

- Performance optimization as usage scales

- Feature enhancements based on trader feedback

Get End-to-End Trading Platform Development Support

Leverage our experience of developing 4,400+ apps to develop a trading platform tailored to your asset classes and business model.

Custom Trading Platform Solutions We Develop

At Space-O Technologies, we build specialized custom trading software solutions tailored to your exact asset classes, trading methodologies, and business model. Whether serving retail stock traders or institutional hedge funds, we architect trading platforms built for specific workflows and strict regulatory compliance.

Stock Trading App Development

Stock Trading App Development

Build stock trading apps for retail or institutional brokers. We create platforms where traders buy stocks, ETFs, bonds, and derivatives with real-time quotes, smooth order management, and clear portfolio tracking. Our designs drive engagement and keep traders coming back daily.

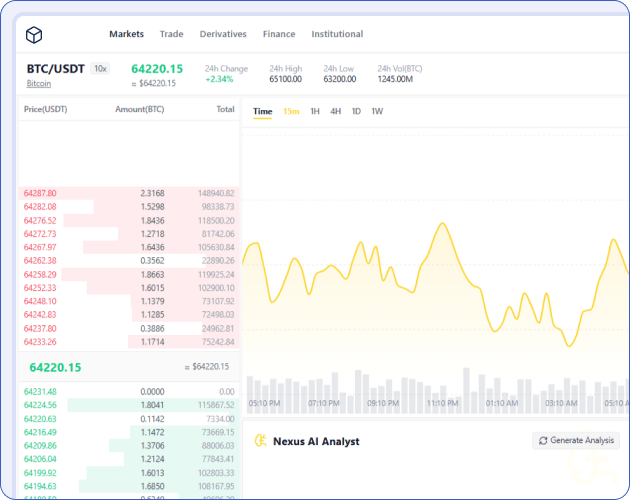

Cryptocurrency Exchange Development

Cryptocurrency Exchange Development

Launch a crypto exchange that traders love. We build centralized and decentralized exchanges with secure wallets, instant settlements, and smart liquidity management. Every platform includes compliance-ready KYC/AML verification and institutional-grade security so regulators approve, and traders trust your exchange completely.

Forex Trading Platform Development

Forex Trading Platform Development

Trade currencies globally with our forex platforms. We build multi-currency systems with lightning-fast execution and precise pricing that currency traders demand. Leverage management, liquidity from multiple sources, and 24/5 support across time zones keep your traders competitive and profitable daily.

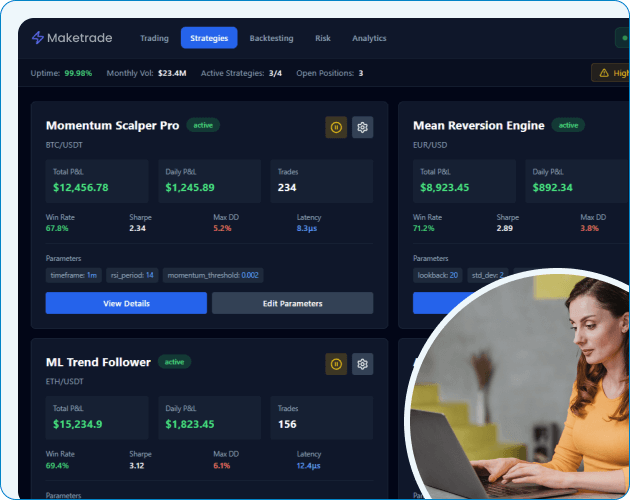

Algorithmic Trading Software

Algorithmic Trading Software

Automate your trading with algorithmic systems. We build high-speed bots with backtesting engines that test strategies against years of data before risking capital. Microsecond execution, machine learning optimization, and real-time monitoring let professional traders execute thousands of trades daily safely.

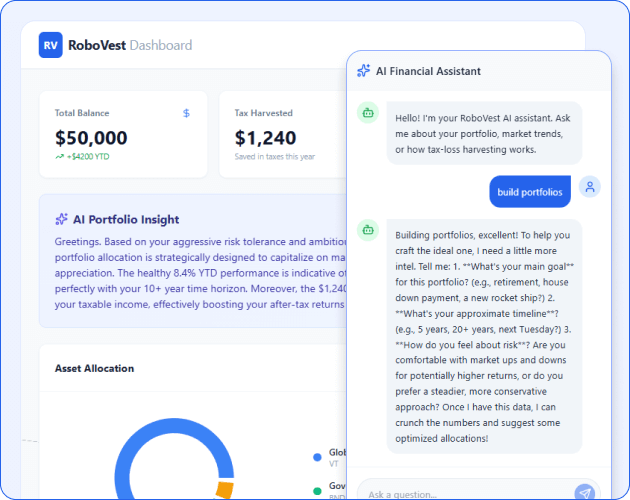

Robo-Advisor Software Development

Robo-Advisor Software Development

Let technology manage investments for your clients. We build robo-advisors that automatically assess risk, build portfolios, rebalance regularly, and harvest losses. Your retail investors get hands-off wealth management with smart tracking while you focus on growing your advisory business fast.

Social Copy Trading Platform

Social Copy Trading Platform

Create a trading community where retail investors win together. We build social platforms where traders discover experts, follow their strategies, and auto-copy trades instantly. Real-time performance tracking and community discussion help users learn while successful traders earn from their followers.

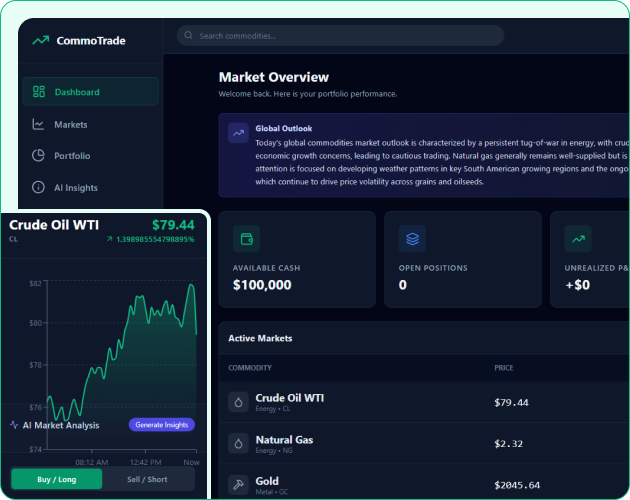

Commodity Trading Platform

Commodity Trading Platform

Trade energy, metals, and agricultural products like pros. We build platforms that handle commodity contracts, margins, and delivery logistics seamlessly. Whether you’re hedging risk or speculating on prices, our systems manage positions, track obligations, and connect you to global commodity markets.

OTC Trading Portals

OTC Trading Portals

Move large trades privately without public disclosure. We build OTC platforms where institutional traders negotiate block deals in crypto, bonds, and alternatives. Complete confidentiality, direct matching, and price flexibility let you execute large positions the way sophisticated traders prefer most.

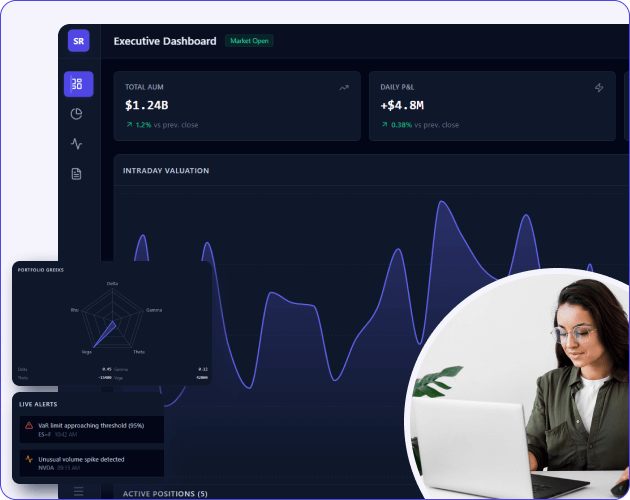

Proprietary Trading Platform

Proprietary Trading Platform

Give your prop traders the speed advantage they demand. We build internal platforms with microsecond execution, direct market access, and real-time risk monitoring. Advanced quantitative support, live analytics, and strategic tools help professional traders execute faster, smarter, and more profitably.

Our Software Development Capabilities & Recognition

Our Trading Platform Development Portfolio

We’ve custom-developed trading bots, mobile platforms, and institutional systems for fintech companies and brokers worldwide. Businesses looking to hire financial software developers trust our trading platform developers, who have engineered crypto exchanges handling $100M+ daily volume and high-frequency trading systems executing thousands of trades per second.

Let’s Build a Trading Platform That Performs at Scale

Space-O Technologies brings 15+ years of trading app development expertise. Partner with experienced developers who handle architecture, integrations, security, and deployment from start to launch.

Hear From Our Top Clients

Project Summary

iOS & Android Dev for Fintech Company

A fintech company hired Space-O Technologies to develop a mobile application that helps users manage their savings more efficiently. The team also built an iOS and Android version of the app.

Project Summary

Mobile App Dev for Tech Company

Space-O Technologies developed a mobile app for a tech company. They built an iOS- and Android-friendly platform that enabled communication among users and provided them access to nearby television listings.

Our Solutions Recognized & Featured In

Technology Stack We Use for Trading Platform Development

We use the best technologies specifically chosen for custom trading software development that demand speed, security, and scalability. Our proven tech stack powers institutional-grade trading systems handling millions of daily transactions while maintaining regulatory compliance and zero downtime across global markets.

Why Choose Space-O Technologies for Trading Platform Development?

We combine deep fintech expertise with institutional-grade execution to deliver both custom solutions and white-label trading platform development services that scale. Whether you need a complete custom build or an enterprise system, we have the proven technical depth.

Financial Industry Expertise

Our developers bring 15+ years of fintech development expertise and deep knowledge of trading workflows, order book dynamics, and regulatory compliance. Our team navigates SEC, FINRA, MiFID II, and GDPR requirements that make or break platforms.

Security & Compliance Excellence

We use bank-grade security, including AES-256 encryption, multi-layer DDoS protection, and advanced authentication (MFA, biometrics). Our compliance frameworks satisfy institutional audit requirements and regulatory scrutiny at the highest levels.

Low-Latency Engineering

We optimize for speed and reliability across entire systems. We architect platforms supporting microsecond execution, high-throughput data processing, and stress testing under extreme market volatility, where milliseconds matter, and failures cost money.

Scalable Cloud Architecture

We leverage AWS and Azure cloud expertise to ensure your platform scales seamlessly from startup MVP to full enterprise scale today. Auto-scaling infrastructure, intelligent load balancing, and database optimization handle any massive growth without degradation.

Full Code Ownership

You get complete intellectual property rights to your custom-built trading platform forever. Full transparent project management via Jira and Slack, daily detailed progress updates, comprehensive documentation, and absolutely zero hidden costs or any vendor lock-in.

Agile & Adaptive Delivery

We use Agile methodologies (Scrum and Kanban) with responsive iteration cycles throughout development. We deliver working features every sprint, adapt quickly to market changes, and incorporate your feedback in real-time through ongoing collaboration rather than rigid waterfall plans.

Choose a Trading Platform Development Partner With a Proven Track Record

With 15+ years in software development, we help trading businesses reduce delivery risk and accelerate time to market.

Our Trading Platform Development Process

We follow a proven 6-stage methodology that transforms your trading platform development services vision into production-ready software. Every phase includes regulatory assessment, security validation, and trader feedback, so you get a platform that regulators approve and that traders love using every single day.

01

Discovery & Assessment

We understand your business, target market, regulatory landscape, and technical requirements. We map SEC/FINRA/MiFID II/GDPR obligations specific to your business model and produce a regulatory roadmap and architectural recommendations.

02

Architecture & UI/UX Design

Based on discovery, we design system architecture optimizing for performance, security, and scalability. Simultaneously, the design team creates interactive prototypes of your trader interface, testing workflows with real users before engineering begins.

03

QA, Security & Performance Testing

Before any feature reaches production, we conduct comprehensive testing: functional validation, security testing (penetration testing, vulnerability scanning), performance testing under market load, and compliance validation, ensuring regulatory readiness.

04

Deployment & Go-Live

We deploy using zero-downtime releases and gradual rollouts that start with internal users before reaching the public. Our comprehensive monitoring catches issues immediately, and we maintain instant rollback capability if anything goes wrong.

05

Agile Development

We develop your platform in 2-week sprints using Scrum, giving your team daily visibility and involvement in the process. You attend sprint reviews and provide feedback that shapes the next sprint, with features delivered every cycle.

06

Post-Launch Support

After launch, we provide 24/7 monitoring, SLA-based support with a typical 4-hour response time, regular security patches, and performance optimization. We also deliver feature enhancements based on trader feedback to keep your platform competitive.

Who We Build Trading Solutions For

Every trading business has unique needs. We serve startups, brokers, hedge funds, and crypto exchanges. Our multi-segment experience as a leading fintech software development company means we build trading platforms perfectly tailored to your exact business model.

Fintech Startups & Entrepreneurs

Visionary founders with limited fintech engineering expertise are launching ambitious ideas. We translate visions into regulated, production-ready platforms, navigating complex regulatory requirements most founders don’t anticipate.

Brokers & Investment Firms

Traditional and online brokers are competing for modern traders in crowded markets. We help quickly modernize legacy systems, launch new asset classes, and deliver the seamless user experience traders expect and demand daily.

Hedge Funds

Professional traders demand raw performance. We build proprietary platforms providing direct market access, real-time risk monitoring, and microsecond speed, separating winners from losers in competitive markets.

Crypto Exchanges & Ventures

Crypto ventures combining blockchain infrastructure with strict financial market performance demands and regulatory compliance. We build exchanges and trading platforms that handle requirements simultaneously.

Wealth & Robo-Advisors

Traditional wealth managers and robo-advisors are automating portfolio management and client engagement. We build direct-to-consumer platforms and fully white-label solutions for existing financial services firms and banks globally.

Banks & Financial Institutions

Established institutions are launching new trading platforms, modernizing legacy systems, or adding new asset classes. We help deploy trading technology, maintaining regulatory standing while delivering modern user experiences.

Frequently Asked Questions on Custom Trading Platform Development

How much does it cost to build a custom trading platform?

Costs vary significantly based on scope, complexity, and compliance needs.

- MVP (Basic Trading App): $50,000–$150,000 (3–6 months). Includes core trading, basic charting, and secure user management.

- Mid-Tier Platform: $150,000–$500,000 (6–9 months). Adds real-time data streaming, advanced technical analysis, social trading, and multi-asset support.

- Institutional/Enterprise Solution: $500,000–$2M+ (9–18 months). For hedge funds and banks requiring high-frequency execution, microsecond latency, algo-trading engines, and complex regulatory compliance.